Find High Percentage Trades Quickly

It is not very often that I recommend trading software, but once in a while I come across a tool that I think is useful for traders and is affordable. There is a school of thought out there that the more expensive something is the better it must be. And with trading software a lot of people actually think and believe that. They think if they buy a trading software for $3000 that they will become a successful trader and can quit their job and phone it in from the beach.

In my early years I thought this would be my life as a trader:

Instead as I got deeper and deeper into the markets I realized it was a lot of work to become a consistently good trader. It took me over 20 years to get to that point, but I was retired by then – at 43 years of age!

I have been in the trading business for over 20 years and have seen most of the software out there. I was an early user of Meta Stock, System Writer, Tradestation, Neuro Shell and Advanced Get. There are others that I can’t even remember. I am always interesting is software that does what it promises and this software does exactly what it promises – it finds high probability trades and gives me all the analysis for the trades.

So when I came across Trade Miner I was pleasantly surprised at the price point. $97 for the Futures module, but if you also buy the Stock and Forex module, you will get all three for a discounted price of $194 or so.

A friend of mine who used to be a CBOT floor trader actually told me about this software. Personally I have always believed in seasonal patterns. When I was on the CME floor there were seasonal studies distributed for free by the exchange and I think it still is.

Commodities have cycles, from planting to harvest and there are trends or patterns that reappear year after year. Literally to the day. Now that doesn’t mean that they will keep appearing in the future. A pattern works until it doesn’t work anymore. You can’t predict the future anymore than you can predict the weather. Heck, I can’t even predict if my wife is in a good mood or not sometimes.

I worked for 4 years at Cargill which the biggest grain trading company in the world and learned a lot not only about trading grains, but the whole supply chain. If you think there aren’t seasonal factors at play in the price of commodities you are sorely mistaken and mislead. Prices of commodities historical rise and fall at certain times of the year for their legitimate supply and demand reasons. There are books written specifically on that topic.

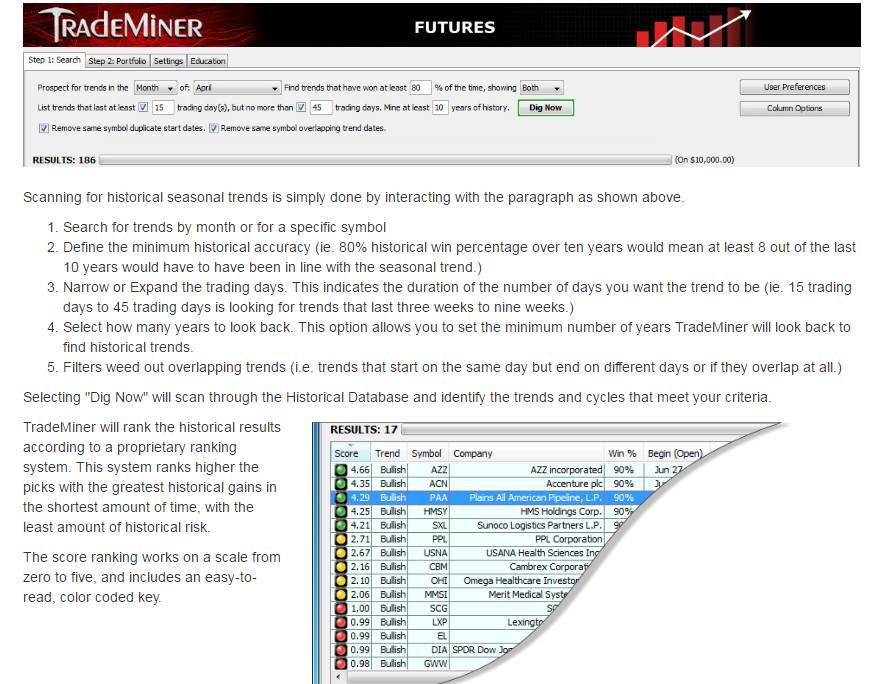

What the Trae Miner software does is lets you research the patterns and gives you a nice output to make your own decision.

It’s easy to see a list of successful trades that happened in the past and think, this is my secret to success in trading. However you should really take the list of historically successful trades and look for the markets where it is working. What I mean is, just because a trade historically has been a winner 18 out of the last 19 years don’t think it will be a winner this year. It stands a good chance, but take it in context of the market. Especially now with President Trump potentially redoing some trade deals that can have an effect on certain markets down the line. For example, if there is a Mexican Peso trade that has been right 15 years in a row and now you get a signal to buy, but you the Mexican Peso has been falling, wait for it to turn and start rallying, don’t just go in and buy it blindly. Some people do, but it is not how I would trade it. I don’t like to fight trends. I prefer to join them.

I cannot stress this enough…Past performance is no guarantee for future trades, but for me, if a trade worked 90% of the time and it is reappearing I will trade that it will happen again, but I would like to look at the macro level of what is happening before making a trade. It’s a risk, this is trading after all. It might not work for whatever reason. Nothing is 100% in trading.

The only thing certain in life is death and taxes.

But what Trade Miner will do is help steer you towards trades that have worked historically over time.

If you are a day trader it can help you as you can find days of possible reversals or specific days when a trend should start. That will give you a bias that if it starts appearing you can take advantage of.

Let me explain what I mean, when I run the software and it says that on June 30, it is a good day to buy Swiss Franc. I will monitor the market for a move higher that day and try to participate. I would watch how the market is trading early to see if it is going to start moving higher.

How easy is this software to use? I created this short video (about 20 minutes long) to show you how simple it is to get started using this software to find possible trades.

This year I would be very careful taking any directional trades on the US Dollar because of Trump. That should be common sense. I think at the end of this year you will read about a lot of hedge funds posting losses related to the FX market because the president’s policies affecting the FX market and the hedge fund’s models failed this year. Who knows if that will happen, but I won’t be shocked to read about it later. Of course, there will be some hedge funds that knocked it out of the park and they will market their funds as such.

But anyway, back to the Trade Miner. It’s a great name because you are in a sense “mining” data. Remember now, it is just data, you still have to take it and apply it to your trading.

Can you use the data alone without any confirmation on a macro level, yes you can. I do think it is better to have a logical reason behind a trade other than, “it says to buy on February 2nd and sell on February 8th.”

I thinking of opening an account to just trade options with this software. I mean if I can get moves like his one in the hogs, where it moved from 68.00 level to the 48.00 level, I would definitely be interested in buying deep out of the money puts if I could. Or maybe trade a spread. There are different ways to approach it.

If you are like me and like to spend your spare time researching trades to see what you can add to your trading arsenal, then definitely pick up a copy of this software. I would recommend the 3 pack of Futures, Forex and Stocks, because it really is buy 2 get 1 free.

Click the link below to get started…

Buy this with an open mind. It is not the holy grail to trading, but it has the potential to put you into some nice trades.

It’s $97 for the Futures module, $97 for the Forex Module and $97 for the Stocks Module. But they have a special where you can buy all three Modules for just $194. So you can’t beat that.

What else can you spend $194 on?

You can buy this message machine for $199, its kinda weird and in a few months you can forget about it or repackage it and give it away. Or you can spend the money and buy Trade Miner. If you find one or two gang buster trades a year its worth. But I think you will see you can find many a month.