Use The Power Of Multiple Imbalances In Order Flow

One of the most misunderstood and neglected parts of order flow is imbalances in a bar.

An imbalance in the order flow occurs in the two-way auction when either the offer trades 4x as much volume than the bid (a buying imbalance) or when the bid trades 4x as much volume than the offer (a selling imbalance).

An imbalance by itself can have different meanings or it can mean nothing.

Most traders are taught to look for bars with stacked imbalances. When there are 3 or more imbalances stacked neatly on top of each other. However, there are two problems with stacked imbalances. 1) They don’t occur very often and 2) Everyone is already looking for them.

What I have found that is just as strong a signal, if not stronger, is a bar that has 3 or more buying imbalances or 3 or more selling imbalances. The imbalances are spread out throughout the bar as opposed to stacked on top of each other.

Big traders like to hide their activity in the market so bullying through the market is not always the best option. Big traders use execution algos to spread out their activity to have as little impact as possible. But sometimes it can’t be helped and their aggressiveness still shows up in the imbalances in a bar.

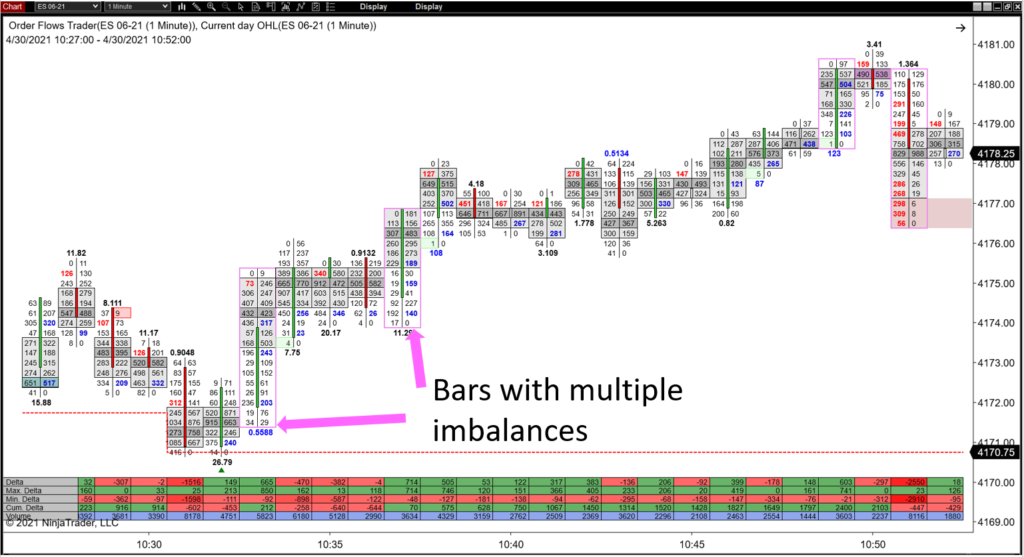

In the ES yesterday, there were two bars with multiple imbalances that happened right after a new low was made. If you were just looking for stacked imbalances you would have missed this opportunity.

To make it easier for you to identify bars with multiple imbalances, the Orderflows Trader draws a magenta colored box around the bar for you. Now you can see unique and actionable instances in the order flow that other traders don’t recognize.

The reality is multiple imbalances is not a fancy concept, but a simple one and as a trader you need to recognize when they are appearing to take advantage of them.

Multiple Imbalances is one of the 17 built in tools of the Orderflows Trader 3.0.

You can now see things in the order flow that other traders don’t.