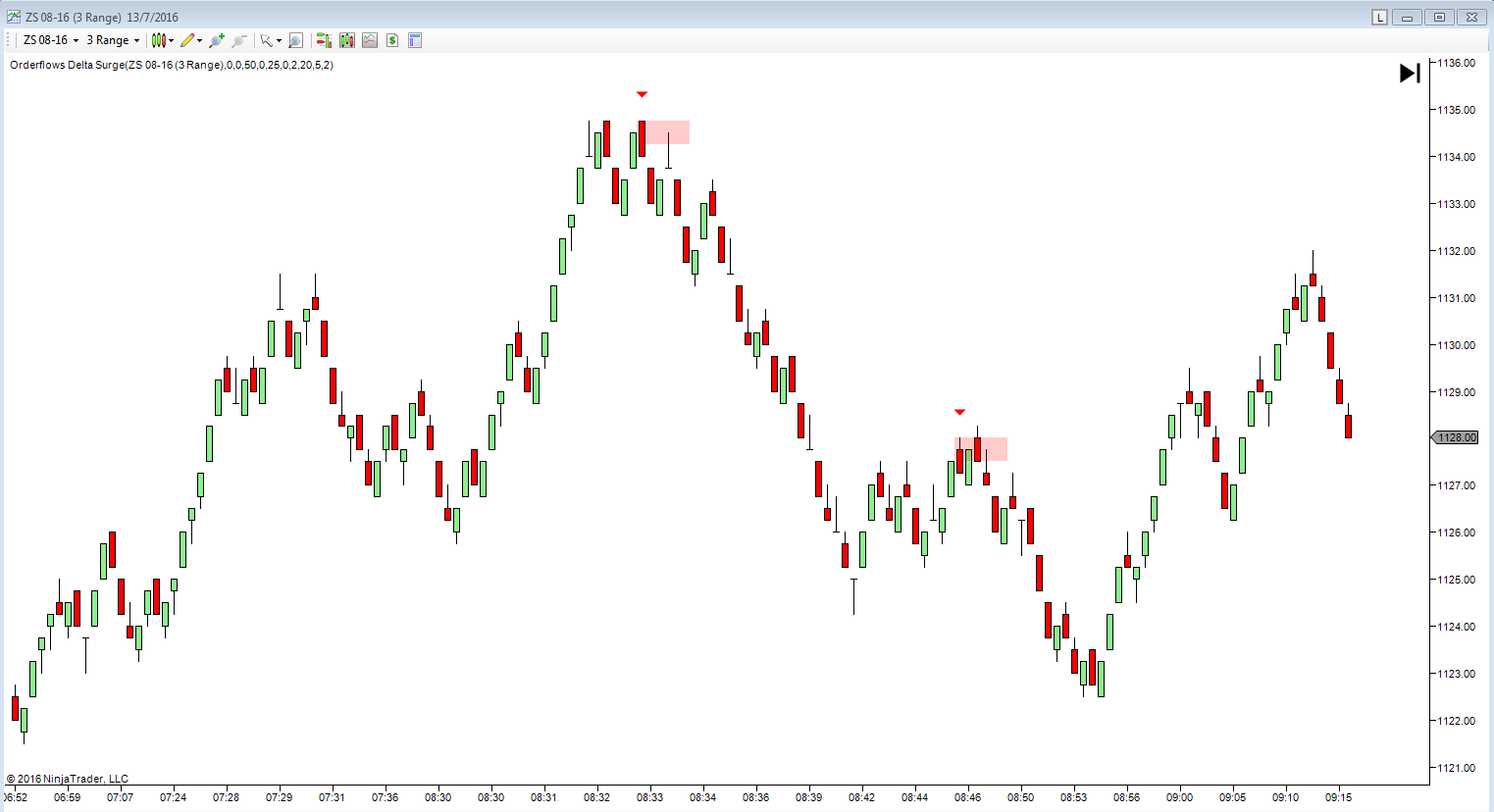

Introducing the Orderflows Delta Surge indicator which was created to help traders understand and analyse order flow delta.

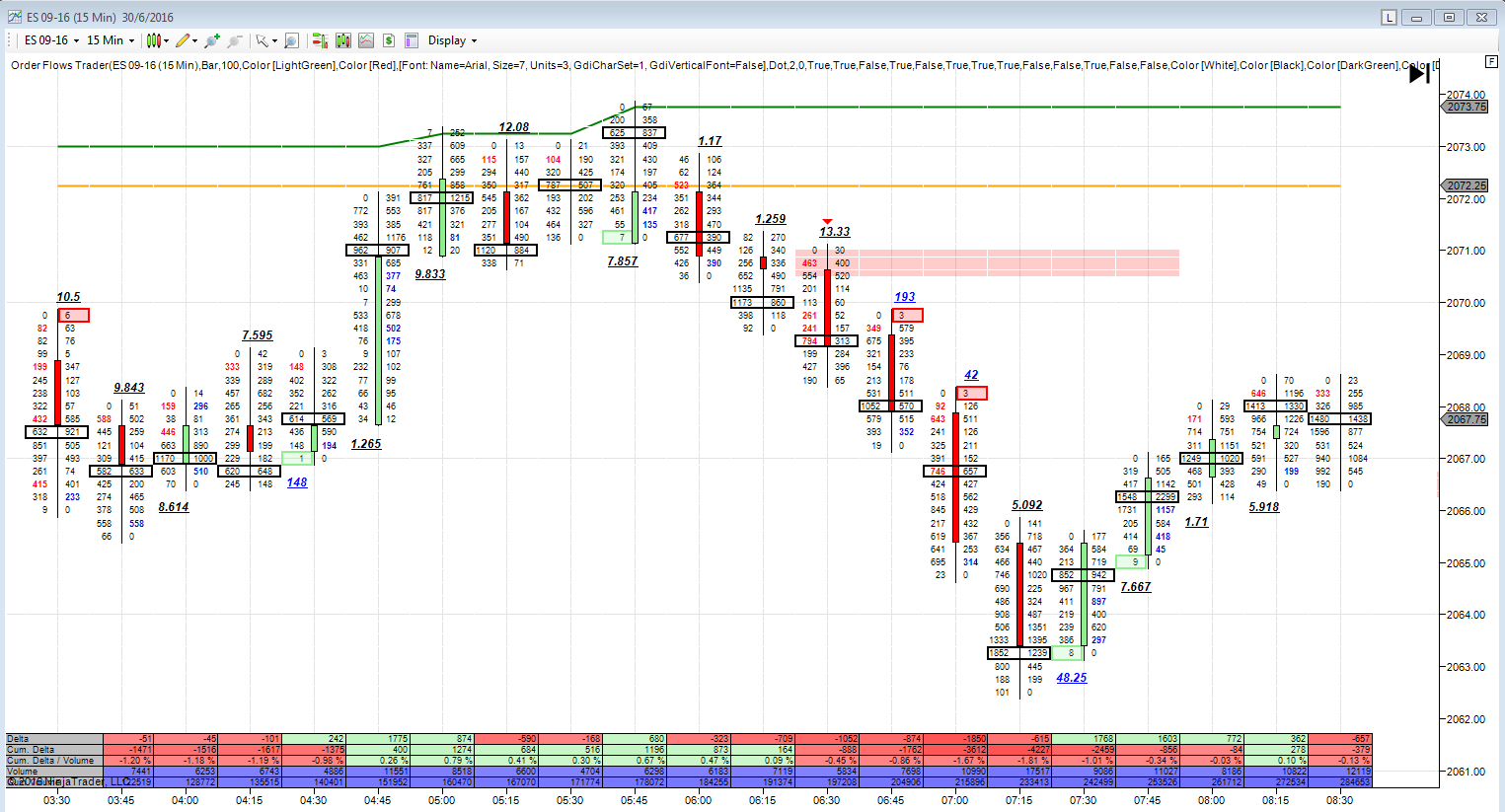

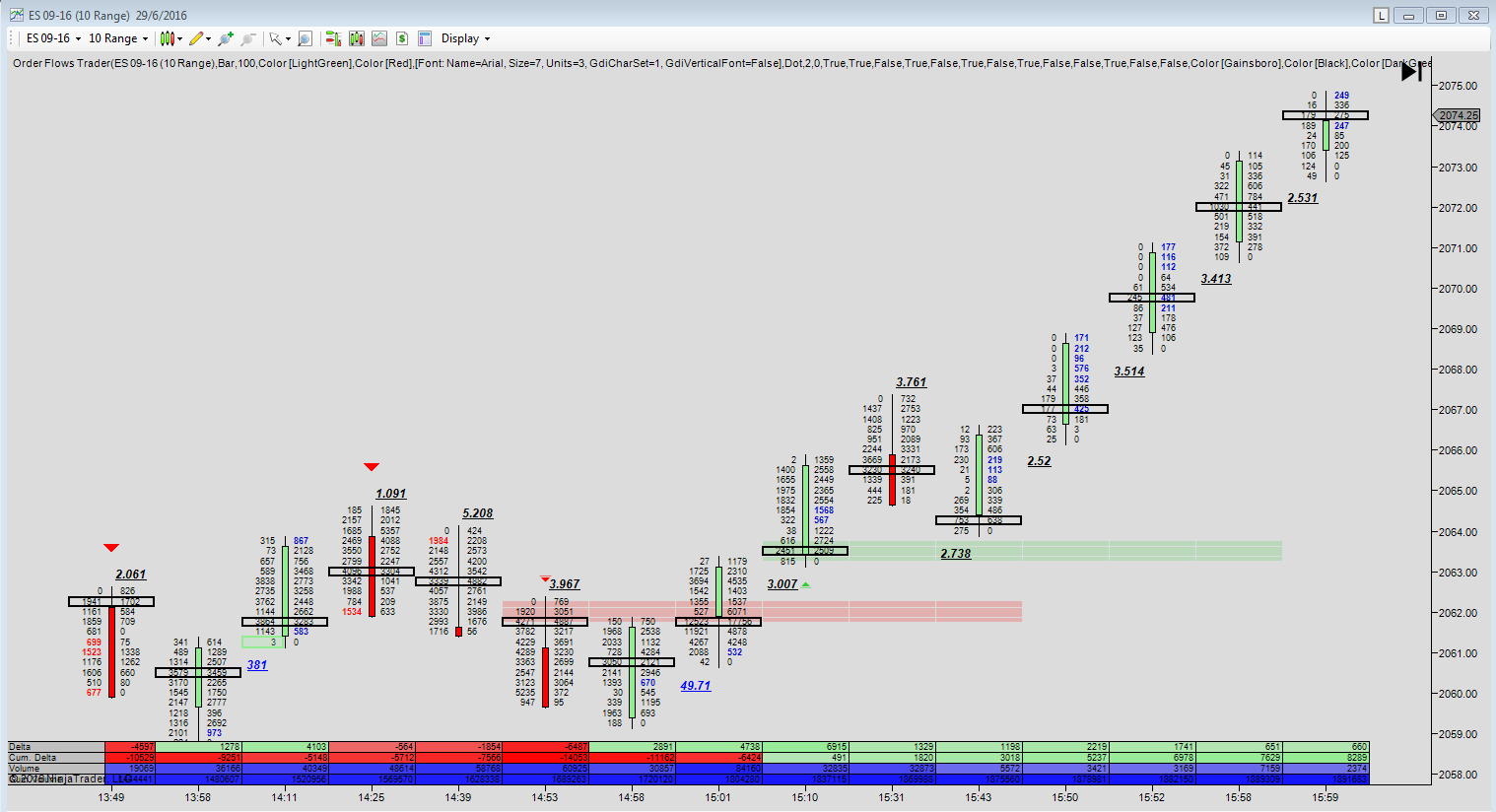

Delta is the difference between the volume traded on the offer minus the volume traded on the bid in a particular bar.

Each bar will have a delta number. Delta will either positive or negative and on rare occasions it can even be zero.

There is not much information on trading order flow delta available on the market as most traders aren’t even aware of order flow delta, let alone thought of trading with it.

But delta is a great tool for traders. However like every tool, it has it uses. You can’t build a house with just a hammer, you need other tools to finish the house. Trading is the same way, to survive in the markets you need different tools to be used at different times.

When a trend is healthy, it builds on itself. Volume will increase slowly, as new buyers are drawn into the move.