Introducing The Orderflows Bulge

See Where Institutional Traders Are Buying And Selling

Add-On For NinjaTrader 8

NEW FEATURE

TRADE ENTRY SIGNAL

TRADE ENTRY SIGNAL

We have taken order flow to another level with the Trade Entry Signal.

Let's face it, one of the reasons most traders fail is because they get confused

on taking trades. What we did is created the Trade Entry Signal to take the emotion

out of trying to decide to take a trade. Even though the conditions for the trade

are there, if the order flow that comes in AFTER the conditions for the Bulge are met

do not match with the direction of the signal, no trade signal is generated.

If the subsequent order flow is complimentary to the Bulge signal then a trade signal

is generated. The beauty of the Trade Entry Signal is it keeps you out of the trades

where the market just goes sideways after you get into your position. Imagine what it

would be like if you could remove 20%-30% of your losing trades right off the top of

your PnL? It could be the difference between a profitable year and a losing year.

Let's face it, one of the reasons most traders fail is because they get confused

on taking trades. What we did is created the Trade Entry Signal to take the emotion

out of trying to decide to take a trade. Even though the conditions for the trade

are there, if the order flow that comes in AFTER the conditions for the Bulge are met

do not match with the direction of the signal, no trade signal is generated.

If the subsequent order flow is complimentary to the Bulge signal then a trade signal

is generated. The beauty of the Trade Entry Signal is it keeps you out of the trades

where the market just goes sideways after you get into your position. Imagine what it

would be like if you could remove 20%-30% of your losing trades right off the top of

your PnL? It could be the difference between a profitable year and a losing year.

Watch this quick video to learn how the Trade Entry Signal can transform your trading!

Not all prices are traded equally

The Reason So Many Traders Lose Money With Price Based Indicators Is They Focus Only On Price. They Don't Take Into Account Market Participation At Price And Market Structure. The Orderflows Bulge Is The Only Tool For NinjaTrader 8 That Accurately Measures Absorption, Supportive Buying, Resistant Selling, Price Action, Swing Highs Or Lows, Point Of Control, Delta & Market Structure And Gives You A Simple Signal.

It Puts The Pieces Of Order Flow And Market Structure Together For You.

It Puts The Pieces Of Order Flow And Market Structure Together For You.

WHAT'S MISSING

THE #1 PROBLEM WITH FOR TRADING ORDER FLOW IS THIS…

Traders struggle to put together the different pieces of order flow correctly to really generate consistent results.

Today's so called order flow software and systems have become overly complicated, super time consuming and in most cases... much too costly.

The Orderflows Bulge keeps it as simple as possible and at a reasonable price.

Today's so called order flow software and systems have become overly complicated, super time consuming and in most cases... much too costly.

The Orderflows Bulge keeps it as simple as possible and at a reasonable price.

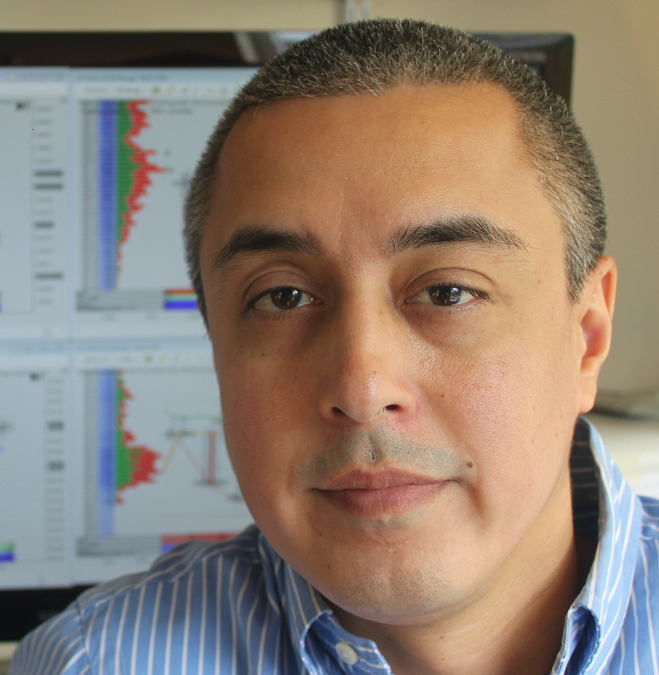

My name is Michael Valtos and I am pleased announce the release of the Orderflows Bulge indicator.

The Orderflows Bulge is a unique indicator in that it clearly shows you, the trader, when institutional trading is taking place right now in the market.

The Orderflows Bulge is a unique indicator in that it clearly shows you, the trader, when institutional trading is taking place right now in the market.

A lot of so called "gurus' always say to follow the institutional traders. Follow the money they say. In theory it sounds perfect, right? If the big banks and funds consistently make money and you follow what they are doing, how can you lose, right?

The problem is you have no idea what their thinking is. You don't know if they are getting into a position or getting out. But if you understood market structure is then you could make a better decision on whether or not to take the trade. Market context and market structure are what the "gurus" don't teach you about.

I have spent just about 20 years as an institutional Futures trader at both top tier investment banks and the worlds largest commodity trading companies. 8 years at JP Morgan, 3 years at Commerzbank, 4 years at Cargill, 2 years at EDF Man and 3 years with Dean Witter Reynolds where I started on the CME floor.

What I am about to share with you comes from my own real life trading experience at the worlds largest trading firms. Do you really believe institutional traders look at MACD or Stochastics on a 2 or 3-minute chart? Do you really believe they are counting the number of waves on a 5-minute chart?

Institutional traders deal in size and are concerned with where they can get their trades done at without impacting the market. They can hide their trading activity, but they can't hide their executed trades.

When an institutional trader trades, they leave a virtual footprint in the bid volume or ask volume.

I have been around since the early days of electronic trading on the CME, CBOT, NYMEX and Eurex. This was back in the days of the closed systems. There were no trading front ends back then. If you wanted to trade SP Fuutres you had to trade it on the CME Globex system. If you want to trade Crude Oil Futures you had to trade it on the NYMEX Access system. Bonds and grains were trades on CBOT Project A.

I have been watching the depth of market since it began. I watched the ticker and time and sales back before there was a footprint chart. I gotta tell you - it was crude, but effective.

What I am about to share with you comes from my own real life trading experience at the worlds largest trading firms. Do you really believe institutional traders look at MACD or Stochastics on a 2 or 3-minute chart? Do you really believe they are counting the number of waves on a 5-minute chart?

Institutional traders deal in size and are concerned with where they can get their trades done at without impacting the market. They can hide their trading activity, but they can't hide their executed trades.

When an institutional trader trades, they leave a virtual footprint in the bid volume or ask volume.

I have been around since the early days of electronic trading on the CME, CBOT, NYMEX and Eurex. This was back in the days of the closed systems. There were no trading front ends back then. If you wanted to trade SP Fuutres you had to trade it on the CME Globex system. If you want to trade Crude Oil Futures you had to trade it on the NYMEX Access system. Bonds and grains were trades on CBOT Project A.

I have been watching the depth of market since it began. I watched the ticker and time and sales back before there was a footprint chart. I gotta tell you - it was crude, but effective.

When I first saw a volume footprint chart it was literally like "WOW, this is a game changer." The amount of information that was now available to the trader was mind blowing. A trader can now easily see how much traded on the bid at a price. It is from that information a trader can start to put the pieces of the trading puzzle together.

That was about 10 years ago. I still shake my head when I see traders struggling because they haven't adopted order flow into their trading. I mean, if someone offered you clear information about where big traders are getting active in the market, why wouldn't you want to use that information. It's totally legal, it's not inside information or anything like that. The trades went through the exchange and are public. Smart traders use it.

I have spent literally decades staring at the DOM, time and sales, tickers and volume footprint. I made my career and living doing it. When I talk about trading techniques you can be rest assured it is tried and tested because that is what I looked for in the market and traded around. If I wasn't good at reading the market, I wouldn't have lasted that long. I would have been thrown out of the company after a few months.

The Orderflows Bulge takes what I personally experienced trading large size and how to move it with minimal affect on the market. The Orderflows Bulge takes what I personally look for in the market when I was looking for potential trading opportunies. Often times I would be in the middle of getting into a position and see a Bulge appear in the market and now that if I don't get more aggressive, price will move away and I will be f@&%ked.

There are cynics out there, the Debbie Downers who say "if this is so good why are you selling it or teaching it to other traders, why aren't you living on an island somewhere with sharks around it to keep the people out who are trying to get your edge?" Well the answer is simple. I did live on an island for about 9 years (Singapore) and I hardly spoke to my immediate family. My world was tiny. I hated that life. Trading 10-12 hours a day. The reason I release this information, this method of trading is because even though it already made me a lot of money, it is not about the money. It is about sharing information with others so they can become a better trader.

At the top level of trading, call it the successful level, it is not a closed club. There is room for everyone. Its not like one person has to become unsuccessful and leave before you can join. No, there is room for anyone willing to put in the work to become successful.

This edge is not going to go away. In fact it is better if more traders follow it because the more traders who recognize it and position themselves in the direction of the trade will benefit us all.

That was about 10 years ago. I still shake my head when I see traders struggling because they haven't adopted order flow into their trading. I mean, if someone offered you clear information about where big traders are getting active in the market, why wouldn't you want to use that information. It's totally legal, it's not inside information or anything like that. The trades went through the exchange and are public. Smart traders use it.

I have spent literally decades staring at the DOM, time and sales, tickers and volume footprint. I made my career and living doing it. When I talk about trading techniques you can be rest assured it is tried and tested because that is what I looked for in the market and traded around. If I wasn't good at reading the market, I wouldn't have lasted that long. I would have been thrown out of the company after a few months.

The Orderflows Bulge takes what I personally experienced trading large size and how to move it with minimal affect on the market. The Orderflows Bulge takes what I personally look for in the market when I was looking for potential trading opportunies. Often times I would be in the middle of getting into a position and see a Bulge appear in the market and now that if I don't get more aggressive, price will move away and I will be f@&%ked.

There are cynics out there, the Debbie Downers who say "if this is so good why are you selling it or teaching it to other traders, why aren't you living on an island somewhere with sharks around it to keep the people out who are trying to get your edge?" Well the answer is simple. I did live on an island for about 9 years (Singapore) and I hardly spoke to my immediate family. My world was tiny. I hated that life. Trading 10-12 hours a day. The reason I release this information, this method of trading is because even though it already made me a lot of money, it is not about the money. It is about sharing information with others so they can become a better trader.

At the top level of trading, call it the successful level, it is not a closed club. There is room for everyone. Its not like one person has to become unsuccessful and leave before you can join. No, there is room for anyone willing to put in the work to become successful.

This edge is not going to go away. In fact it is better if more traders follow it because the more traders who recognize it and position themselves in the direction of the trade will benefit us all.

Watch This Video To understand more about the Orderflows Bulge

The Orderflows Bulge analyzes what is happening inside the bar based on the volume traded on the bid and offer and combines it with market structure and order flow.

Improve your trading with market generated data as it occurs. Forget lagging indicators. Trade based on what is happening right now in the market.

Keep It Simple.

Traders try to make the market more complicated than it really it. More importantly, let the computer do the analysis for you.

Traders try to make the market more complicated than it really it. More importantly, let the computer do the analysis for you.

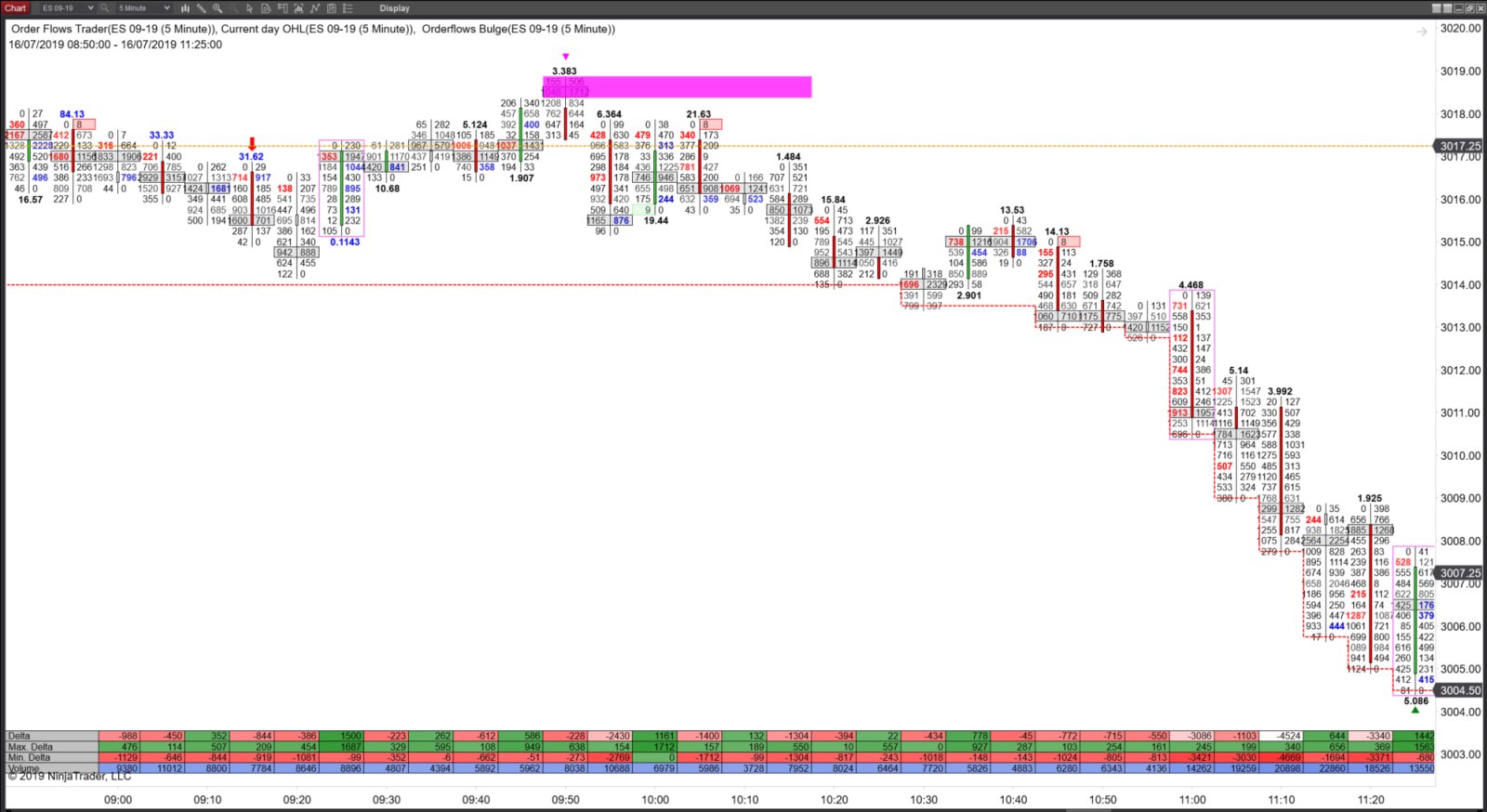

A chart is worth a 1000 words...

5-Minute ES Futures

5-Minute ES Futures

5-Minute CL Futures

The orderflows Bulge also works on regular candlestick charts...

1-Minute FDAX Futures

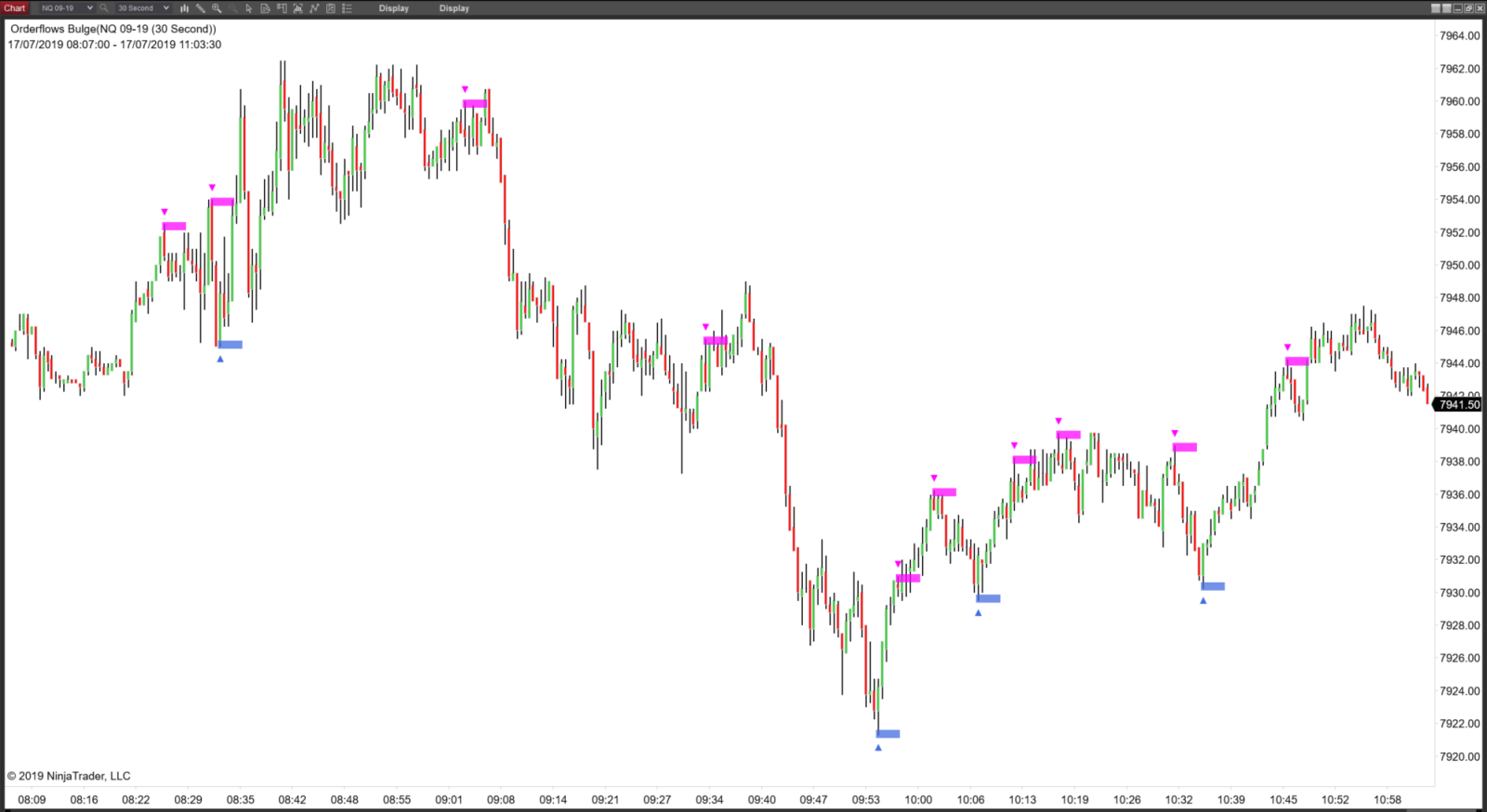

30-Second NQ Futures

5-Minute CL Futures

Clicking on the order link will redirect you to our secure payment processor page.

Frequently Asked Questions and Answers:

What trading platform does the Orderflows Bulge run on?

It runs on NinjaTrader 8.

Will signals show up on historical data?

Yes. The Orderflows Bulge reads the volume data as it trades and is recorded by NinjaTrader.

When I load the Orderflows Bulge on my chart I don't see any signals?

Make sure you have tick data enabled. If you are new to NinjaTrader and don't know what that is or how to set it up, it is explained in the user manual.

How many computers can I install the Orderflows Bulge on?

One. The Orderflows Bulge license token is machine specific. However additional licenses are available at reduced prices.

Will the Orderflows Bulge repaint?

No. The Orderflows Bulge is a real-time indicator that plots as soon as the data in the bar meet the requirements. As the bar is still forming the signal may appear when the conditions are met, but disappear as the conditions are no longer met. However, once the bar is closed and the conditions are met, the signal will not repaint.

Can I get a free trial?

No. Sorry we don't offer a free trial.

What If The Orderflows Bulge Is Not For Me?

14 Day Money Back Guarantee

The Orderflows Bulge comes with a 14 day money back guarantee if you find that it doesn't help you in your trading journey.

Results May Vary: I cannot guarantee success in your trading. I can only guarantee to give you the best training possible. And your money back if you are not completely satisfied. I want to see you happy and successful. And that's what I strive for each and every day and you should also.

It runs on NinjaTrader 8.

Will signals show up on historical data?

Yes. The Orderflows Bulge reads the volume data as it trades and is recorded by NinjaTrader.

When I load the Orderflows Bulge on my chart I don't see any signals?

Make sure you have tick data enabled. If you are new to NinjaTrader and don't know what that is or how to set it up, it is explained in the user manual.

How many computers can I install the Orderflows Bulge on?

One. The Orderflows Bulge license token is machine specific. However additional licenses are available at reduced prices.

Will the Orderflows Bulge repaint?

No. The Orderflows Bulge is a real-time indicator that plots as soon as the data in the bar meet the requirements. As the bar is still forming the signal may appear when the conditions are met, but disappear as the conditions are no longer met. However, once the bar is closed and the conditions are met, the signal will not repaint.

Can I get a free trial?

No. Sorry we don't offer a free trial.

What If The Orderflows Bulge Is Not For Me?

14 Day Money Back Guarantee

The Orderflows Bulge comes with a 14 day money back guarantee if you find that it doesn't help you in your trading journey.

Results May Vary: I cannot guarantee success in your trading. I can only guarantee to give you the best training possible. And your money back if you are not completely satisfied. I want to see you happy and successful. And that's what I strive for each and every day and you should also.

YOU’VE GOT TWO CHOICES HERE…

1. You could keep trying to figure out all this stuff on your own and waste thousands of dollars and your valuable time going through the process and failing like everyone else.

2. You could literally load this indicator into your NinjaTrader 8 and start seeing absorption in the market immediately.

What sounds better to you?

For the TRUE action takers and winners... The choice is obvious.

2. You could literally load this indicator into your NinjaTrader 8 and start seeing absorption in the market immediately.

What sounds better to you?

For the TRUE action takers and winners... The choice is obvious.

Before you click the buy button, take a look at the chart below...

If you struggle trading a day like that, then the Bulge is not for you.

However, if you know how to trade and know how to minimize your losing trades,

Then you should seriously consider getting the Bulge.

However, if you know how to trade and know how to minimize your losing trades,

Then you should seriously consider getting the Bulge.

All Rights Reserved - orderflows.com - Copyright 2019

Disclaimer

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities. The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

CFTC Rules 4.41:

Hypothetical or Simulated performance results have certain limitations, unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Disclaimer:

This presentation is for educational and informational purposes only and should not be considered a solicitation to buy or sell a futures contract or make any other type of investment decision. Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. no representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.

©Orderflows.com

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..