You Have Seen It Live In The Trade Room...

You Have Seen It On YouTube...

Orderflows.com Presents

Delta Scalper

Delta Scalper takes the hard work of analysis of order flow out of the order flow chart for you.

Add order flow trading to your current style of trading without having to read volume footprint charts like tea leaves?

- Works with just about any type of bar, candle, renko or order flow footprint chart.

- Allows you to place tight stops.

- Identifies quality low risk trade locations.

- Market generated Buy and Sell signals in real time.

- Instantly identifies situations in the market when supply and demand are POTENTIALLY shift.

- Multiple entry opportunities depending on your trading style.

See changes in supply and demand. This is where trends often start.

See where the institutional traders have shown their hand and are trading big size at the market when it is happening.

Have tight stop placements. You will know pretty quick if a trade is not working out allowing you to exit quickly.

Volume often preceeds price movement. Allows you to see when buyers or sellers have taken control.

Take the stress out of your trading. When traders are stressed out about their trades that often leads to losing trades. Delta Scalper makes finding trades less stressful.

Works with your existing charts. Add it to your current charts to get an additional look at the market.

Delta Scalper Solves The Biggest Mistake Most Traders Make

Those of you who know me, know I am one of the authorities on order flow trading. I have written books and given seminars on order flow. I have been trading order flow for years. I have even created my own software for trading order flow. I have spent nearly 20 years trading on the institutional side of the market. I traded for JP Morgan (8 years). I traded for Cargill (4years). I traded for Commerzbank (3 years). I traded for EDF Man (2 years). Let me share with you one thing about all the successful traders I know and dealt with on a daily basis. The one common trading methodolgy all the big traders I know follow is...

Buy when the market is showing strength and sell when the market is weak.

Sounds simple right? But yet many losing traders fail to realize it and more importantly do it.

This is why I have created Delta Scalper.

Stop Overtrading

A problem many traders have is overtrading. Many opportunities for profit occur everyday in the market. Only the choicest, best opportunities should be taken. How many times do you take trades that you wished you didn't take? Delta Scalper shows you where and when to take trades.

Stop Searching For The Perfect Indicator

Stop searching for the perfect indicator. It doesn't exist. What makes Delta Scalper different is that it reads the market and tells you when there is a potential change in supply and demand. It is not a trading system by itself but it can be worked into your existing method of trading.

Do You Have A Problem Understanding Order Flow?

Delta Scalper was created to allow traders who want to add order flow to their trading arsenal. I will be honest, many traders simply do not understand order flow and how to use it. They are missing out on many of the key pieces of information the market is telling them.

Easy To Understand Entries And Exits

Delta Scalper gives you easy to see entry levels and more importantly, easy to see stop levels. There is no need to have wide stops. With Delta Scalper you will know pretty quick when a trade is not working in your favour.

Bring Your Trading Account Back To Life

I don't understand how people can keep throwing money at their trading account to bring it back to life. Isn't it better to bring your trading account back to life with better trades, winning trades.

Delta Scalper Is One-Of-A-Kind

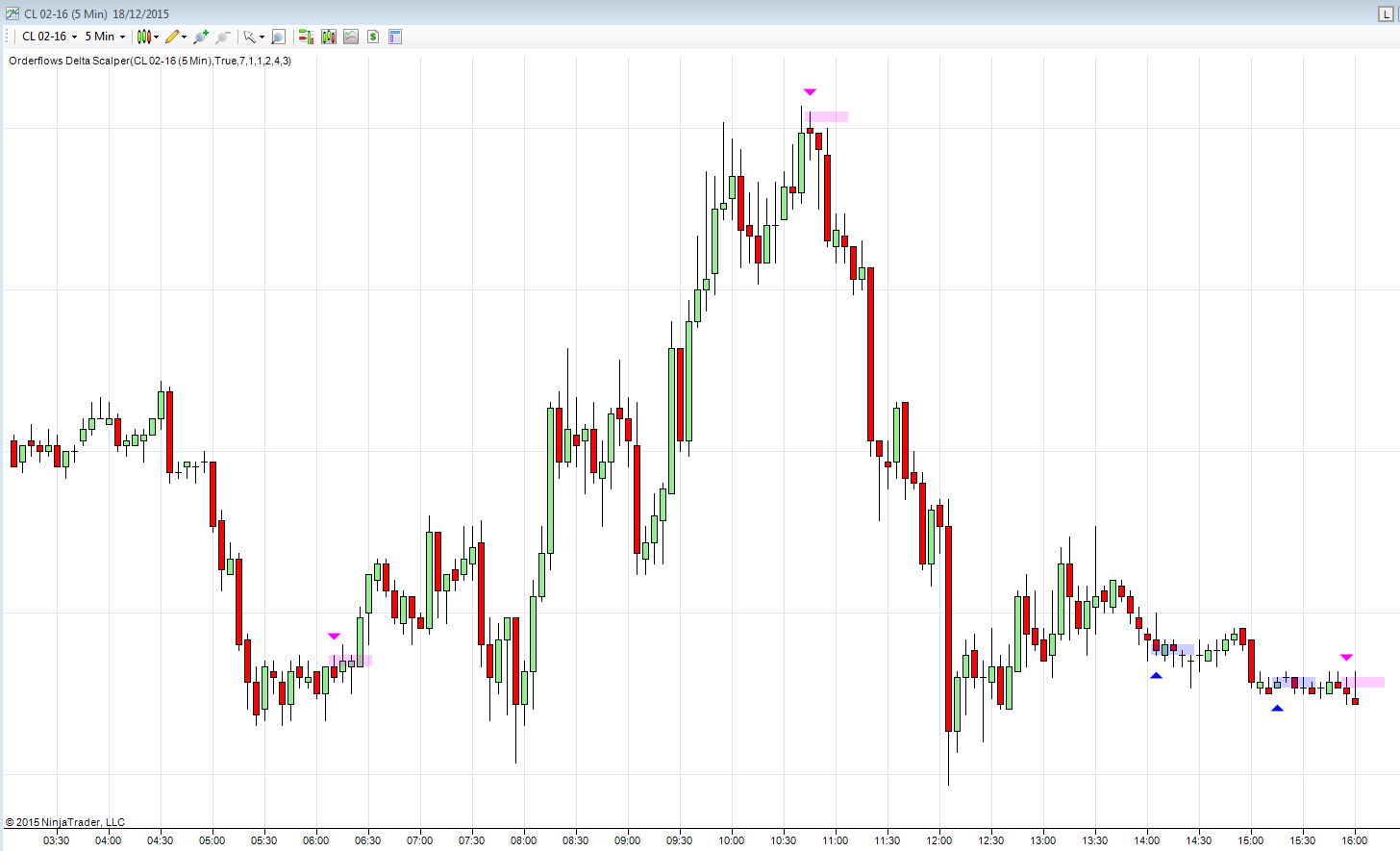

Delta Scalper's unique ability is that it can actually change the way you look at the market. Forget about looking at order flow footprint charts. Delta Scalper was designed for those who don’t want to deal with order flow. Delta Scalper will run on normal bar, candlestick charts and renko charts.

Delta Scalper was designed around interpreting delta in the market place; to understand when and where buyers or sellers are showing their strength in the market.

What Is Delta? Why Is Delta Important?

What is delta? It is the difference between the volume traded on the bid and the volume traded on the offer.

Why is delta important? It measures the strength of the aggressive traders in the market. The traders who are buying the offer or selling into the bid.

As a trader what do you want to do? Do you want to buy when the sellers are showing their strength? NO. You will get run over by the sheer strength of their selling. You want to sell when the selling is overwhelming the buyers.

The same is true when buyers are showing signs of strength you don’t want to be selling into a rising market on the back of solid aggressive buying, you want to be buying into it. You want to be buying when the buyers are scooping up all the available supply

Let

me say it again: you want to trade on the strong side of the market.

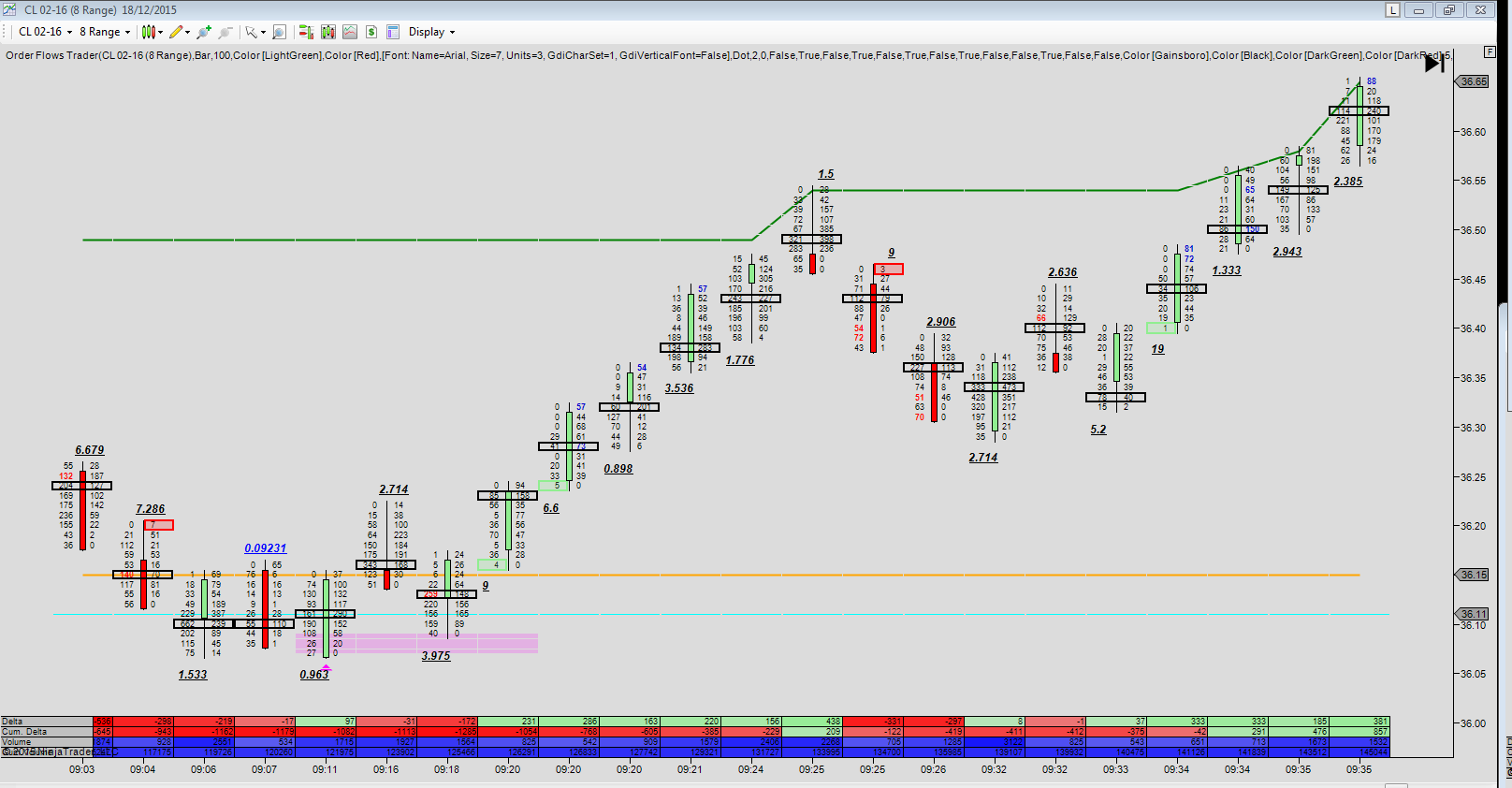

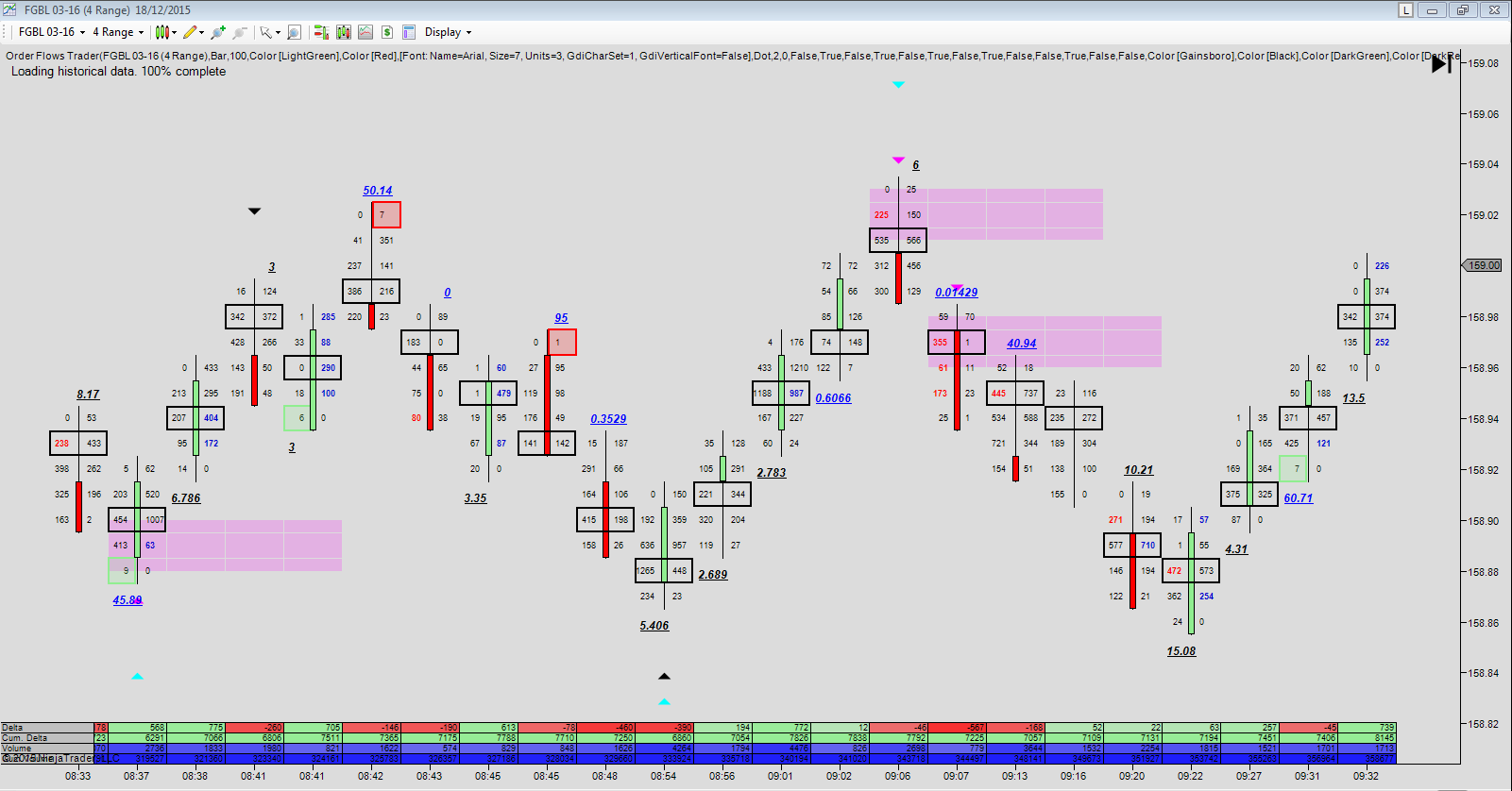

Lets Take A Look At Some Charts:

You Don't Want To Look At Order Flow Charts? No Problem!

I know not everyone is convinced of the benefits of following the market on an Orderflows.com footprint chart that is ok. I have designed the Delta Scalper to run on a normal bar chart.

Finally a way to read an important aspect of order flow without having to read an order flow footprint chart. The first of its kind.

Delta Scalper is based on my own experience while trading at JP Morgan. When I was accumulating a position and I would see a MAJOR shift from normal buying and selling to one side being incredibly strong that is when I knew I also had to be more aggressive and finish up my accumulation because more often than not the market would continue in that direction.

There are several ways you can trade this. I am more of a short term trader nowadays and look to capture the immediate move. However, some users have told me they are using it to capture major intraday moves.

As with any method of trading you must use prudent stop and risk management. I will tell you right now, this is not a 100% winning Holy Grail trading system. Delta Scalper is a tool for the trader's toolbox. An extra arrow in your trading quiver.

So what are you waiting for?

Get Delta Scalper Now for Just $250

-

Verified Secure

Verified Secure

Safe and secure checkout and ordering.

Clicking on the order links will redirect you to our secure payment processor page.

Frequently Asked Questions and Answers:

- Do I need the Orderflows Trader software to run Delta Scalper?

No. Delta Scalper is a stand alone indicator that interprets mainly the delta in the market.

- Do you offer a free trial?

Unfortunately not anymore.

- I am a short term trader, I look at the DOM and tick charts. Will Delta Scalper help me?

Delta Scalper analyzes a volume traded on the bid and volume on the offer. If there is not enough volume to analyze the readings won't be very accurate since the date is just too small. I prefer to run Delta Scalper on chart ranging from 1 minute to 15 minutes and range charts between 4 range and 10 range.

- Do I need to use a footprint chart to use Delta Scalper?

No. Delta Scalper will run on any chart type. It will run on regular bar charts, candlesticks chart, renko charts, etc. Just about any chart you use it can be run on.

- When I load Delta Scalper on my chart I don't see any arrows?

Delta Scalper reads the traded bid volume and the traded offer volume. It works on real time data as it comes in or it works on recorded data in market replay. Delta Scalper starts reading the data once you turn on your NinjaTrader and apply it to a chart.

- Does this indicator work with Bloodhound or The Indicator Store's Markers?

This is not a "trading system" that you can take every single set up. As with every trading method you should be taking signals in context of the market. What that means is buying when the market is low and selling when the market is high, in general.

To Your Success,