Get Instant Access To The Orderflows Foundation Courses For One Low Price!

Learn The Foundations Of Order Flow:

Delta, Imbalance and Point Of Control

Delta, Imbalance and Point Of Control

We have bundled up our 3 courses into one package to teach you everything you need to know about the foundations of order flow analysis so you can start applying it to your trading now.

Join the elite group of traders who understand and profit from

order flow by learning in the Orderflows Foundation Bundle

order flow by learning in the Orderflows Foundation Bundle

If you are a serious trader, you understand the importance of learning about different types of market analysis. But what often happens is life gets in the way. You work a 60 hour week, you have kids to manage or you are busy running your own business. You end up having limited time to study and implement what you are learning.

Last year I created 3 different order flow courses, with each course covering the three most important parts of order flow analysis: delta, point of control and imbalances. Over the course of 3 days, you can become proficient in understanding order flow just by spending one evening per course. I designed each course to be consumed in one evening.

You will learn 26 different order flow trade setups. Realistically you will not use all 26 setups, but more likely you will use a handful in your trading. Just as a successful singer needs to find their own voice, a successful trader needs to find the setups and trading methods that resonate with them. The ways of trading that make most sense to them and is suited to their style of trading.

By going through the Orderflows Foundation Bundle, you will be able to find your own voice in the markets. You will be able to find ways of market analysis and trading that best fits your personality.

Last year I created 3 different order flow courses, with each course covering the three most important parts of order flow analysis: delta, point of control and imbalances. Over the course of 3 days, you can become proficient in understanding order flow just by spending one evening per course. I designed each course to be consumed in one evening.

You will learn 26 different order flow trade setups. Realistically you will not use all 26 setups, but more likely you will use a handful in your trading. Just as a successful singer needs to find their own voice, a successful trader needs to find the setups and trading methods that resonate with them. The ways of trading that make most sense to them and is suited to their style of trading.

By going through the Orderflows Foundation Bundle, you will be able to find your own voice in the markets. You will be able to find ways of market analysis and trading that best fits your personality.

What You Will Learn About Delta

In The Delta Trading Course

In The Delta Trading Course

The Delta Trading Course is designed to help you improve your market understanding by learning to the order flow delta, and by improving your ability to interpret the real forces that drive markets; to trade successfully, you must understand what your competition is doing.

You’ll learn to see the way traders reveal their strength and weakness, and how to position yourself to take advantage of it.

By the end of the Delta Trading Course, you will learn how to:

-Understand the importance of delta.

-Read and interpret the different types of delta information available to traders.

-Recognizing the signs of trends that are getting weaker or stronger.

-Understanding the importance of what does not occur.

-Monitor trades for continuation.

-I explain in depth 7 different delta trade setups that you can look for.

-And much, much more.

You’ll learn to see the way traders reveal their strength and weakness, and how to position yourself to take advantage of it.

By the end of the Delta Trading Course, you will learn how to:

-Understand the importance of delta.

-Read and interpret the different types of delta information available to traders.

-Recognizing the signs of trends that are getting weaker or stronger.

-Understanding the importance of what does not occur.

-Monitor trades for continuation.

-I explain in depth 7 different delta trade setups that you can look for.

-And much, much more.

Module 1 - Delta Explained

In this module I explain what delta is and why it is important in trade analysis. Order flow delta is a major piece of the trading puzzle that many traders have been missing in their analysis. I explain what makes up the delta number and its meaning in the market.

Module 2 - How To Read Delta

In this module I explain the different choices that traders have to view delta on a chart as well as the different ways a trader can chart delta. It is important to know the different ways to view delta because it can give you an edge over other traders not using delta.

Module 3 - Delta Numbers

In this module I explain the different delta numbers that you can have on your chart. I explain their importance and what makes that particular number useful to a trader. I cover delta (the final, headline delta number), max delta, min delta, cumulative delta, cumulative delta/volume. Each delta number has its own uses as you will see in lesson 4 when I discuss delta trade setups.

Module 4 - Delta Trade Setups

In this module I explain and break down 7 different order flow delta trade setups. Several of these setups have been programmed and sold for hundreds of dollars. In this lesson I teach them to you so you can train yourself to look for them in real time so you don't have to rely on expensive indicators.

Module 5 - Delta Exercises & Wrap Up

In this module you have a chance to apply what you have learned in reading and understanding delta. Through a series of charts you compare what you see on the chart to what I see on the chart. The goal of this lesson is to get you analyzing order flow delta. With this lesson I wrap up everything you have learned about delta analysis.

In this module I explain what delta is and why it is important in trade analysis. Order flow delta is a major piece of the trading puzzle that many traders have been missing in their analysis. I explain what makes up the delta number and its meaning in the market.

Module 2 - How To Read Delta

In this module I explain the different choices that traders have to view delta on a chart as well as the different ways a trader can chart delta. It is important to know the different ways to view delta because it can give you an edge over other traders not using delta.

Module 3 - Delta Numbers

In this module I explain the different delta numbers that you can have on your chart. I explain their importance and what makes that particular number useful to a trader. I cover delta (the final, headline delta number), max delta, min delta, cumulative delta, cumulative delta/volume. Each delta number has its own uses as you will see in lesson 4 when I discuss delta trade setups.

Module 4 - Delta Trade Setups

In this module I explain and break down 7 different order flow delta trade setups. Several of these setups have been programmed and sold for hundreds of dollars. In this lesson I teach them to you so you can train yourself to look for them in real time so you don't have to rely on expensive indicators.

Module 5 - Delta Exercises & Wrap Up

In this module you have a chance to apply what you have learned in reading and understanding delta. Through a series of charts you compare what you see on the chart to what I see on the chart. The goal of this lesson is to get you analyzing order flow delta. With this lesson I wrap up everything you have learned about delta analysis.

What You Will Learn About Imbalances

In The Imbalance Course

In The Imbalance Course

The Imbalance Course teaches you the nuances among the different types of imbalances in the market.

The imbalance course is not just a course saying "oh there are more aggressive buyers here so do this." I explain what different types of imbalances mean, why it is important, why they occur and how to apply them to your trading. This is an in depth dive into the world of order flow imbalances that will change the way you look at imbalances.

People (not traders) like to theorize that everything that happens in the market is random, that there is no direction trade going on. I say let them keep on believing that for they are the ones who provide the money that successful traders earn. The very next trade hitting the market may be random, but a big buying order being executed in the market is not a random event, it was caused by something to prompt the trader to react a certain way. What I care about is seeing that big order and determining if it is important and will cause other traders to also come to the market and for the market to move.

When dealing with imbalances, there are individual imbalances which can mean nothing or mean everything. There are also stacked and multiple imbalances which can matter or not. A stacked imbalance can be a clear sign of an institution putting on a new position and be very important or it can occur when an institution is getting out of a position and mean very little. Learn the differences.

The imbalance course is not just a course saying "oh there are more aggressive buyers here so do this." I explain what different types of imbalances mean, why it is important, why they occur and how to apply them to your trading. This is an in depth dive into the world of order flow imbalances that will change the way you look at imbalances.

People (not traders) like to theorize that everything that happens in the market is random, that there is no direction trade going on. I say let them keep on believing that for they are the ones who provide the money that successful traders earn. The very next trade hitting the market may be random, but a big buying order being executed in the market is not a random event, it was caused by something to prompt the trader to react a certain way. What I care about is seeing that big order and determining if it is important and will cause other traders to also come to the market and for the market to move.

When dealing with imbalances, there are individual imbalances which can mean nothing or mean everything. There are also stacked and multiple imbalances which can matter or not. A stacked imbalance can be a clear sign of an institution putting on a new position and be very important or it can occur when an institution is getting out of a position and mean very little. Learn the differences.

Module #1 - What Are Imbalances

In this module I break down what causes imbalances, how to see them and their importance when they occur. Order flow imbalances are the easiest way to see when the institutional traders are active in the market.

Module #2 - Individual, Stacked and Multiple Imbalances

In this module I break down and explain the difference between individual, stacked and multiple imbalances. You will learn why they appear and how to start applying them to your trading.

Module #3 - Improve Your Trading With Imbalances

In this module I show you how you can improve your trading by using order flow imbalances in your analysis. You will get an edge over other traders when you apply order flow imbalances to your trading, whether it is an individual imbalance, stacked or multiple imbalance, you will trading will get better once you understand and add imbalances into your analysis

Module #4 - Imbalance Trade Setups

In this module I break down 9 different order flow setups. There are setups involving just a single imbalance and setups involving multiple and stacked imbalances. These are trade setups, not trading systems. Once you understand the different setups you can begin to create your own trading plan around these setups.

Module #5 - Wrapping Up Imbalances

In this module I wrap up "The Imbalance Course." Here you will see different charts and market conditions, by now you should be able to determine what is happening in the market based on the types of imbalances you see appearing.

In this module I break down what causes imbalances, how to see them and their importance when they occur. Order flow imbalances are the easiest way to see when the institutional traders are active in the market.

Module #2 - Individual, Stacked and Multiple Imbalances

In this module I break down and explain the difference between individual, stacked and multiple imbalances. You will learn why they appear and how to start applying them to your trading.

Module #3 - Improve Your Trading With Imbalances

In this module I show you how you can improve your trading by using order flow imbalances in your analysis. You will get an edge over other traders when you apply order flow imbalances to your trading, whether it is an individual imbalance, stacked or multiple imbalance, you will trading will get better once you understand and add imbalances into your analysis

Module #4 - Imbalance Trade Setups

In this module I break down 9 different order flow setups. There are setups involving just a single imbalance and setups involving multiple and stacked imbalances. These are trade setups, not trading systems. Once you understand the different setups you can begin to create your own trading plan around these setups.

Module #5 - Wrapping Up Imbalances

In this module I wrap up "The Imbalance Course." Here you will see different charts and market conditions, by now you should be able to determine what is happening in the market based on the types of imbalances you see appearing.

What You Will Learn About POC In

The Point Of Control Course

The Point Of Control Course

Point Of Control (POC) in order flow is the price level with the highest volume in a bar. The best way to think of Point of Control is in terms of value. We all know what value, we think about it everyday and don’t even realize it. Whether you are buying vegetables at the grocery market or buying the latest Samsung mobile phone we either accept price or reject it. The markets act the same way with the main difference being that prices are being accepted or rejected much faster and multiple times a day.

You have often heard me talk about how the Point of Control can act as support or resistance in the next bar in a sustained move. However, where the Point of Control appears in a bar is important from a market structure stand point. It becomes clearer when you take it in context of the market. For a market to find support it should preferably come after a move down. To find resistance, the market should have made a move higher.

The purpose of the market is to facilitate trade, but how does it happen? The market seeks out value and moves from value area to value area. In the case of individual bars, it moves from Point of Control to Point of Control.

You have often heard me talk about how the Point of Control can act as support or resistance in the next bar in a sustained move. However, where the Point of Control appears in a bar is important from a market structure stand point. It becomes clearer when you take it in context of the market. For a market to find support it should preferably come after a move down. To find resistance, the market should have made a move higher.

The purpose of the market is to facilitate trade, but how does it happen? The market seeks out value and moves from value area to value area. In the case of individual bars, it moves from Point of Control to Point of Control.

Module #1 - All About Point Of Control

What you need to know about Point of Control, how it is calculated (spoiler alert, it is easy) and what it really means to traders. Point of Control is an important tool not just for order flow traders but also for any really interested in what is happening in the market.

Module #2 - Viewing Point Of Control

Learn how to view Point of Control. There are many different charting software available to the trader. I use both Sierra Chart and NinjaTrader to walk you through the different features so you can decide how you would like to view Point of Control on your screen.

Module #3 - Point Of Control As Support & Resistance

Discover how you can use Point of Control as support or resistance to find better traders, faster. Once you understand how Point of Control is better than most other forms of support and resistance you will clean up your charts and make your trading easier as you will be using real-time data to see real market generated support and resistance levels.

Module #4 - Point Of Control As Confirmation

Learn how you can use Point of Control as confirmation of market bias and more importantly how to confirm if you are in a good trade or bad trade. Once you get into a trade you have to manage it. Would you rather get stopped out and take a full loss or know how to read order flow so you can get out before your stop is hit?

Module #5 - Point Of Control As Stopping Volume

See stopping volume in the market using Point of Control. Stopping volume occurs are market turning points and is the result of strong passive buyers absorbing aggressive seller or passive sellers absorbing aggressive buyers. What make stopping volume unique is when aggressive traders turn passive buyers. Order Flow and Point of Control help you see when and if that happens.

Module #6 - Point Of Control Setups Part 1

The first 5 of 10 Order Flow Point of Control trade setups explained:

1. Pair Up Point of Control

2. Extreme Point of Control

3. Point of Control In The Wick

4. Slingshot Point of Control

5. Point of Control Wave

Module #7 - Point Of Control Setups Part 2

The second 5 of 10 Order Flow Point of Control trade setups explained:

6. Point of Control Migration

7. Point of Control Pullbacks

8. Point of Control Blocks

9. Triple Distribution Point of Control

10. Point of Control Escape

Module #8 - Point Of Control Wrap Up

A wrap up Point of Control for you. To be a successful a trader, one needs to understand himself, his trading methods and his capabilities with the ultimate goal of using that understanding to improve his trading results. Understanding Point of Control helps you get to where you want to be as a trader.

What you need to know about Point of Control, how it is calculated (spoiler alert, it is easy) and what it really means to traders. Point of Control is an important tool not just for order flow traders but also for any really interested in what is happening in the market.

Module #2 - Viewing Point Of Control

Learn how to view Point of Control. There are many different charting software available to the trader. I use both Sierra Chart and NinjaTrader to walk you through the different features so you can decide how you would like to view Point of Control on your screen.

Module #3 - Point Of Control As Support & Resistance

Discover how you can use Point of Control as support or resistance to find better traders, faster. Once you understand how Point of Control is better than most other forms of support and resistance you will clean up your charts and make your trading easier as you will be using real-time data to see real market generated support and resistance levels.

Module #4 - Point Of Control As Confirmation

Learn how you can use Point of Control as confirmation of market bias and more importantly how to confirm if you are in a good trade or bad trade. Once you get into a trade you have to manage it. Would you rather get stopped out and take a full loss or know how to read order flow so you can get out before your stop is hit?

Module #5 - Point Of Control As Stopping Volume

See stopping volume in the market using Point of Control. Stopping volume occurs are market turning points and is the result of strong passive buyers absorbing aggressive seller or passive sellers absorbing aggressive buyers. What make stopping volume unique is when aggressive traders turn passive buyers. Order Flow and Point of Control help you see when and if that happens.

Module #6 - Point Of Control Setups Part 1

The first 5 of 10 Order Flow Point of Control trade setups explained:

1. Pair Up Point of Control

2. Extreme Point of Control

3. Point of Control In The Wick

4. Slingshot Point of Control

5. Point of Control Wave

Module #7 - Point Of Control Setups Part 2

The second 5 of 10 Order Flow Point of Control trade setups explained:

6. Point of Control Migration

7. Point of Control Pullbacks

8. Point of Control Blocks

9. Triple Distribution Point of Control

10. Point of Control Escape

Module #8 - Point Of Control Wrap Up

A wrap up Point of Control for you. To be a successful a trader, one needs to understand himself, his trading methods and his capabilities with the ultimate goal of using that understanding to improve his trading results. Understanding Point of Control helps you get to where you want to be as a trader.

"Why is order flow important?

Why do I have to learn order flow?"

Why do I have to learn order flow?"

These are typical questions that you have most likely asked at one time or another in your trading journey. While you may learn things about the market that you will not use again, the study of order flow is still an important one for a trader's development. Order flow is widely-used in daily activities (e.g. shopping, running a business, etc.).

Order flow is also considered a "universal language" of market activity. One of the fundamental reasons why you learn order flow is to help you understand what is happening now in the market, as opposed to what happened in the past, with clear, concise, and logical steps. In the Orderflows Foundation Courses, you will study and learn important fundamental and foundational order flow concepts.

You will not only learn the theory behind delta, POC and imbalances, but also how to apply this information to your trading. The best part is that you most likely already know them, even if you did not know the proper order flow names.

Order flow is also considered a "universal language" of market activity. One of the fundamental reasons why you learn order flow is to help you understand what is happening now in the market, as opposed to what happened in the past, with clear, concise, and logical steps. In the Orderflows Foundation Courses, you will study and learn important fundamental and foundational order flow concepts.

You will not only learn the theory behind delta, POC and imbalances, but also how to apply this information to your trading. The best part is that you most likely already know them, even if you did not know the proper order flow names.

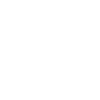

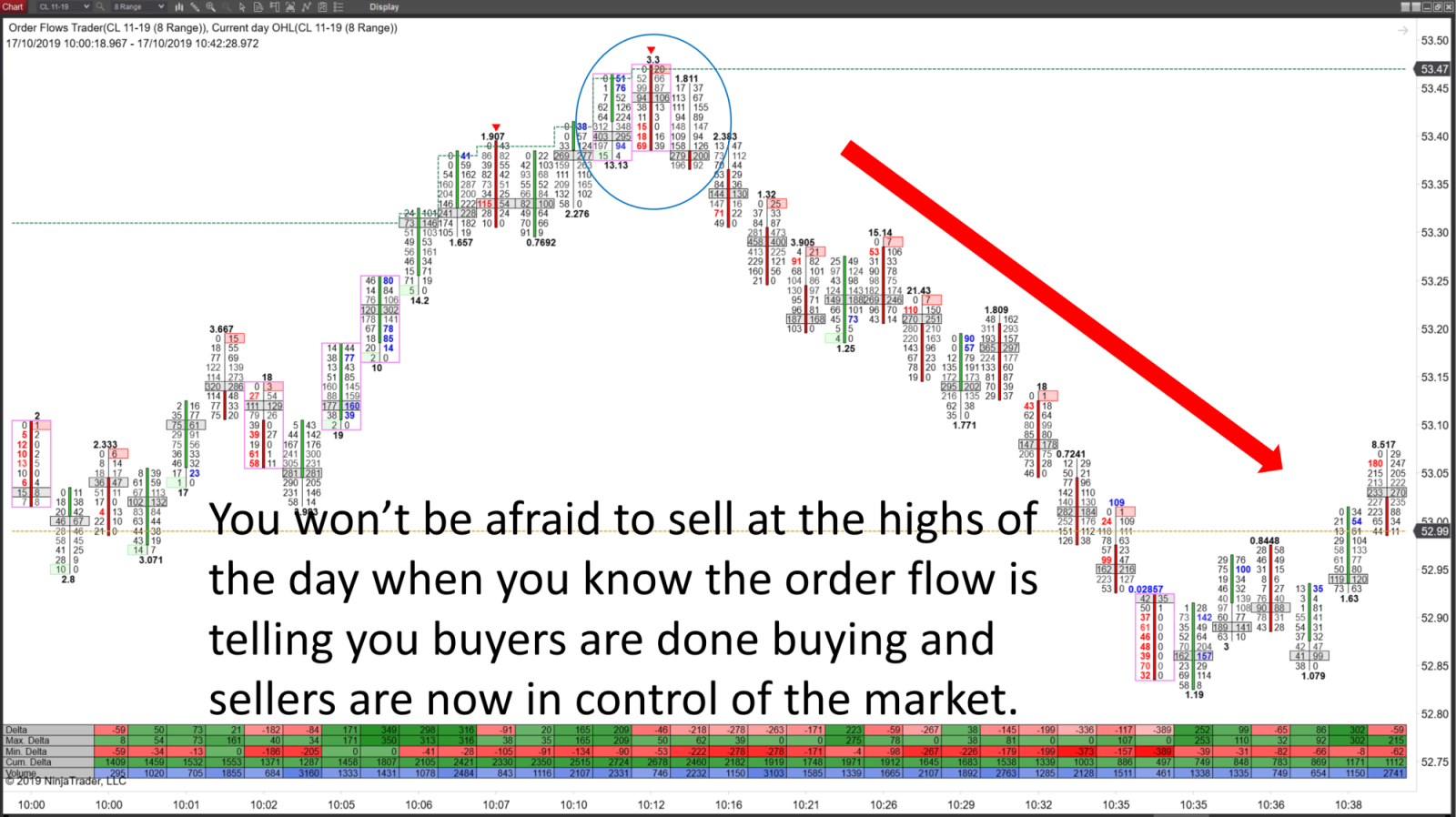

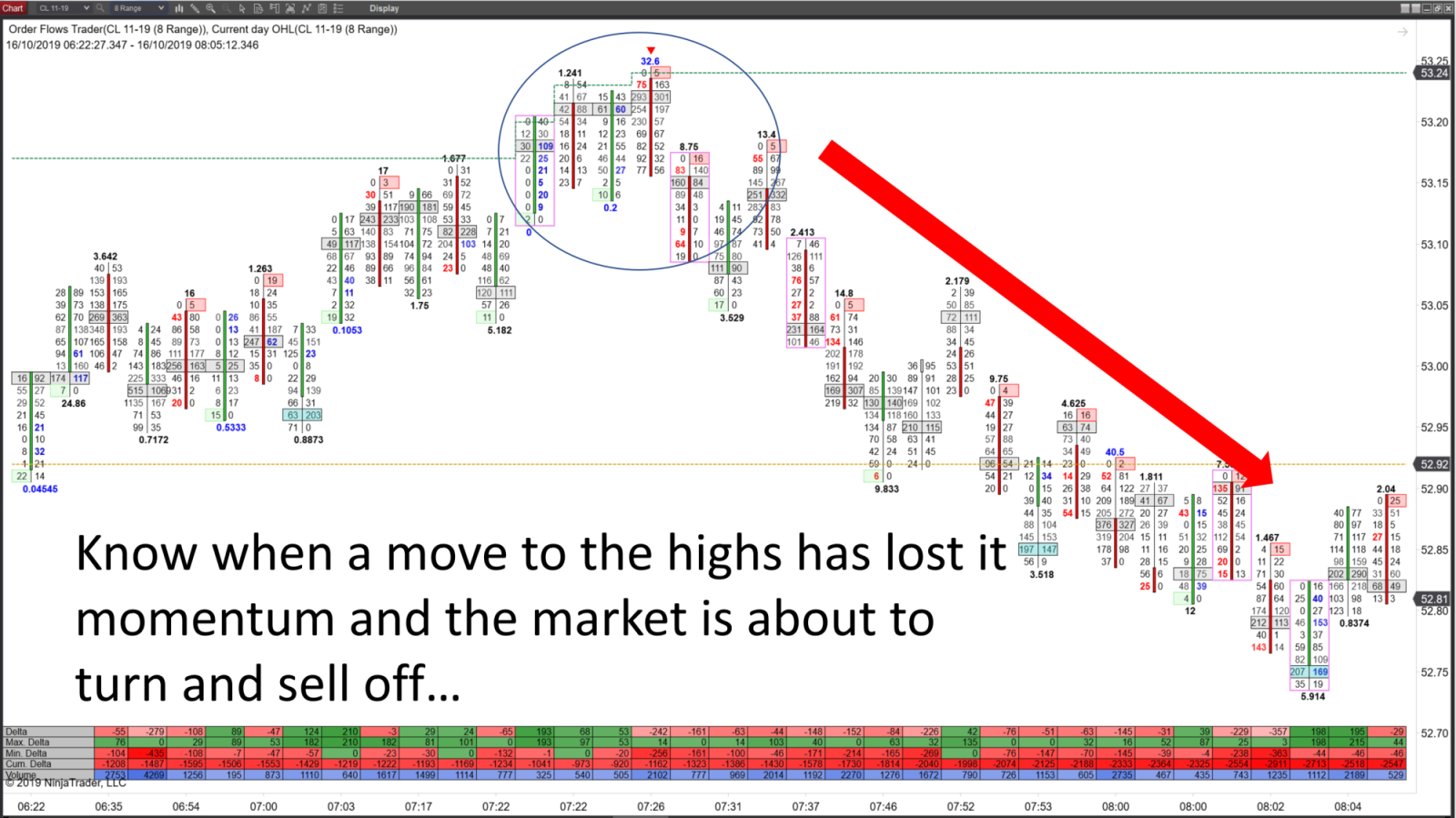

Order flow analysis applies to all markets, here are examples of a few things you will learn in the Orderflows Foundation Courses...

If you want to improve your trading, then you will want to take advantage of this special bundled offer of The Delta Trading Course, The POC Trading Course and The Imbalance Course for a fraction of the cost.

If bought separately, these course would cost you $597 (3 x $199), if you act RIGHT NOW, you get LIFETIME access to the Orderflows Foundation Bundle for a ONE-TIME PRICE of just $97. A Savings of $500

Once your payment has been processed, your login information will be sent to your PayPal registered email address used to complete your PayPal transaction. All emails are usually sent within 3-6 hours. Please check your PayPal registered email address.

14 Day money back guarantee

14 Day Money Back Guarantee

For whatever reason during the first 14 days, if you are not 100% satisfied with the Orderflows Foundation Bundle,

simply contact our support desk and we will refund your purchase in full, no questions asked.

Simply send our support team and email and we will refund you 100% of the purchase.

simply contact our support desk and we will refund your purchase in full, no questions asked.

Simply send our support team and email and we will refund you 100% of the purchase.

All Rights Reserved - Orderflows.com - Copyright 2019

Disclaimer

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Disclaimer

All Rights Reserved. Reproduction without permission prohibited. All of the foregoing is commentary for informational purposes only. All statements and expressions are the opinion of Orderflows.com and are not meant to be a solicitation or recommendation to buy, sell, or hold securities.

The information presented herein and on our web site has been obtained from sources believed to be reliable, but its accuracy is not guaranteed.

Estimates, assumptions and other forward-looking information are subject to the limits of forecasting. Actual future developments may differ material due to many factors.

RISK DISCLOSURE:

Futures trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

HYPOTHETICAL PERFORMANCE DISCLAIMER:

HYPOTHETICAL PERFORMANCE RESULTS HAVE MANY INHERENT LIMITATIONS, SOME OF WHICH ARE DESCRIBED BELOW. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE SHOWN; IN FACT, THERE ARE FREQUENTLY SHARP DIFFERENCES BETWEEN HYPOTHETICAL PERFORMANCE RESULTS AND THE ACTUAL RESULTS SUBSEQUENTLY ACHIEVED BY ANY PARTICULAR TRADING PROGRAM. ONE OF THE LIMITATIONS OF HYPOTHETICAL PERFORMANCE RESULTS IS THAT THEY ARE GENERALLY PREPARED WITH THE BENEFIT OF HINDSIGHT. IN ADDITION, HYPOTHETICAL TRADING DOES NOT INVOLVE FINANCIAL RISK, AND NO HYPOTHETICAL TRADING RECORD CAN COMPLETELY ACCOUNT FOR THE IMPACT OF FINANCIAL RISK OF ACTUAL TRADING. FOR EXAMPLE, THE ABILITY TO WITHSTAND LOSSES OR TO ADHERE TO A PARTICULAR TRADING PROGRAM IN SPITE OF TRADING LOSSES ARE MATERIAL POINTS WHICH CAN ALSO ADVERSELY AFFECT ACTUAL TRADING RESULTS. THERE ARE NUMEROUS OTHER FACTORS RELATED TO THE MARKETS IN GENERAL OR TO THE IMPLEMENTATION OF ANY SPECIFIC TRADING PROGRAM WHICH CANNOT BE FULLY ACCOUNTED FOR IN THE PREPARATION OF HYPOTHETICAL PERFORMANCE RESULTS AND ALL WHICH CAN ADVERSELY AFFECT TRADING RESULTS.

Thanks for subscribing. Share your unique referral link to get points to win prizes..

Loading..