Catching A 5 Point Move In ES Futures

Today in the ES there were a few nice trading opportunities where the setup was clear on the Orderflows Trader software. The reason I developed the Orderflows Trader software was because I wanted an order flow chart to show me what I always look for on the chart. The reason behind this thinking is because I have found that once I am in a trade, my normal line of thinking becomes biased towards the position I have on. It can be hard to be objective when money is on the line.

You always want your trade to be a winner and if you start to take a little bit of heat you can easily ignore the signs that the market conditions for getting into the trade have changed and instead of getting out just say “I’ll give it a little more time to turn around.” We all know what happens after that. The market moves more against you before you capitulate and close out the position.

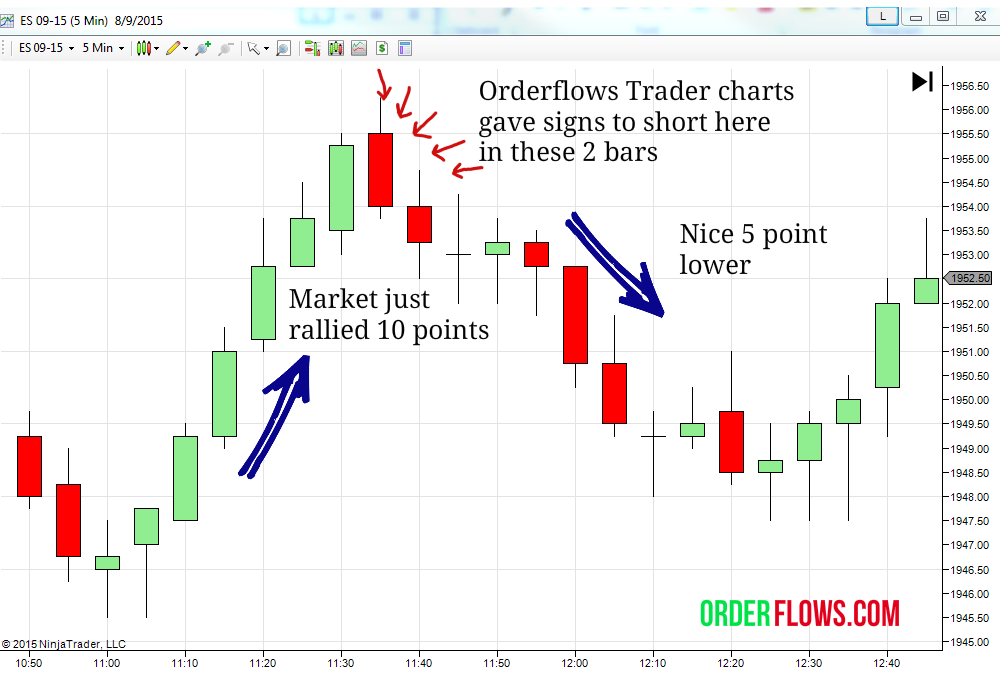

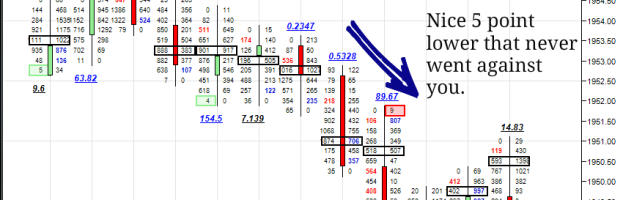

Here was a nice trade setup on a 5 minute ES chart. At the bar at 11:35 the market hit a high of 1956.25 with just 45 lots trading there, but immediately below it there was 515 lots and 1337 lots with the latter being a buying imbalance which occurred in the wick of the candlestick and the candlestick then closed lower; there were 2 selling imbalances in the body of the red candlestick. The candlestick had a negative delta which indicates more volume being sold into the bid. This is the type of bar I would look to short.

The market had been moving up from the 1946.00 level at 11:00am. A 10 point rally. I would be looking for shorting opportunities instead of continuation trades. Sure a 10 point rally could turn into a 20 point rally, but when you have a nice short set up like you do at 11:35am you got to take it.

If you didn’t want to get short during the 11:35 bar, the next bar confirmed that the rally was over when there was a single print high of 3 lots before the market sold off in the time period of the bar. This was an added incentive to get short if you already weren’t.

Although not one of the biggest moves of the day, it was still good for four or five points depending on your entry level. You have to take what the market will give you and five points in the ES is a nice trade. If you can do that consistently at the end of the year you will have a nice bankroll.

What I like about this trade is that once you were in, it never really went against you. I try to stay away from trades that have a tendency to go against you once you get in. Of course there is no guarantee that will happen. I just try to go with the direction of the market.

They always say “the trend is your friend.” So if you get in and the market goes against you, neither the market nor the trend is being very friendly to you.

Happy Trading.

Mike