Taking What The Market Gives You

As a trader we all want to get the most out of trades. In the best of all worlds the market will run straight to our take profit level. Unfortunately that doesn’t always happen. The market will do what it wants to do and no matter how much praying and hoping we do if the market doesn’t want to get to our take profit level we have to know when to take what is available.

I am full of clichés and here is another one. Don’t leave money on the table. It is easier said than done. When I enter a position it is because of what I see developing in the Orderflows chart. In my dreams I expect the trade to go to infinity, but I know that it won’t. So I have to be practical. I have to know what to expect from the market.

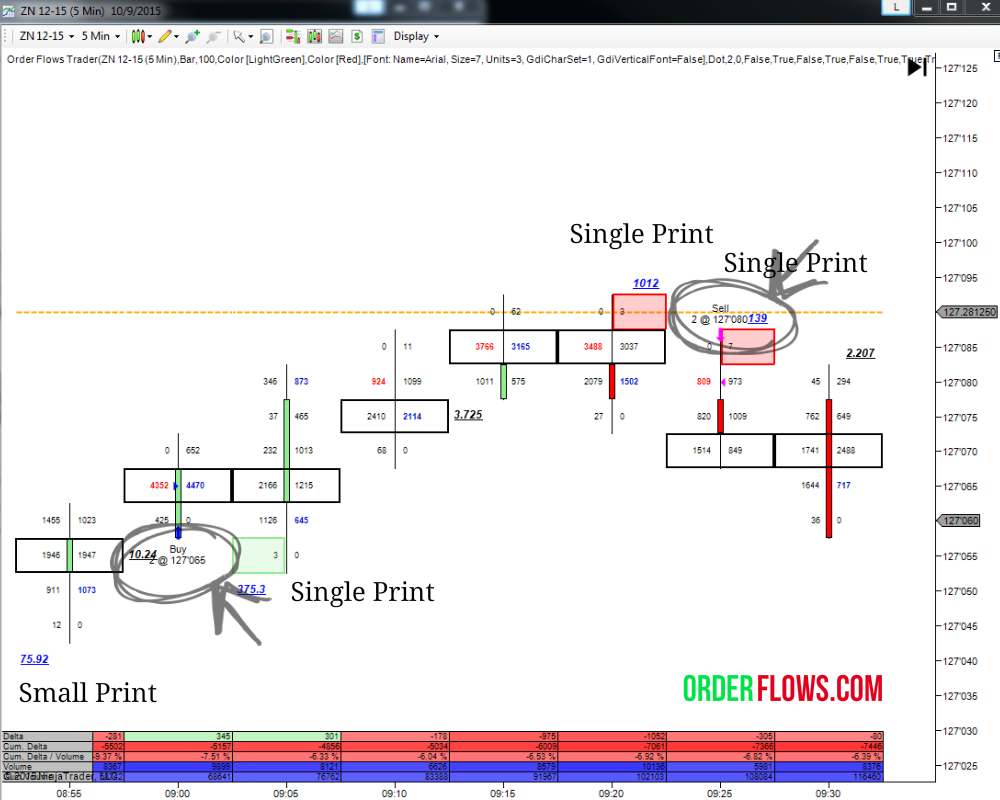

Here is a trade in the ZNZ5, US 10yr note on the CBOT. The market was kind of quiet, not really making big moves one way or another for the last hour or so. I got a set up I like to see – a small print. 12 lots on the bottom and 911 immediately above it. The market was 127-06 / 127-06.5 and I went ahead and just bought 127-06.5’s. I could have worked a 127-06 bid as the market was kind of quiet, I just wanted to get in. I took a little heat as the market ticked down to 127-05.5 before going in my direction, UP.

I was looking to get out at the 127-10.5 level which would have been 4 points. The market traded up to 127-09 but just couldn’t muster any move beyond it. The market traded 62 lots at 127-09, came off, then tried again and only traded 3 lots. This was a sign of weakness. The second time the market tested the level it did so on less volume. The market gave a single print sell set up, trading 3 lots. It was at this point I decided I need to get out. Selling 127-09 was just not going to happen and certainly not my original take profit level of 127-10.5.

Now I am staring at the market and it is 127-07.5 bid and offered at 127-08. I put in an offer at 127-08. It too some time to get filled but eventually did.

When the reason for getting into a trade changes, you need to start looking for an exit. Don’t sit around waiting for the set up to auto correct itself and start going the way you originally thought. The market was telling me to take my 2.5 points and get out.

I could have also chosen to go short at 127-08 because the market conditions changed and sellers were now in control. It would have been a valid sell set up. Especially with 2 single prints, one following the other.

This goes back to the reason I created my software. So I can see the changes in the market more easily once I have a position on. It is too easy to lose sight of things. It highlights the single prints and small prints for me so I notice them, short of saying “hey idiot look at the chart.”

Happy Trading.