What To Do When Market Conditions Change Once You Are In A Trade

How often have you been in a trade that was a winner but then the market turned and you got stopped out for a loser or break even? If you are trading with indicators it almost feels like an all or nothing way of trading. You will either get to your profit target or get stopped out. That isn’t the way to trade.

Every time I get into a trade I have a profit target that I work with as well as a stop level based on where the market would invalidate the reason for taking the trade.

But what happens when you are in a trade and your profit target hasn’t been reached and neither has your stop level but the market conditions have changed? I prefer to get out of the position. Even though I am not stopped out or the reason has for getting into the trade has not changed, rather there could be a signal in the market that conditions have changed.

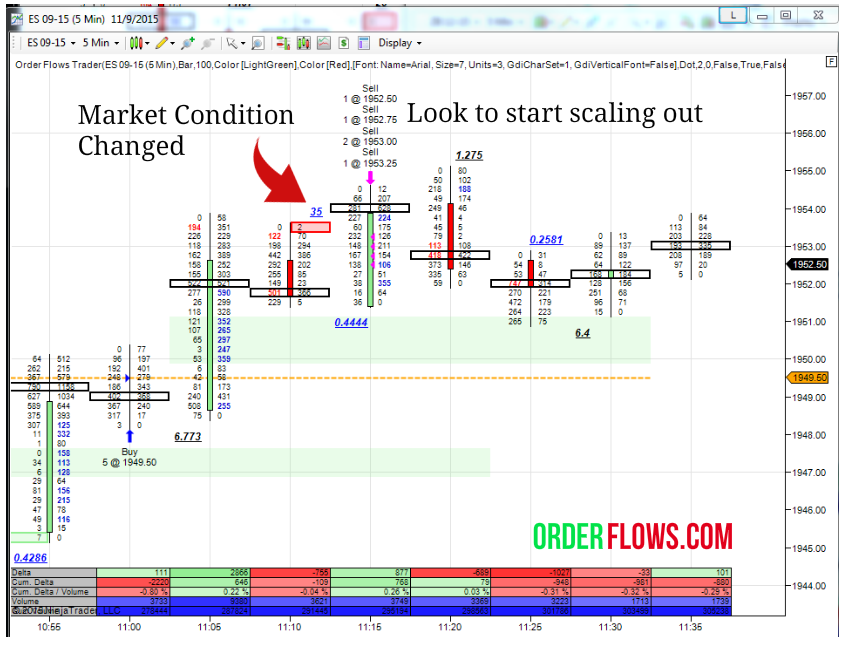

Here is an example of what I am talking about.

This was Friday’s session in the ES. I went long in the ES at 1949.50 based on a few small and single prints. Normally my default take profit level in the ES is 5 points which would have been 1954.50. The market traded up to 1954.00 missing my target by 2 ticks. I was getting close to my 5 point target level when a small print sell indication appeared along with a couple of selling imbalances, one of which appeared near the top and one near the bottom of the bar.

At this point I had to make a decision. Do I stay in the position and try and get my level at 1954.50 or should I start looking to get out. I decided to start looking to get out. But where do I get out? I noticed in the 11:05am bar there was a stacked buying imbalance zone that appeared between 1951 and 1949.75. This became my support level. If the market were to trade below that level I would just get out at the market. In the meantime I decided to work a few scale sell order to get out between 1952.50 and 1953.25 because at this time the market was trading around 1951.50 so I was still a full point away from my first scale out order, but with the aggressive buying that occurred between 1951 and 1949.75 I was confident we should get a small pop back up which we did and I was out at a little less than my ideal take profit level.

Some people will ask why didn’t I just stay in? Well my reasoning is simple, the conditions changed. I could have stayed in and reached my profit target level a few minutes later. Of course the market could have sold off and I would be lucky to scratch the trade.

If there wasn’t the sell signal I would have stayed in position but as a trader you have to make a decision. I would rather take my profit and come back to trade again than take the chance that I will either hit my profit target or get stopped out.

This is what makes order flow trading different than trading off of indicators, you are making trading decisions based on what the market is telling you.

I created the Orderflows Trader software specifically to tell me when the market conditions have changed so I don’t have to wait until the market stops me out to let me know the market conditions have changed.