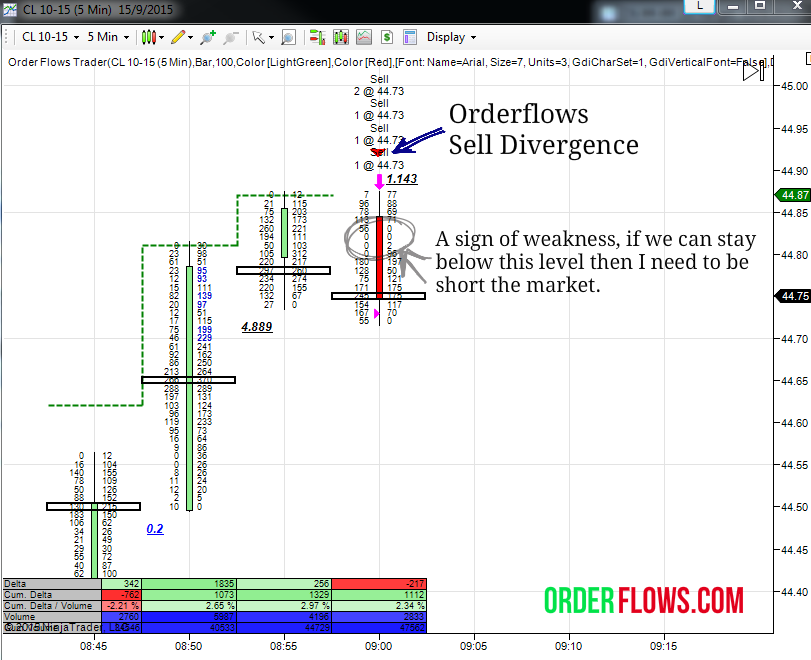

Crude Divergence With Internal Confirmation

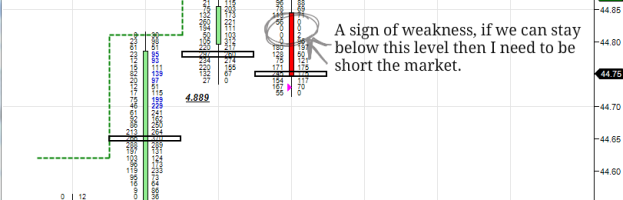

The reason I am a big believer in trading the order flow is because you can see things in the market that might otherwise be overlooked by traders. Sometimes prices move so fast there is nothing in the market for traders to trade against. It can occur when a trader sweeps the market by taking out all the bids down to a certain level or if a buy taking out all the offers on the way up. Of course there would have to be orders at those levels in order to get filled. If not there is a 0 at the level. Usually though there is something at each level, a few lots and sometimes not if the order book can’t be filled fast enough with fresh orders. It is almost like an intraday gap.

Today in the CL there was an Orderflows sell divergence setup. I was watching it when I noticed a seller came in and pushed it down about 7 ticks from the 44.82 level to the 44.75 level. I was watching to see if the levels would be filled in. It didn’t look like the prices were as they were trading back and forth between 44.73 and 44.76. So I went short at 44.73.

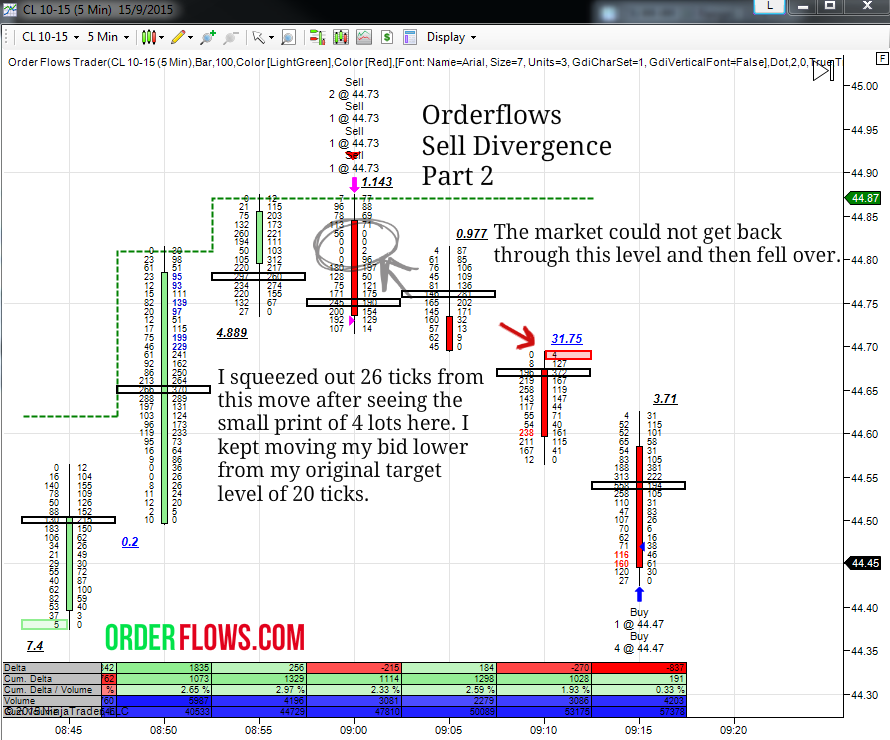

The market did try and fill in the 0’s on the chart, but couldn’t quite make it up to the levels. It was met with good passive sellers coming in between 44.77 and 44.79.

Eventually the market got below 44.70 and a small print high appeared at 44.69. This told me to try and squeeze a little more out of the trade since it is a bearish signal to me. The market couldn’t follow through with the buying.

I had my bid in to get out at 44.53, 20 ticks from my entry. But seeing the small print, I moved it another 5 ticks to 44.48. Once we got down to 44.53ish I moved it down another tick because I thought we should get a push down below 44.50.

This trade happened to work out nicely for me. The market told me that I could move my take profit lower to try and squeeze a little more juice out of the position.

I created the Orderflows software to see into the bar as it form and look for things that appear out of the ordinary to profit from them.