How Money Do I Need To Start Trading With?

The first question most beginning traders ask is how much money do they need to start trading with? The simple answer is “as much as possible.” But the more realistic answer would depend on how much money you have to lose. A futures account can be opened and funded with as little as $1000. While $1000 is not very much it is a start. Intraday margins for many contracts, like the ES is as low as $500.

You can’t do much with a $1000 account. At best you should only be trading a one lot of ES. You can’t take a lot of risk. I know most traders aren’t interested in trading just one lot because it doesn’t even feel like actually trading because if you lose $50 you might not think much about it.

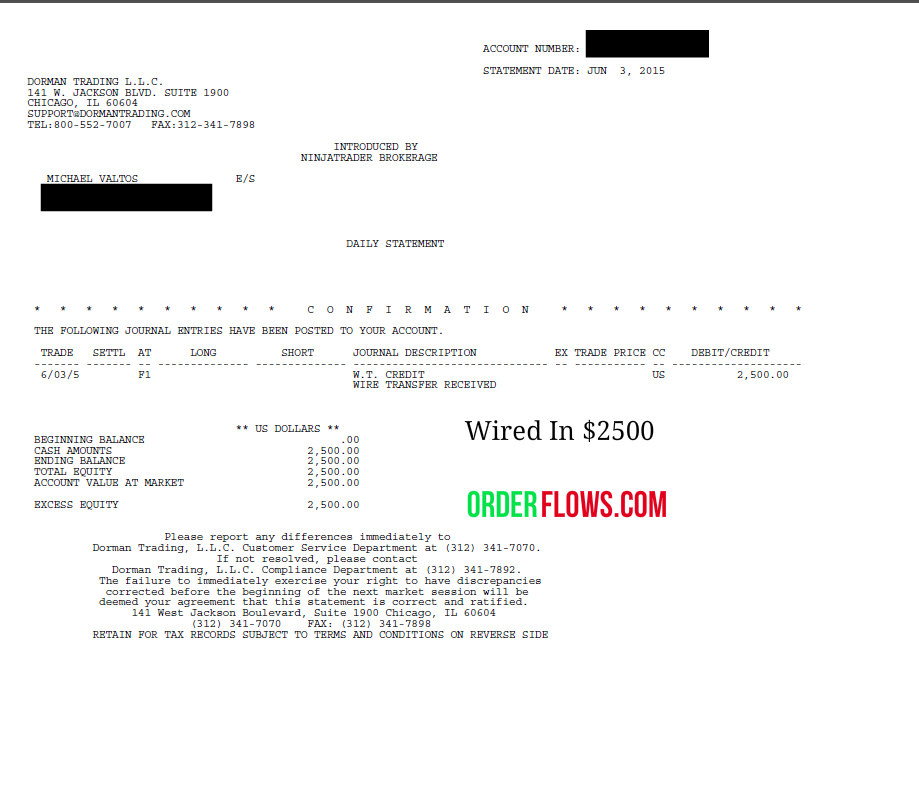

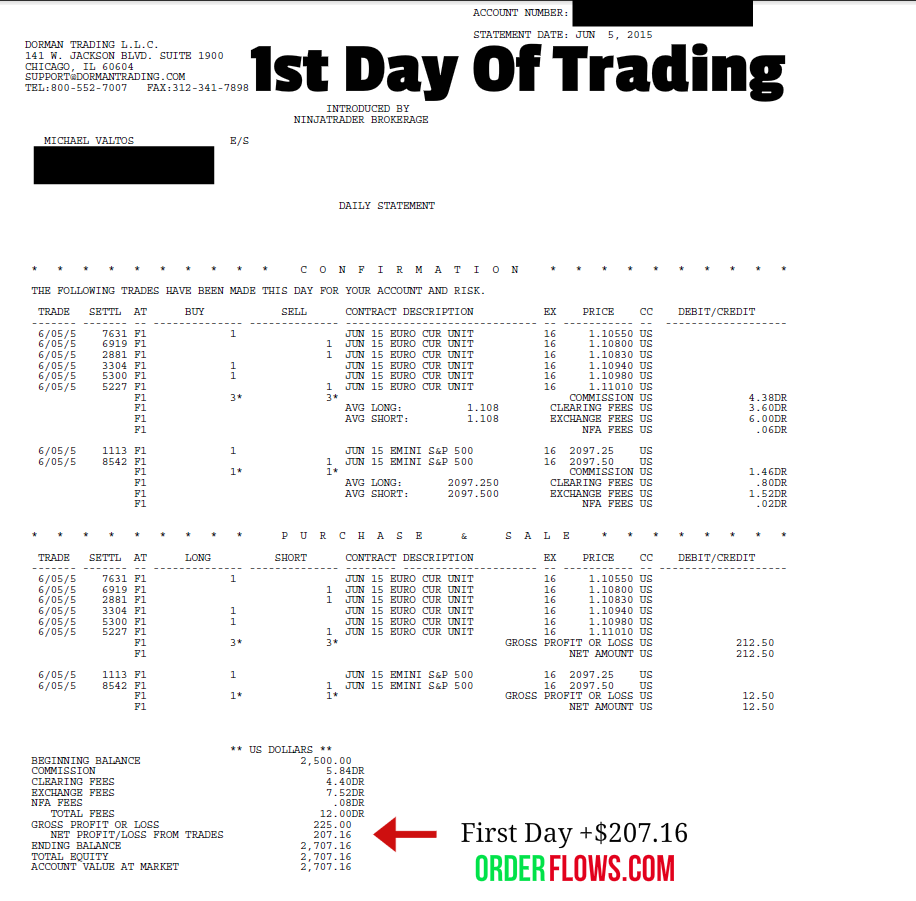

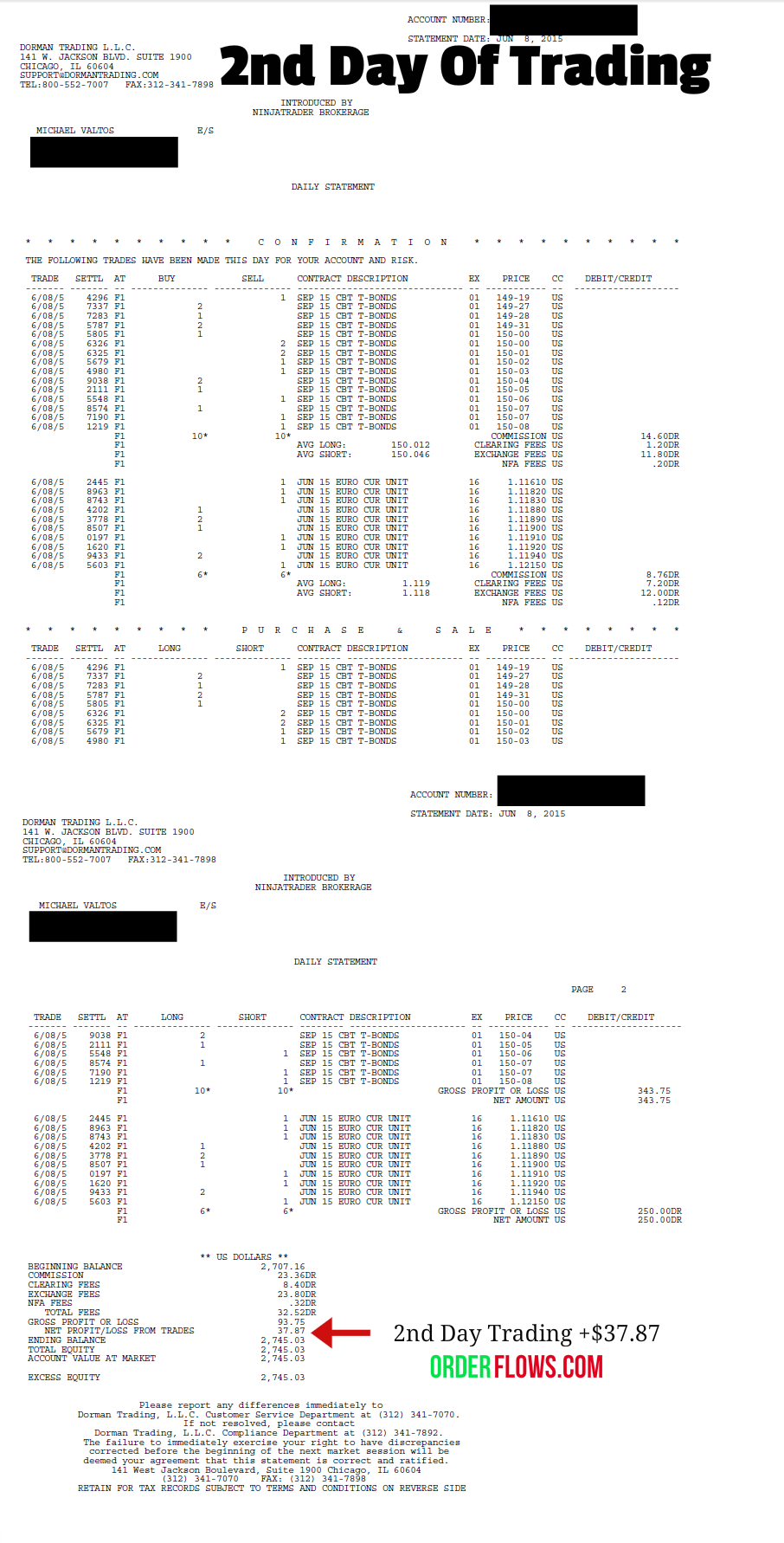

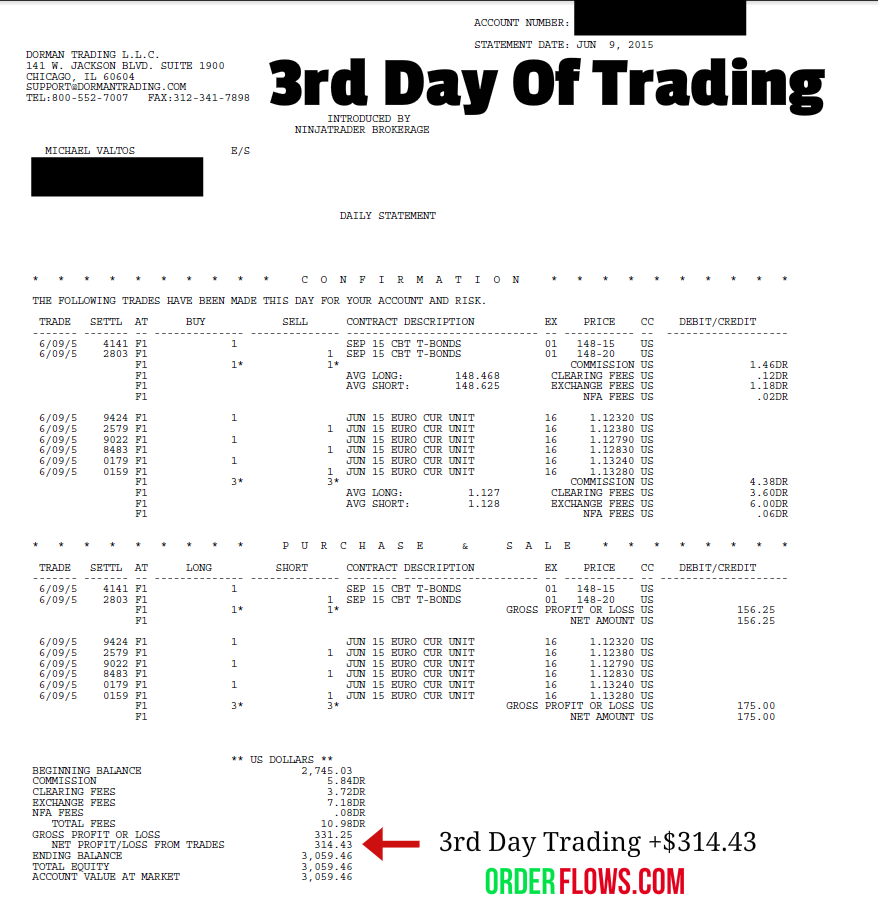

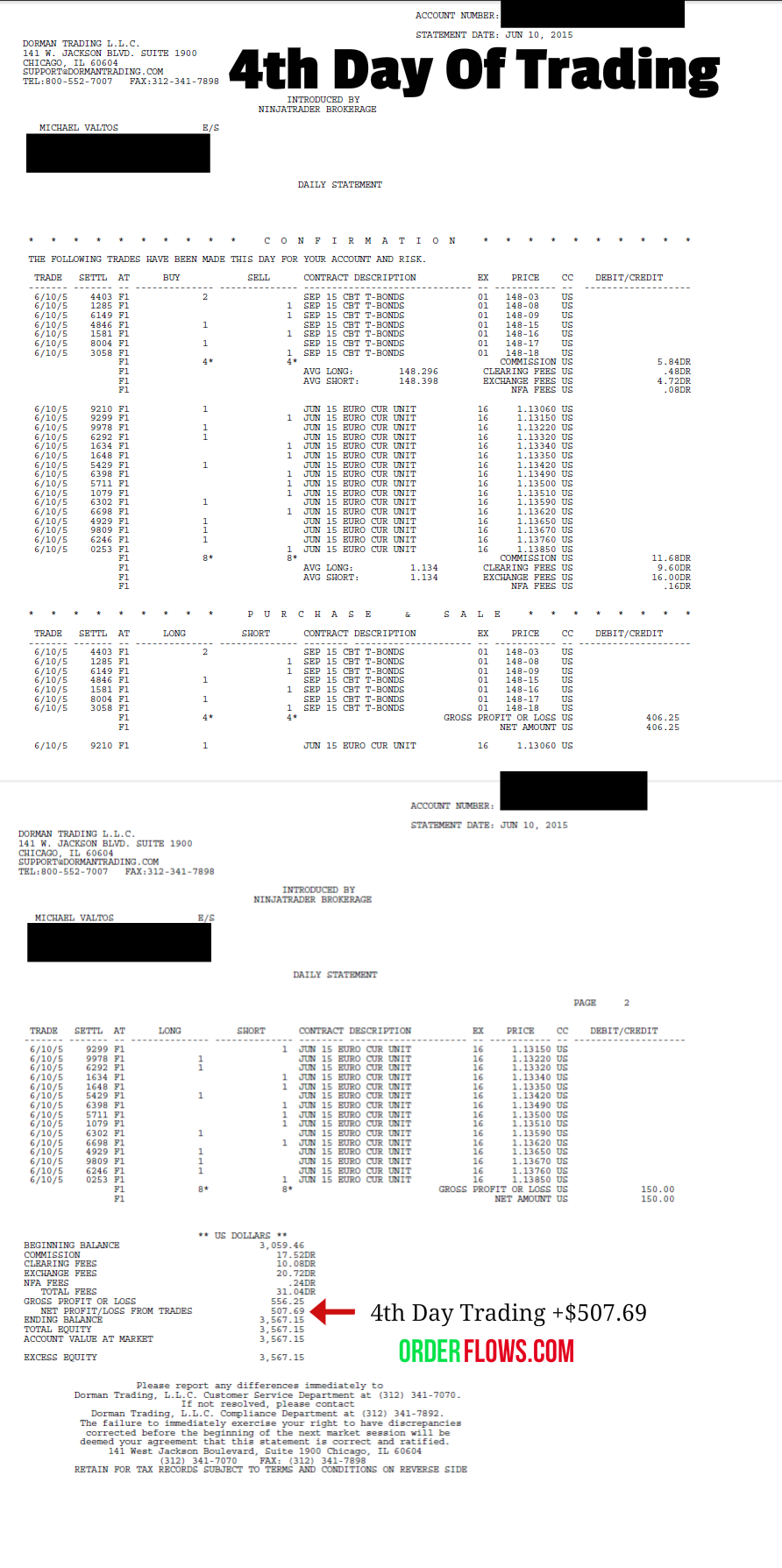

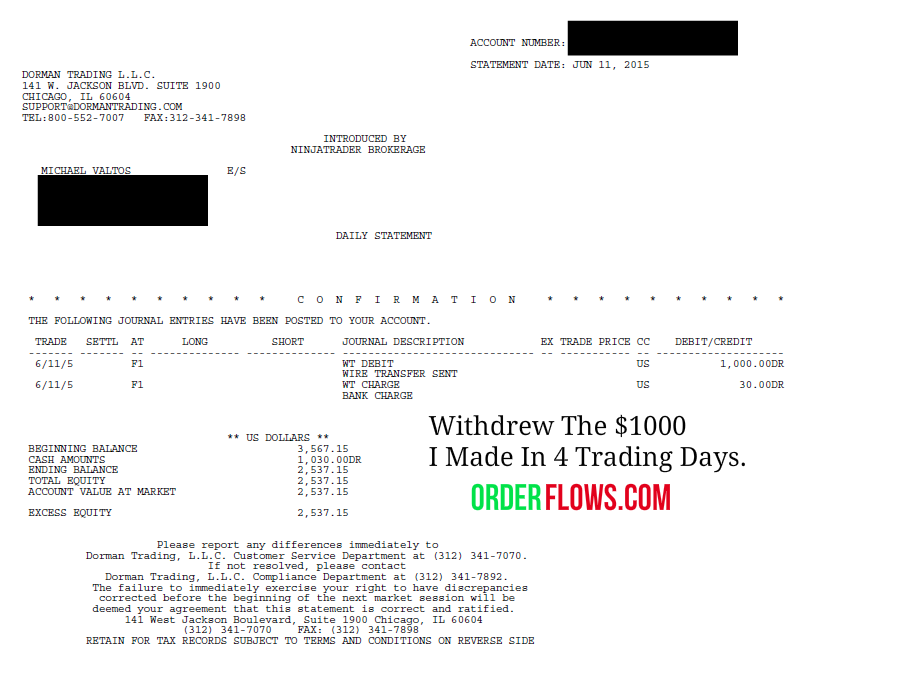

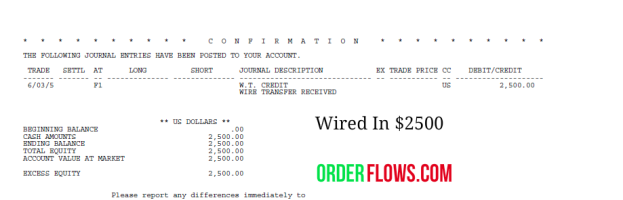

A few months ago I was challenged by a potential customer to show that my order flow setups can be used on a small account to make decent money. So we agreed that I would open an account with just $2500 and try an earn $1000. Trading just one and two lots of the 6E (eurocurrency) and ZB (US 30yr bonds) I was able to reach the target in just 4 days.

A more common entry level account should be $5,000 to $10,000. This amount will allow you to trade several contracts and markets at a time comfortably.

I trade mostly intraday positions. There are many different type of trading out there. You have to find what style of trading is best for your temperament. I am not a long term trader by definition. I don’t buy and hold. I might buy options if I have a long term view, but mostly I am more interested in where the market is going in the next few minutes than the next few weeks.

Is intraday trading better than long term trading? No its not. The big money is made in the long term moves, waking up and having the market gap in your favour. But the consistent money is made trading intraday. Hedge funds can be down 3% in January, down 6% in February, up 1% in March, down 3% in April, up 12% in May because they are right about a big move. Independent local traders prefer to make money on a daily consistent basis. If a local trader can make $1000 a day then it is a good day. Not everyone trades the same so returns will differ, but at the end of the year everyone wants to make a profit. There are different routes to get there.

Intraday traders don’t take big risks the way a hedge fund does. The trading style is different. A hedge fund is like a big oil tanker in the sea while a local trader is like a small motor boat navigating in and out of the market.

If you are an intraday trader you do not need to keep $10,000 in margin to trade one lot of ES. That is ridiculous. Your trade risk is for a few minutes or slightly longer, you are not holding for days or weeks.

But not everyone has $10,000 to commit to trading, does that mean they shouldn’t trade? Of course not. Even if you have only a few thousands saved up for you trading account, go ahead and start trading. The experience you will get from trading real money is priceless. You can trade on a simulator for 10 years and the experience will be like nothing you can gain in a few months trading real money.

People will throw stones at me for telling people to go ahead and open a small account to trade with, but really the only ones who will urge you not to start trading with a small account are system sellers or gurus who want to sell you their trading course for $3000 or so. These are the same guys that will tell you that you need 10,000 hours of screen time to be successful. Who has 5 years of their life to devote staring at a trading screen all day before you become successful? You will go cross eyed. You can stare at a trading screen for a million hours and if you don’t know what to look for or can figure out what to look for you will just waste your time.

Instead I am a firm believer of “On The Job Training”. That is where you will learn what works and what doesn’t work. What to look for and what to avoid. When you have skin in the game you pay more attention to it.

Below are my statements from a challenge to make $1000 trading profit with a small account using Orderflows analysis and setups, trading one and two lots. It took me 4 days to reach the target. I am not trying to brag or anything, but I just wanted to show you that a small account can be used for trading and if you have good setups you can make decent money trading one and two lots at a time.

Some people will say “so what, its only 4 days, you got lucky” or “big deal, I can do that in a day” or “you probably lost the $2500 a few times before hitting the winning run.” There will always be detractors out there, ones that don’t want to believe, but whatever. Traders have their own way of thinking that how they trade is the best way to trade. What works for them may not work for others. But I know what works for me works for others.

The order flow that happens when trades are executed in the market doesn’t change. Once a trade prints, its there it happened. The order book changes constantly, orders are going in or being pulled, even though spoofing has become illegal, that hasn’t stopped it in some respects. Traders and brokers are still working orders to try and hide what they are doing.

Give order flow trading a try and see if it is something that you can use in your trading arsenal.

Happy Trading,

Mike