The Importance Of Good Stop Levels – Don’t Use Arbitrary Stop Levels

Every trader knows he has to use stops in some form. However the problem that many traders face is that most traders use arbitrary stop levels. Maybe they have back tested their system and see that the average loss is 10 ticks, so all of a sudden their stop is 10 ticks on every trade.

While it is good that they have a stop plan in place, the stop level is kind of arbitrary. Wouldn’t it make more sense to have a stop level based on what the market is telling you?

When trading with order flows the market tells you exactly where to place your stop. If you don’t need a 10 point stop then don’t use one. If the market tells you that you only need a 3 tick or 5 tick stop isn’t that better than using an arbitrary 10 tick stop? So why use an arbitrary number when you can use a closer stop that is in line with what the market it telling you? With an arbitrary stop level you are leaving more money on the table for other traders to take from you.

One of the beautiful aspects of trading off of order flow is the market will tell you where to place a stop. Sometimes it could be as close as 1 or 2 ticks.

1 or 2 ticks? I know you are thinking I must be out of my mind. But let me show you. The Orderflows Trader software has a stacked imbalance marker which will highlight on your chart where stacked buying or selling imbalances occur. These levels act as market generated support and resistance levels to trade against.

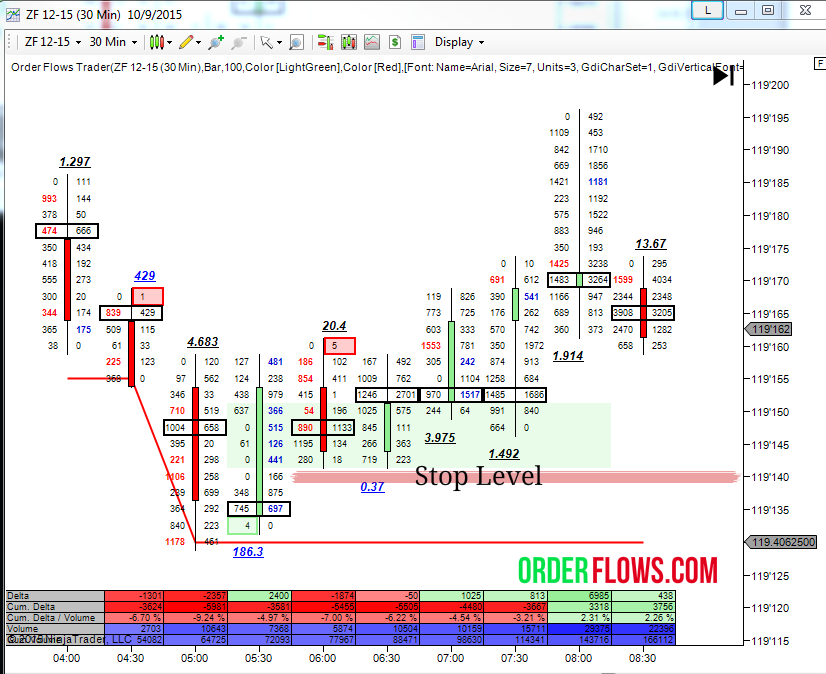

In the example below, you will see a stacked imbalance occur between 119-14.25 and 119-15.25. A low risk trade would be to put a limit order at 119-14.25 or 119-14.50 with a stop at 119-14.00. That is a 1 or 2 tick stop.

The reason behind this trade is that there was an aggressive buyer who bought at those level causing the market to rally, when the market retraces into that zone, the aggressive buyer can show up again.

So here you are risking 1 tick and if you are wrong you are wrong and you lose a tick. But when you are right, you are golden. The market rallied 20 ticks. That is not a bad risk to reward trade. Risk 1 tick to make 20. Who wouldn’t want to take a trade like that? Granted the trades don’t always work out this way. Sometimes it fails completely, but you only lose 1 tick. Other times it 2 or 3 ticks through your stop level before reversing and rallying 20 ticks. It is not cut and dry. But at 20-1 you don’t have to be correct every time.

Well that is an example of a 1 tick stop. What about a trade with a few ticks stop?

For a trade that has a few ticks stop, your entry level is important. If you enter into a trade by just buying or selling at the market you are giving up the edge. Although there is nothing wrong with that, if you are able to get in a better price by working a limit you have a greater profit potential. The one caveat is that you can miss the trade altogether if the market runs away from you. I have noticed that about half of the time the market will retrace a bit before moving on in its direction. The other half of the time the market will run.

When the market runs and you are in a position, then your stop generally won’t get hit as strength of the move is such that the trade never really goes against you. But unfortunately not every trade is like that.

When you buy on retracements you can get better trade entry prices and more importantly tighter stops.

Let’s take a look at some examples.

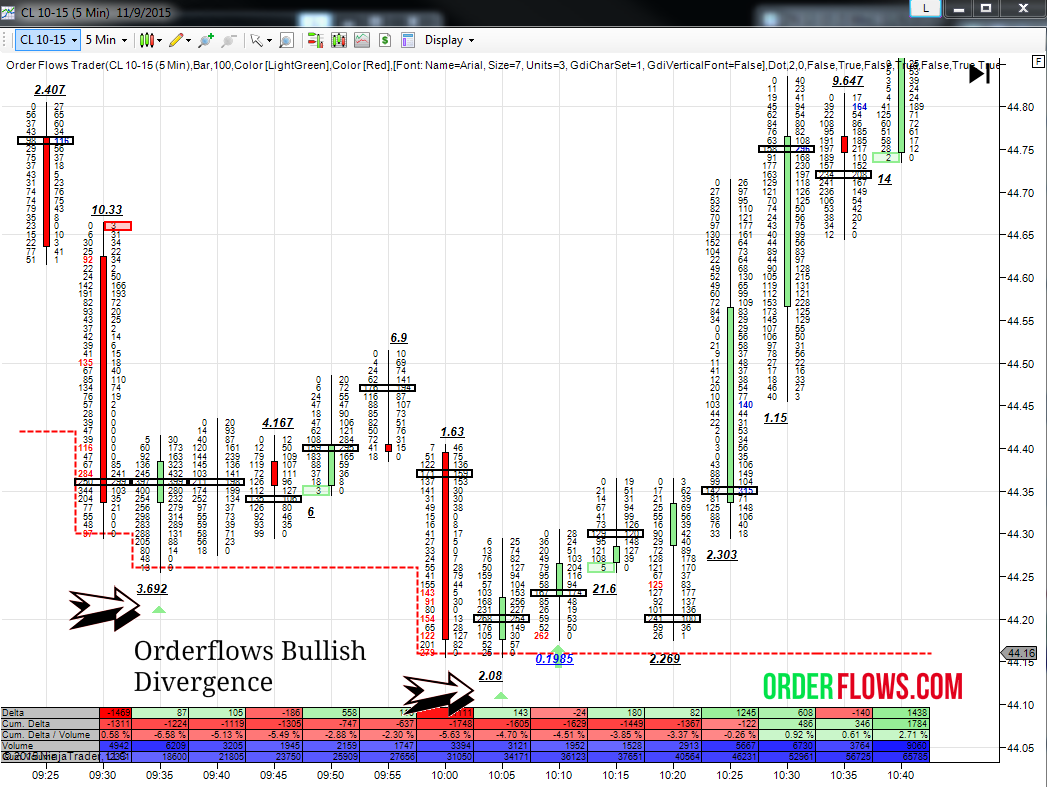

In the first example, we have a couple of Orderflows Bullish Divergence signals. In both cases the market retraced almost down to the low price of the bar with the divergence signal. For an Orderflows Bullish Divergence setup your stop would go immediately below the low of the day (the red line). So you want to buy as close to the low of the day as possible. How do you do that? The easiest way is to scale in with order just above the low, like the low +2, the low +3, the low +4, the low +5. So if your stop is the low -1 and you buy at the low +3, your risk is only 4 ticks.

In the example below, let’s use the low +4 as an entry and the low -1 as our stop. In the first case you would have gotten in at 44.30. The market rallied up to 44.51, once the trade is in your favour you can choose the trail the stop. You could have gotten 20 ticks out of that trade with a 5 tick stop or if you were going for more and trailed your stop you would be stopped out with a small winner. If you kept your stop the low -1, you would lose 5 ticks.

On the next occurrence of an Orderflows Bullish Divergence setup, still keeping with the stop of low -1 and entry as low +4 you would have gotten long at 44.20. The market went as low as 44.18 before rallying almost 100 ticks.

Market generated stop levels is probably the best way to trade. If you are using an indicator like MACD you have no choice but to use arbitrary stop levels to protect yourself and that is a problem. The market can change direction on you but because you are using an arbitrary stop level you are prevented from getting out, that and MACD doesn’t really tell you the market is starting the invalid the trade signal until it is way too late.

This is why I find trading with order flow to be extremely important. As a trader you want to trade what the market is telling you, not because a squiggly line crossed the zero line.

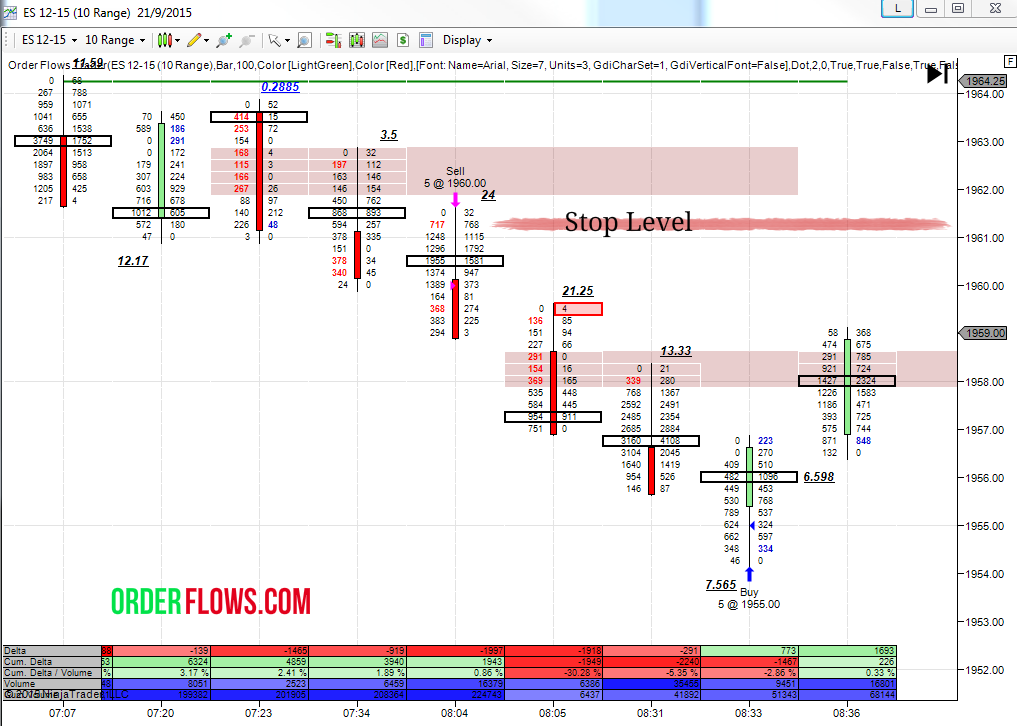

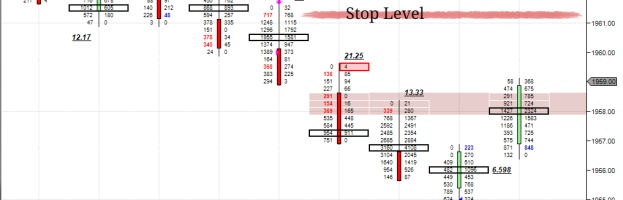

Here is another example, this time not scaling into the market. I missed by entry into the market based on the Stacked Selling Imbalances. I tried to get in at 1962.75 but missed it. Ok that happens, but the market still looked very weak with the selling imbalances so I still wanted to get short. There was quite a bit of trading between 1960.50 and 1961.00, more than the normal 500-600 lots. There were 1200-1700 lots going through on both sides. If we could stay below that the market should go lower and with the cash market about to open soon, if the market is trading on the back foot I figured we would see an extra kick to the downside which is exactly what happened. I got in at 1960.00. My stop level was right above the heavy volume area of 1961.25 giving me about 1.25 points of risk (5 ticks) while looking for a 5 point (20 ticks) winner.

I created Orderflows Trader to help me find trades that have low risk and that I can employ tighter stops. At the very least I try to get 1:1 reward to risk, but more often than not I able to get 3:1 or more reward to risk.

Market generated stop levels are much better to use than arbitrary levels. I find that not only does it give me better exit levels but also eliminates extra financial losses. Why should I make my stops wider than what is a reasonable market expectation? If the market tells me to get out now then I get out.