Sept 29 – 3 Trades 3 Different Reasons 3 Winners

Today I was speaking with another trader about order flow trading and he asked me “what is so good about it?” This guy trades using price action and is quite good at it so its not like this guy is a losing trader and wants to move to the next shiny object, but like most successful traders he is inquisitive and wants to understand more ways to trade profitably.

I walked him through 3 trades today to show him how I use order flow to make informed trading decisions.

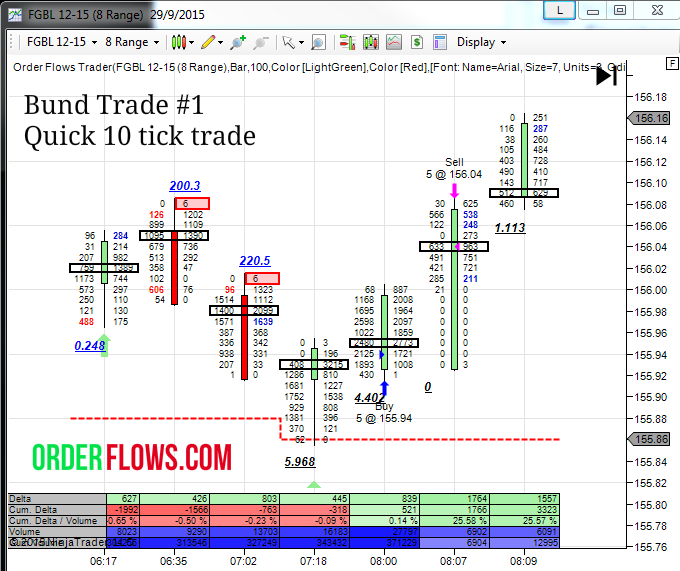

The first trade was in the bund futures using an 8 range bar. FGBL. We just made a new low on the back of 2 bars that had small prints at the top and both bars closed lower. To me that is bearish. Keep in mind. We were trading near the lows. Even though we could go lower, I don’t usually like to take bearish signals at lows. I prefer to look for buys. It was only just past 7am Chicago time so, yes, the market could go lower still. But like I said I like to look to buy when prices are low and sell when prices are higher, not sell when prices are low and try and buy back lower.

The market hit a new low at 155.86 and then proceeded to trade higher and close the bar higher. Delta was positive. This is a setup I like to look for – Orderflows Buying Divergence. I got long at 155.94. Admittedly the market struggled a bit for the first 10 minutes as it traded between 155.92 and 155.98. It was in the money for the most part but twice traded down to 155.92. At worst it was 2 ticks against me. Finally the market woke up and popped to my take profit level at 156.04 I got 10 ticks out of it on 5 lots. Not the greatest trade ever, but good enough. +500 Euros.

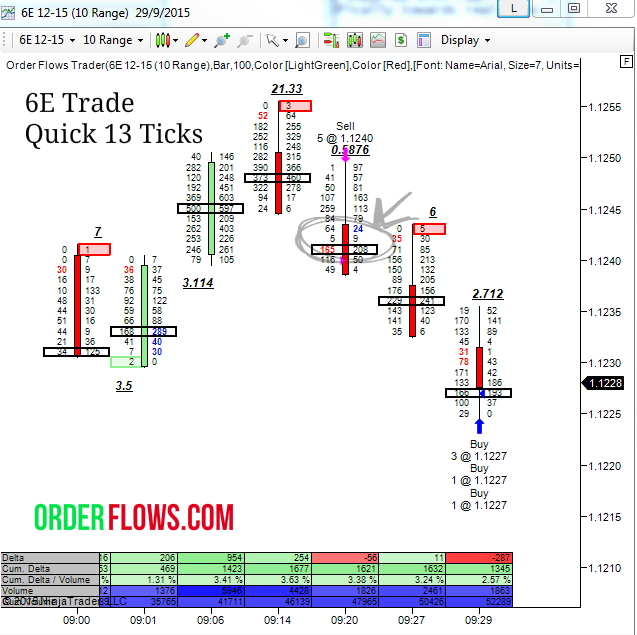

The second trade was in the Eurocurrency futures, 6E. The market had just come off a swing high at 1.1255 and put a single print up there. Originally I had an order in to sell at 1.1253 if the market retested 1.1255. But as I was watching the market trade I noticed a flurry of selling activity come in and it left a pocket of illiquidity where only 5 lots traded on the bid and 9 lots traded on the offer at 1.1242.

I find these pockets of illiquidity very interesting because that is usually a sign that big institutional traders are pushing the market through levels to get their orders done. This presents a good short term trading opportunity. I got short at 1.1240. The market tested that level again, 1.1242, but there was no buying interest above it and the market sold off. I tried for 15 ticks out of this trade and the market did hit my take profit level at 1.1225 a couple of times but traded small and I got nothing, so I just went ahead and adjusted my take profit up to 1.1227 and got out. 13 ticks on 5 lots. +812.50 $

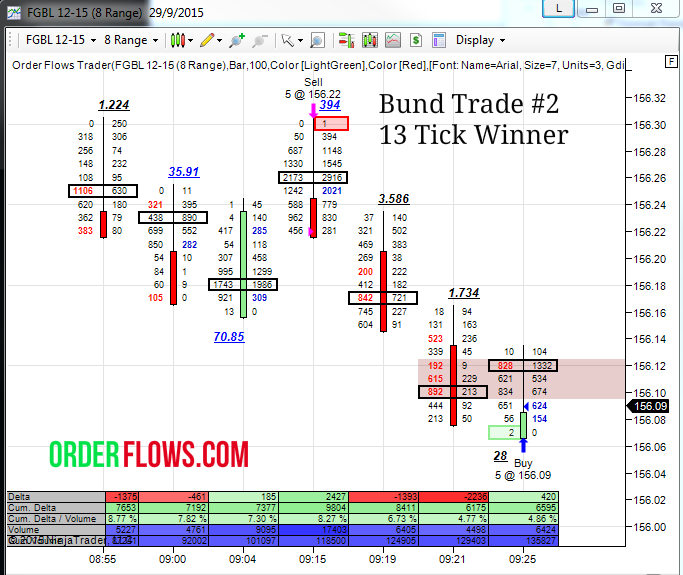

The third trade occurred at almost the same time as the second trade. The third trade was in the Bund again, FGBL. We had just come off a swing high at 156.30 with a single print of 1 lot. If you look 3 bars ago that high traded 250 lots. So clearly there was no more buying interest at that level. When you look at the volume that traded on the offer on side on the way up, starting at 156.26 you have 2916 lots, at 156.27 there are 1545 lots, at 156.28 there at 1148 lots, at 156.29 there are 394 lots and at 156.30 there is just 1 lot traded. Buying just gradually declined on the way up. In the middle of the bar there were 2 price levels with very fat volume numbers 2173 + 2916 at 156.26 (5089 lots) and 1242 + 2021 at 156.25 (3263 lots). Immediately under those two price levels the market is just trading 500, 700 , 800 lots on the bid and offer. A big drop off in volume. At the 156.25 and 156.26 level price was fair as there was a lot of 2 way trading going on. But what is important to note is that the buyers were satisfied, but the sellers still have inventory to sell because price was still moving lower.

So when you break it down, you have a single print high at 156.30 so it’s a sign that prices up there are rejected by buyers. Then you have heavy selling in the middle on the offer side, passive sellers were stepping in willing to sell. The market kept going lower, below 156.25 the buy limit orders were almost non-existent when just above there was over a thousand lots at 156.25, 156.26 and 156.27. Get out of the market’s way as it is about to drop which it did quite nicely. I covered my short at 156.09. 13 ticks on 5 lots. +650 Euros.

A pretty decent trading day. Made 3 trades which came out to about +$2000. But more importantly I was able to show my friend that order flow trading is relative easy once you know what to look for.

I created Orderflows Trader in order to interpret what I think is important in trading order flow. There are many ways to look at order flow and it can be intimidating to many people, especially those who are new to trading. I try to keep it simple and easy to understand.

If you want to learn how to trade profitably using order flow, feel free to contact me.

Happy Trading,

Mike