Trade For Points Not Ticks – Trade Recap October 6, 2015

If I had to define my style of trading I would have to call it intraday trading. I hold positions anywhere from a few seconds to an hour. If a trade is not going my way after an hour or hasn’t reached my profit target after an hour I am willing to get out with a small loss or profit and move on rather than be married to the trade.

I often get emails from people selling systems to make 2 ticks a day and with 2 ticks a day you will achieve financial freedom. Really? Financial freedom with $25 less commission of $4, so about $21 a trade? They tell me to just scale up my position by trading more. $21 x 10 lots is $210. That is not the type of trader I am. I would rather make $210 with trading a 1 lot than a 10 lot.

For losing traders the reality of having a lot of winners is self assuring and maybe it gives them hope that they can make money trading. But what happens when they get a loss that is out of their realm. I find that trading for 1 or 2 ticks is quite deadly because it is easy to let the market drift 2 to 3 or even 4 ticks against you while you think “just come back to my level.”

If I am going to risk 4 ticks I need a better return than 2 ticks. Some markets move 2 ticks like it is nothing and if you are on the wrong side you are screwed.

So these 2 tick gurus then proceed to talk about setups to get your 2 ticks. To be honest I lose interest when someone starts talking about making 2 ticks, so I don’t know if they are selling a system to only get 2 ticks a day or a system that trades a lot and at the end of the day your goal is to come out 2 ticks in the plus. Either way it is a death wish. I already explained the problem trying to earn only 2 ticks on a trade. If you are trading a boat load of contracts in and out and hope to come out 2 ticks ahead, that’s not trading that is gambling.

No thanks. I am a trader not a fruit picker.

Today I took 2 trades based on what I saw on my Orderflows Trader and each of them had a different thought process.

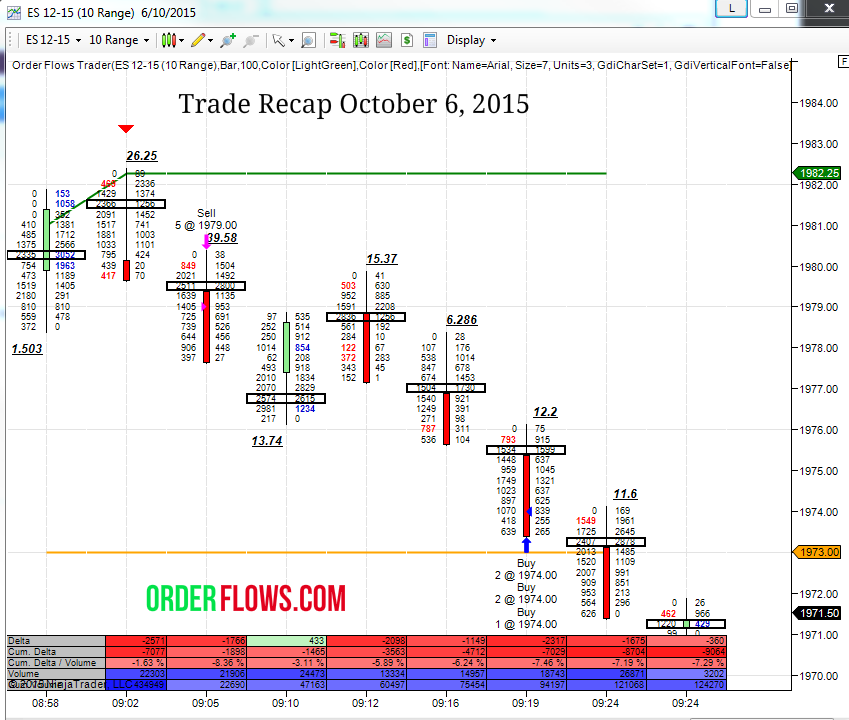

The first was in the ES. The market had just reached new intraday high and started to come off. I then saw one of the setups that is one of my bread and butter trades – the Orderflows Selling Divergence. I got short at 1979.00. The market sold off initially before coming back up to the area I got short at and weakly traded up to 1980. So there was a 1 point (4 ticks) where the market was against me before selling came in and the market sold off to my 5 point target at 1974.00.

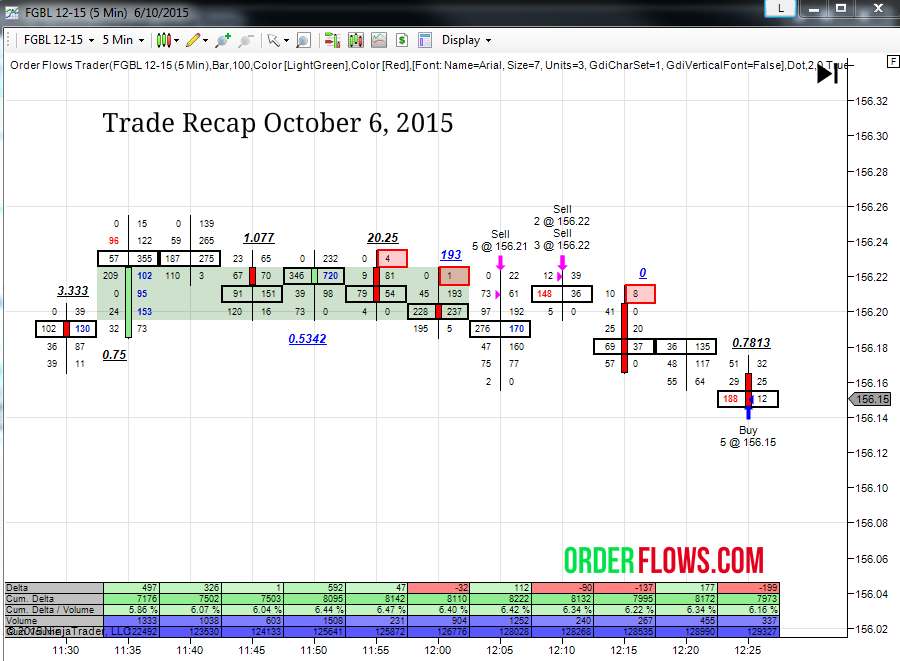

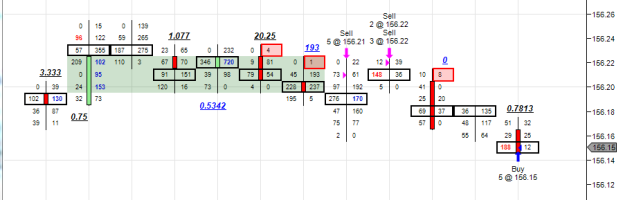

The second trade was a few hours later in the bunds. This trade setup was similar to the smack down trade I wrote about yesterday. Today was a little different. We had a stacked buying imbalance zone that the market was trading in, but couldn’t really get out of, every time the market would try to break out it would go back into the zone. Then there were 2 small prints with the market hanging around the 156.20 level. I put in a couple of offers, working to sell 5 at 156.21 and 5 at 156.22. My thinking was that if the market got above 156.23 I would get out. So I had a very tight stop level. 1 tick on 5 lots and 2 ticks on the other 5 lots.

Initially the market started to trade down to 156.16 and I thought I missed the trade. But I was patient and gave it a few more minutes which proved right as the market rallied back up to 156.22 and I got filled on both my offers. I put in the first bid to get out at 156.15 and the other one at 156.14. Eventually I moved that bid up to 156.15 as well.

Trading with order flow doesn’t need to be so confusing. Once you know how to read what the market is telling you then it makes trading a more fulfilling activity instead of one that drives you crazy.

Don’t sell yourself short. Why go after 2 ticks when you can make more?