Make Smarter More Profitable Trades With Order Flow – Trade Recap Oct. 7, 2015

One of the benefits of using order flow in making trading decisions is that you can see real-time market generated supply and demand levels.

With the advances in technology in the last 30 years traders have changed the way they look at the market. Traders have become indicator junkies to the point that they don’t know how to trade without indicators. Don’t get me wrong, computers are a great help to traders and without which it would be a lot more difficult for a retail trader to survive.

When people create indicators they are looking mainly for overbought or oversold and momentum based measurements from which to react to.

When I trade with order flow I am watching how the market participants react to traded price and volume. Humans trade on and react to price. Computer programs and models react to statistics and mathematically derived indicators. Computer programs cannot measure the emotions of the market participants, which is one of the keys to understanding the market.

Every trader is different. Risk tolerance, reasons for getting into a trade, amount of time to trade. Every trader has different reasons for being in a trade. Computer programs and algos can’t take into account all the different reasons people get into or out of the market. I am not saying that humans can either, but at least humans can understand human behaviour where as a computer can only do what it is programmed to do.

What reading the order flow allows me to do is understand how the market participants are reacting to traded price and volume. The problem with indicators is traders are often stuck waiting for confirmation before they can get into a trade and as a result give up a trade location premium as price had to move first before they could get confirmation for the trade.

Orderflows Trader allows me to read the market and know where there is market generated support and resistance based on traded volume and price. I am not saying that you have to disregard all your way of finding support and resistance especially if it works for you. Rather, what I am saying is with Orderflows Trader when you read the order flow – the actual volumes traded on the bid and offer at prices – you can see the levels that the market participants, the ones who are actively buying and selling, are telling you where the support and resistance is.

Before you get all excited and think that Orderflows Trader is the greatest thing since sliced bread let me tell you upfront that the market moves up, moves down and moves sideways. I hate to call it noise because its not noise, but a lot of times there are no clear trading opportunities because traders are buying and selling, inventory changing hands. When you understand order flow you see that in the charts.

What order flow allows you to do is see when the conditions in the market start to change. When buyers start to overwhelm sellers or when buyers start to dry up, etc. This is the type of information you can have when you are trading with order flow. Real information that can be used logically. Is price going down because there is a motivated seller or is it going down because buyers are just not interested in buying at certain levels?

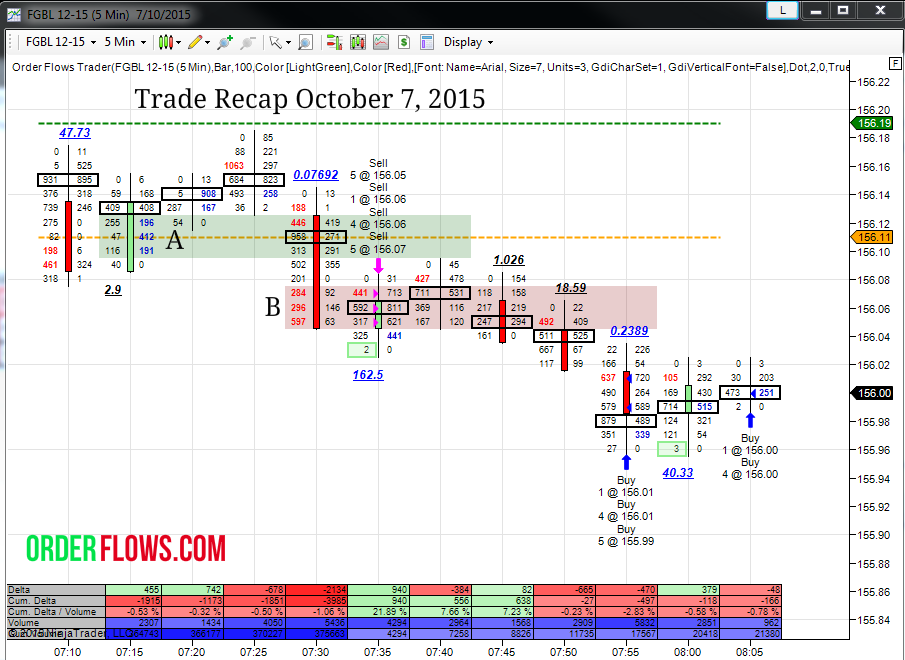

Here is a nice trade that I took in the bunds today that had very limited risk. I had hoped to get more out of it than I did, but the market wasn’t very cooperative.

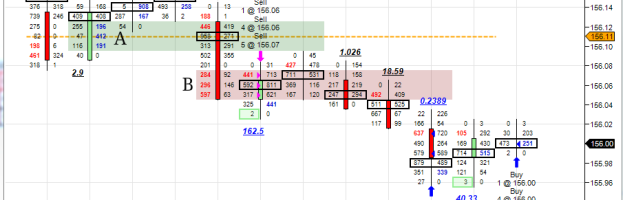

Let’s take a look at the trade. Initially there was a stacked buying imbalance which initially held up as support as it is a bullish signal, but then an aggressive seller came in and pushed the market not just into the stacked buying imbalance zone but clearly through it and caused a stacked selling imbalance zone.

There was a 2 tick gap between the bottom of the stacked buying imbalance zone and the top of the stacked selling imbalance zone.

What I saw was a clear violation of support and now I am looking to get short and use that previous level of support as my new resistance. There was a stacked selling imbalance zone between 156.05 and 156.07. I decided to scale in at each price. I got filled on each level.

Normally I would look to put my stop in just outside of the stacked selling imbalance zone but with the failed stacked buying imbalance zone just a couple of ticks above part of me was thinking there might be a high chance we may pop up towards that failed zone before we come off.

My average sell price was 156.06. I was willing to risk the trade up to 156.10. The market did rally up to 156.09. I have to admit I was a bit interested when it was trading back and forth between 156.07 and 156.08 on heavy volume. This was the area between the two zones, it was almost like the buyers and sellers were struggling with each other to take control. The fact it only traded 45 lots at 156.09 made me feel more comfortable because buyers weren’t really interested in taking it back up. If the volume was 245 I really think it would have gone to 156.10 and possible 156.11. There was a selling imbalance of 427 lots at 156.08 so it indicates aggressive sellers. So now I am feeling pretty good.

Over the next couple of bars the market is still trading inside the stacked selling imbalance zones so I put in a couple of bids below around the big psychological price of 156.00. I put in to buy 5 at 156.01 and to buy 5 at 155.99. The big round numbers can act as both a magnet or a wall. I figured I would take off a portion of the trade and try and leave some on for a bigger profit.

As the market finally came out of the stacked selling imbalance zone and spiked down to 155.96. I was filled at 156.01 and 155.99. I still was short 5 lots that I wanted to cover at 155.91. After trading 155.96 the market bounced a little higher back up to 156.02 and there was a small print on the second test at 155.96. That was the sign for me to look to get out. I put a bid in to get out at 156.00.

Eventually the market rallied over the next hour. It was a good trade for me to get out at an average of 156.00.

If I was trading with an indicator instead of my brain and the indicator told me to get short at 156.06 I probably would have been stopped out either at a loss or at best break even because indicator based systems don’t take into account the psychology of the humans that are actually doing the trading in the market.

If you want to learn more about trading with Orderflows Trader be sure to drop me a message.

Happy Trading

Mike