How To Handle Slow Trading Days – Trade Recap Oct 12, 2015

One of the problems traders face is how to handle slow trading days. One of the main causes of slow trading days, or rather slow market moving days, can be due to a holiday. In the old days of open outcry the exchange would be closed, but now that everything is traded electronically it is easy for the exchange to keep the servers running. Besides that, everything is “global” now. So a market moving event can occur in another country that is not observing a holiday.

Most traders today are too young to remember or know that German Bund futures used to trade on both LIFFE (now Euronext Liffe) and the DTB (now Eurex). For a long time the LIFFE contract traded much more volume than the DTB version. The big shift came one bank holiday when the LIFFE was closed but the DTB was open. People needed to trade bunds, so they traded that day on DTB. Since the contracts had different specs and were not fungible (meaning you couldn’t offset one with the other) if you opened a position on DTB you had to get out on DTB. The DTB bund futures started growing in open interest and eventually overtook the LIFFE contract at a time when everything was going electronic. The DTB was fully electronic. Slowly the LIFFE contract began its slow death.

Anyway, back to Monday’s trading session. The CME was open. The US observed Columbus Day. Its one of those holiday that people call a parking meter holiday. Its an official holiday but people still go to work. Being a Monday and a quasi holiday means people will take a long weekend. The result is decreased volume and tighter ranges.

With that in mind you have to be very careful with how you trade. Don’t expect the market to trade the way it does when there is normal trading activity and volume. The first option is to just take the day off and enjoy yourself. But if you have to or want to trade, you have to be careful with your exits. One of the things I do is lower my take profit. If I normally go for 15 ticks I go for 10 (6E). If I normally go for 5 points I go for 2.5 or 3 points (ES).

Many bank traders will take the day off, so if you are trading foreign exchange you have to realize that ranges can be tighter. Trader at banks will be in, but there are there mostly to facilitate trade for customers. On days like Columbus Day their biggest decision is deciding what to order for lunch.

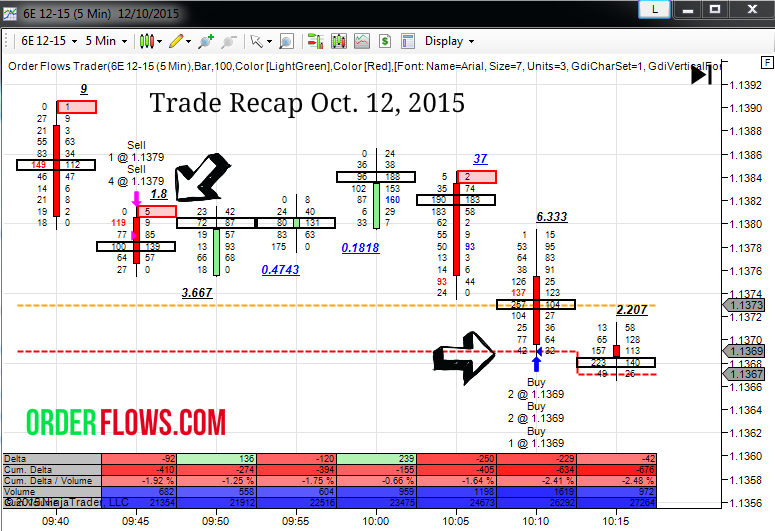

Here is a trade I took on the 6E on Monday.

The set up wasn’t that pretty, but that that is how it is sometimes. In the first bar (9:40am) there was much more action occurring on the bid side which indicates to me there is more active selling into the bid than buying into the offer. There was a clear lack of buying interest in the form of people willing to pay up to the offer. This is a 5 minute chart. So over that time period traders were more than happy to sit on the bid and let the market come to them. These are passive buyers.

In the second bar (9:45am) the bar was pretty much non-eventful. However there was that selling imbalance of 119 lots at 1.1380 against a small print of 5 lots at 1.1381. I decided to see if that would hold over the period of the bar and got in just before the bar closed. I got short at 1.1379. I figured I could risk it up to 1.1389. But I didn’t think we would get up there. Realistically I was thinking my risk was around 1.1385 which was the POC in the first bar.

After I sold, the market rallied. I hate that. But it happens and the market actually traded all the way up to 1.1386. 1 tick above the POC before falling over. I had my take profit level at 1.1369, 10 ticks only because it is a holiday and volume is less than normal, so I don’t expect normal moves. This was a 1:1 trade. Not all trades are going to have a risk:reward of 1:4, especially on slower days.

Even though the trade was profitable, it was a bit of a struggle to find the trade because it was a quiet day and on quiet days you often get setups that that don’t go anywhere and just burns money in your trading account.

Happy Trading.

Mike