A Tale Of Two Stops – Don’t Get Stopped Out With Stops Too Tight

One of the hardest parts of trading is getting stopped out of a position only to see it then turn at exactly the point you got stopped out at and then continue on in the original direction of the trade and move to your profit target.

So what is a trader to do? Do you not use stops? That is extremely dangerous and risky. It’s a bad idea to leave a position open with no stop. You can turn a small loss into a much bigger account damaging loss. Do you use a tight stop? That leaves you with a much higher probability of getting stopped out.

Ideally what you want to find is the “middle ground.” A stop level not too far away where the loss won’t be huge and not too close that the stop won’t run the risk on getting stopped out with ordinary back and forth trade.

Everyone wants “low risk trades.” But does that mean your stop has to be extremely tight? No necessarily. A low risk trade can be one that may move against you say 3 ticks, but if you have your stop set for 2 ticks you will get stopped out.

You can easily use a mental stop to watch the market as it moves against you 2 – 3 ticks. I often talk about worst case scenario stops. For example if the market moves 5 ticks against me I would get out no matter what. That stop order would be working in the market while the 2-3 tick mental stop would not be working.

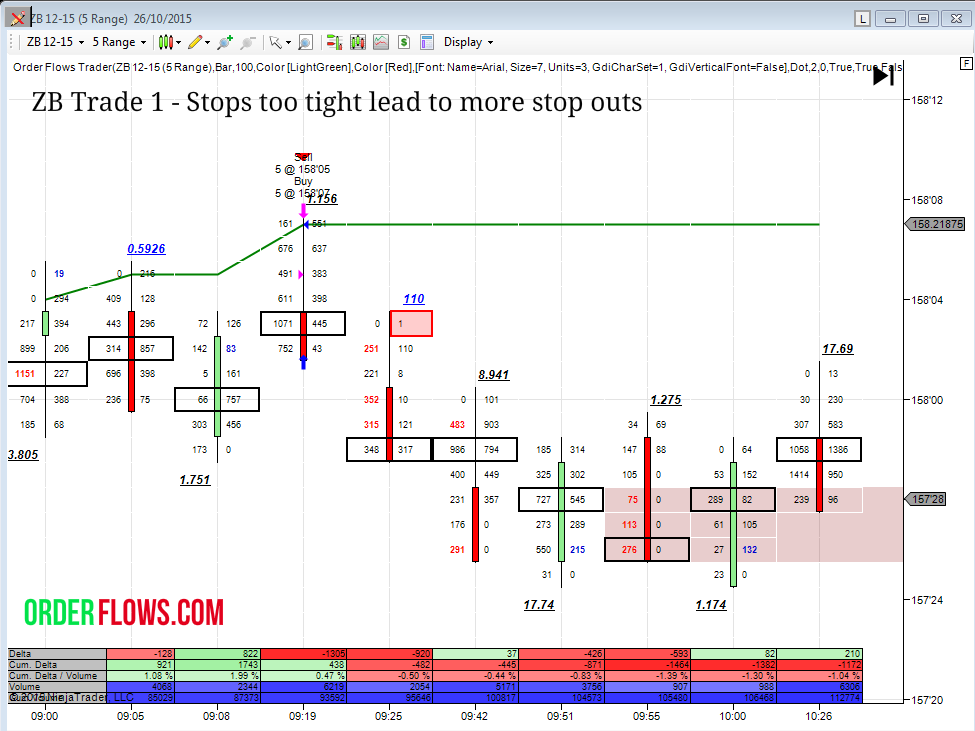

Below are a couple of trades I took in the ZB.

In the first example, I sold ZB at 158-05 and put in a stop of 2 ticks that was actually working in the market. As luck would have it, the market then proceeded to stop me out 2 ticks higher at 158-07 before stopping and turning around and selling off in the original direction as I had expected it to.

The operation was a success but the patient died. My stop that was working in the market was just too tight that it got me out too early.

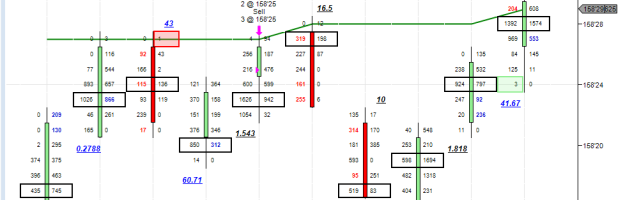

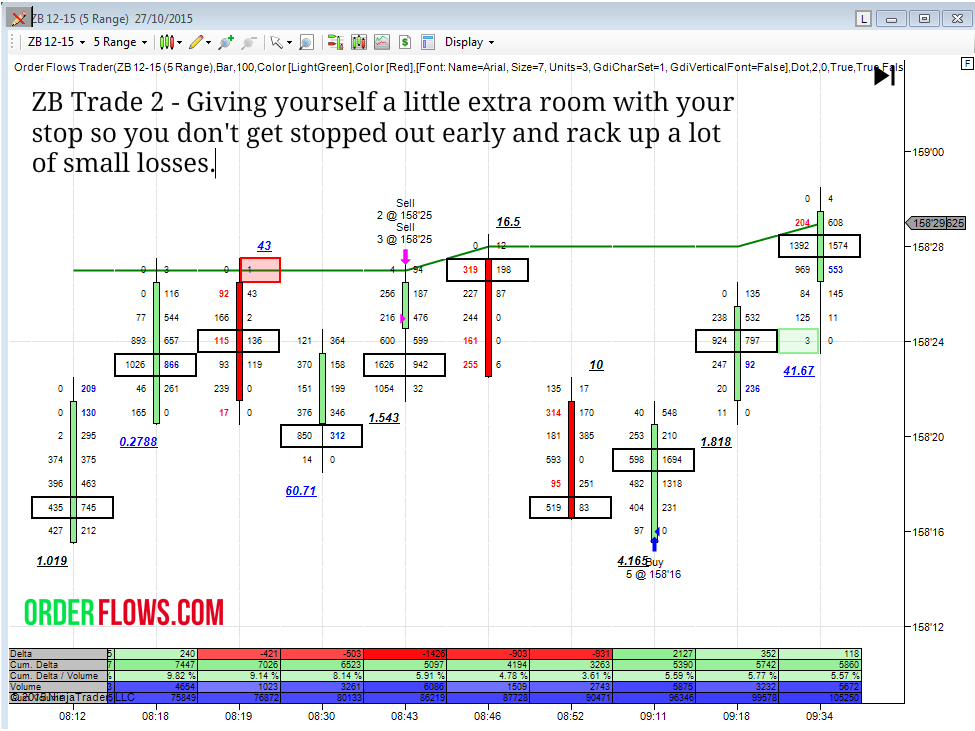

In the second example, I got short at 158-25. However the difference was I had a mental stop of 2-3 ticks that wasn’t entered into the market to actually be working. The market moved 3 ticks against me before stopping and selling off to my take profit level.

In both cases if the market moved 5 ticks against me there would be absolutely no reason for me to be in the trade. Hence the reason for a worst case scenario stop. But at 2 or 3 ticks against me I am not panicking. I am willing to accept that the market can move 2 – 3 ticks against me, but I don’t really want to get stopped out when it happens.

Sure when the market goes 2-3 ticks against me there is a chance it can then go to five ticks against me. But when you are trying to pick a level, there is a chance you may or may not get filled. Its small chances that the market goes exactly to your entry level price and gets you in then turns and runs to your profit level.

When you are trading a pull back and have a level where you are working a bid or offer to get in, it is perfectly normal for the market to hit your level and fill your entry order and still move 2-3 ticks against you before turning and continuing in the direction you expected. You have to keep in mind that when you are waiting for the market to come back to your level some momentum make be building that would move it slightly past your entry order.

So what is a trader to do? Some people will say that having a mental stop is blasphemy. That is goes against all reasonable aspect of trading. Having a stop that is not actually working? I must be mental. But I do have a worst case scenario stop that is working, it is just further away.

So why even have a mental stop to begin with. Why not just use a worst case scenario stop only? That is because I am trading with order flow. I make my decisions to enter based on order flow and for the most part I make my exits based on order flow. So if something happens in the order flow from my entry bar signal while I am waiting for the pull back to get me into the market my view may have changed.

When you are waiting for a pull back to happen there could be a small shift in the order flow that may get you off a trade. That is why I use a 2 – 3 tick mental stop. If I don’t like what I am seeing and it is 2 – 3 ticks against me I am perfectly fine to get out before the market moves against me more.

In the first example, there wasn’t anything in the order flow to tell me that the market conditions have changed. My stop was too close.

In the second example. My entry signal was based on the single print at 8:19am bar. Even though there was a small ratio of 60.71 at the 8:30am bar the delta for the bar was still negative which told me that selling might not be over yet. If conditions were slightly different then I would be looking to get out at 2-3 ticks. But we were still putting in negative delta near the high of the day which to me is a sign of weakness. The market made a new high by a tick before selling off to my target. The stop was a “mental” stop in my head and not in the market where it would have been elected. I am interested in watching how the market reacts when it gets to my mental stop as opposed to actually getting out. If the market put in more volume at the new high I would be much more worried that the move would continue in that direction. But 12 lots is not too much to get me worried.

Stop placement is a tricky subject. Each person will view stop placement differently. There are a couple common themes that everyone will agree on. We all want tight stops and low risk. But at the same time having a tight stop will lead you to more losses and not only from getting stopped out 2 -3 ticks away from your entry, but also in lost profits as there will be trades that you got out too early before the market could have a chance to go to your profit level target.