Finding Levels To Watch With Order Flow

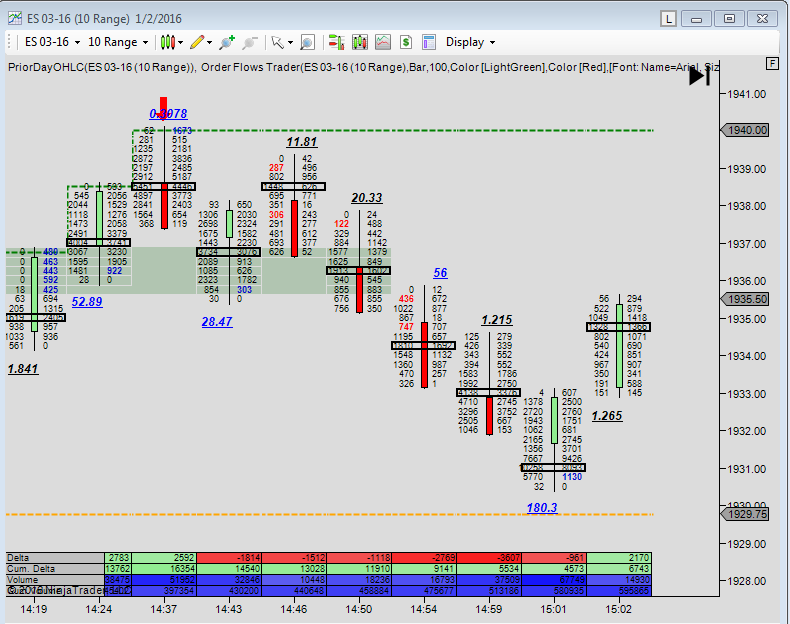

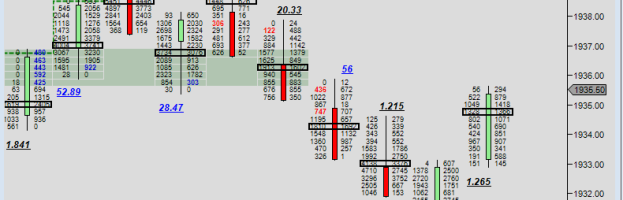

I am always interested when the market makes a high of day (or low of day) and there is a lot of volume traded at that high and the market comes off. On February 1st, the ES traded up to 1940 and 1673 lots traded on the offer at that price causing a buying imbalance and the market proceeded to sell of the rest of the week.

While I am NOT going to say “order flows called that high.” That is a stupid assumption to make and anyway that tries to tell you that also has some prime swamp land for you in Florida for sale cheap. Firstly, order flow can’t predict the high or low before it happens. By definition of ‘order flow’, orders would have to flow into the market before a high or low can be made. Secondly, order flow doesn’t claim to predict highs or lows before they happen. Order flow is a tool for a trader to analyse the market with and make their own trading decisions.

Going into Friday morning the market is trading around 1909. Today is the release of NFP, so I will be watching to see if the market starts to move up and can get near the high of 1940. What will happen? Will we take out that high? Will we bounce from it? Will the sellers that were there earlier in the week reappear? At this point, I don’t know. We have to wait until the market gets back up there. But for a level that is one that I am watching very closely. If we get there today it will be a nice way to end the trading week and hopefully we can build on it going into the second week of February especially since China will be closed for Chinese New Year celebrations and there won’t be negative news come from there to weigh on the US markets.

UPDATE: Well the market didn’t rally on Friday, but that is ok, I will just wait and watch this level when the market approached it again.