The Valtos Flip

I am pleased to announce the release of my new indicator The Orderflows Valtos Flip.

What is a Flip in the Futures?

A flip occurs when you would see giant orders on one side of the market that would flip and go the other way. For example, when someone was posting massive buy

orders, waiting until the market moved toward that price and then selling instead — a massive head-fake.

Nowadays you would call it spoofing to a certain extent. Just recently Citibank paid a fine of $25 million for spoofing the treasury markets. So as much we would like to think it doesn’t happen because it is illegal, it still happens.

Here is a link to the an article about Citibank’s fine.

I like the comments section in the article…there was one that was quite striking…why aren’t any Citibank employees going to jail. If you remember last year trader Michael Coscia was sentenced to 3 years in prison for spoofing and I think the USA is still trying to get Navider Sarao to face trial in the US for alleged spoofing activities for causing the 2010 flash crash. Personally I think they should do more than just fine Citibank, this was just pure manipulation coordinated among several traders with the sole purpose of boosting profits. And people wonder why the banks are hated.

But I digress.

If you are familiar with order flow analysis there are instances that are sometimes easy to see and sometimes you completely overlook them because you are looking at other things and not noticing what is right in front of you.

I have often said that delta is the most under-utilized trading tool available to traders. The power of delta is that it gives traders clear clues as to what is happening in the market.

The flip will work on an Orderflows Trader chart as well as a normal bar chart.

If you are not familiar with what flipping is in the market, let me explain. What big traders used to do was spoof the market with bogus orders. For example, in simple terms, if the trader wanted to buy bonds at 165-20 and the market was trading 165-22, they would stack the order book with big offers at 165-24, 165-23 and even 165-22 to give the false impression to the market that there was more supply available in the market which should cause the market to move lower. Then they would be able to buy at 165-20 as the market moves lower then they cancel their offers and the market moves back to where it was before.

When I say “traders used to do” is because spoofing is illegal. However, there are times when a true flip happens, one that is not due to market manipulation.

In the Orderflows flip what it looks for 4 distinct instances of market activity. Flip A and Flip B.

- The market gets pushed down with extreme selling and then comes right back up with extreme buying. Flip A buying.

- The market pops up with extreme buying and then comes right back down with extreme selling. Flip A selling.

- The market gets pushed down with extreme selling, pauses and then comes right back up with extreme buying. Flip B buying.

- The market pops up with extreme buying, pauses and then comes right back down with extreme selling. Flip B selling.

I treat signals for Flip A and Flip B the same.

Why did I program this indicator? It is based on my own personal trading experience. Obviously, there is the flip style of trading via spoofing, which again is illegal, however I do think it still occurs. But secondly when dealing with large size a trader will often stack his bids or offers in the order book. If a trader wants to buy 500 CL futures, see the market is offered at 49.52, knows if he starts piecing in his order he will move the market 10 cents, so he may sweep through the order book and buy the market up through 5 price levels to 49.57 in order to get everything filled at a better average price. Other traders see the market trading at 49.57 and react thinking the price is out of line and enter the market and sell it back down to 49.52. It happens time and again in the just about every market, every day.

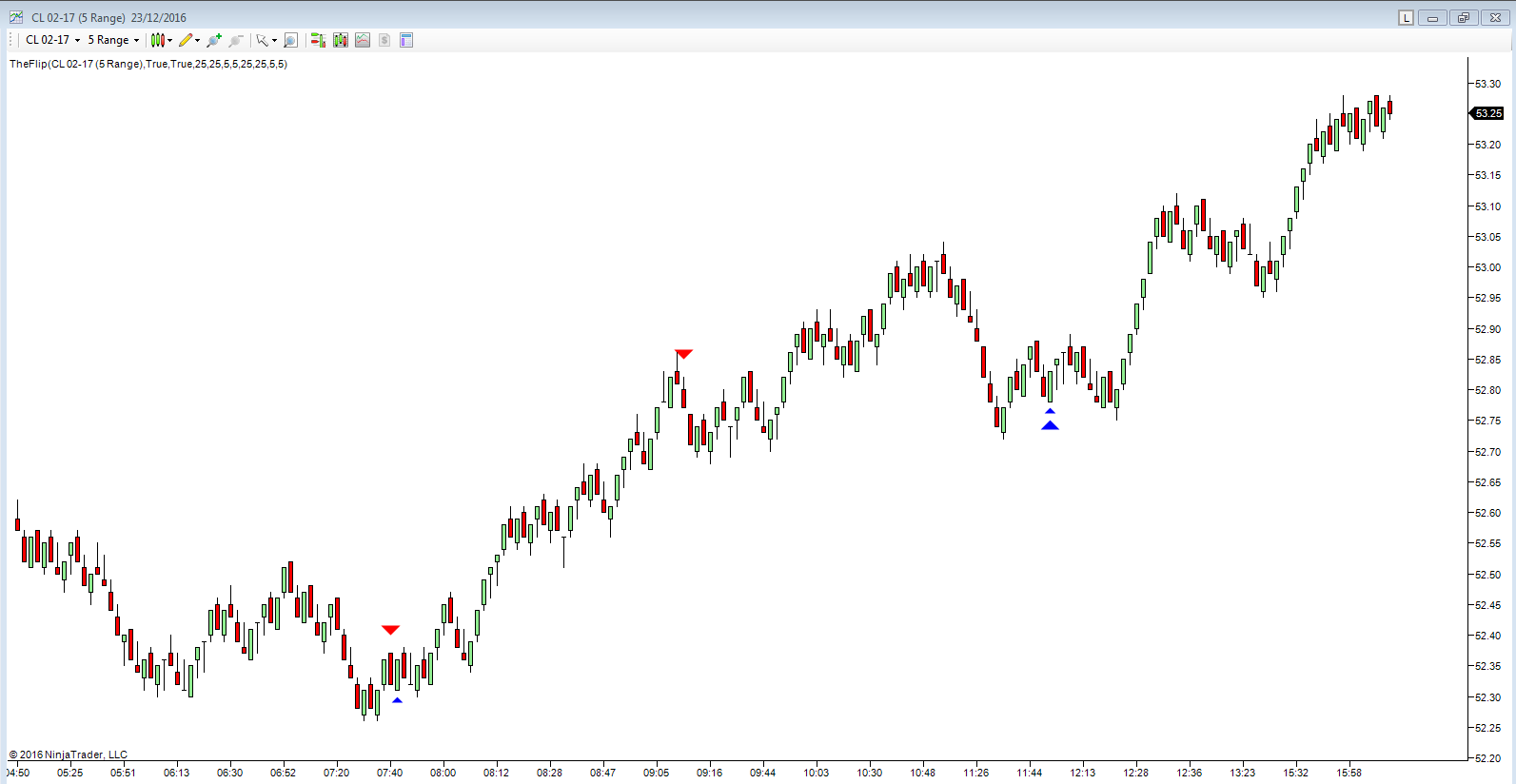

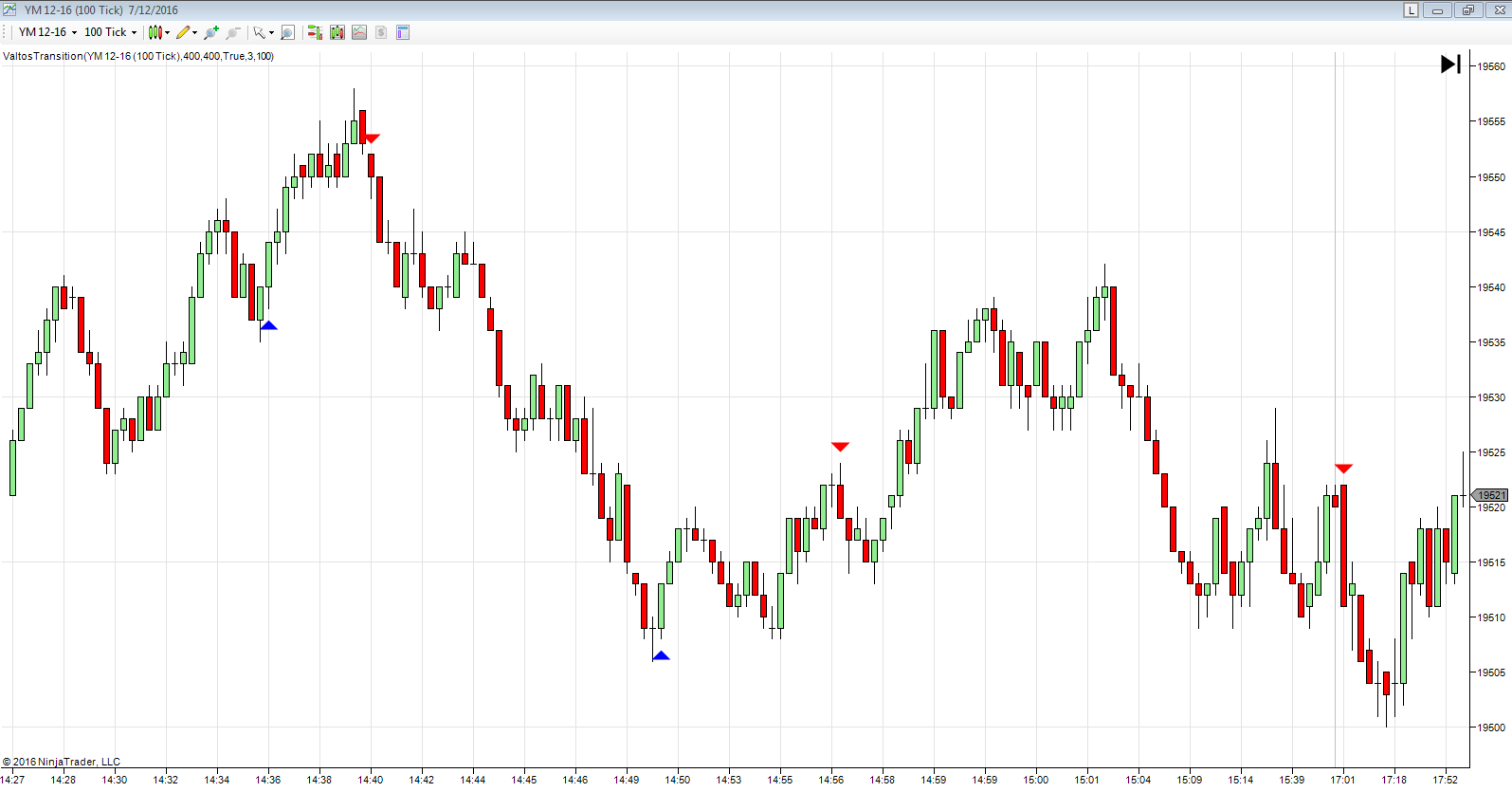

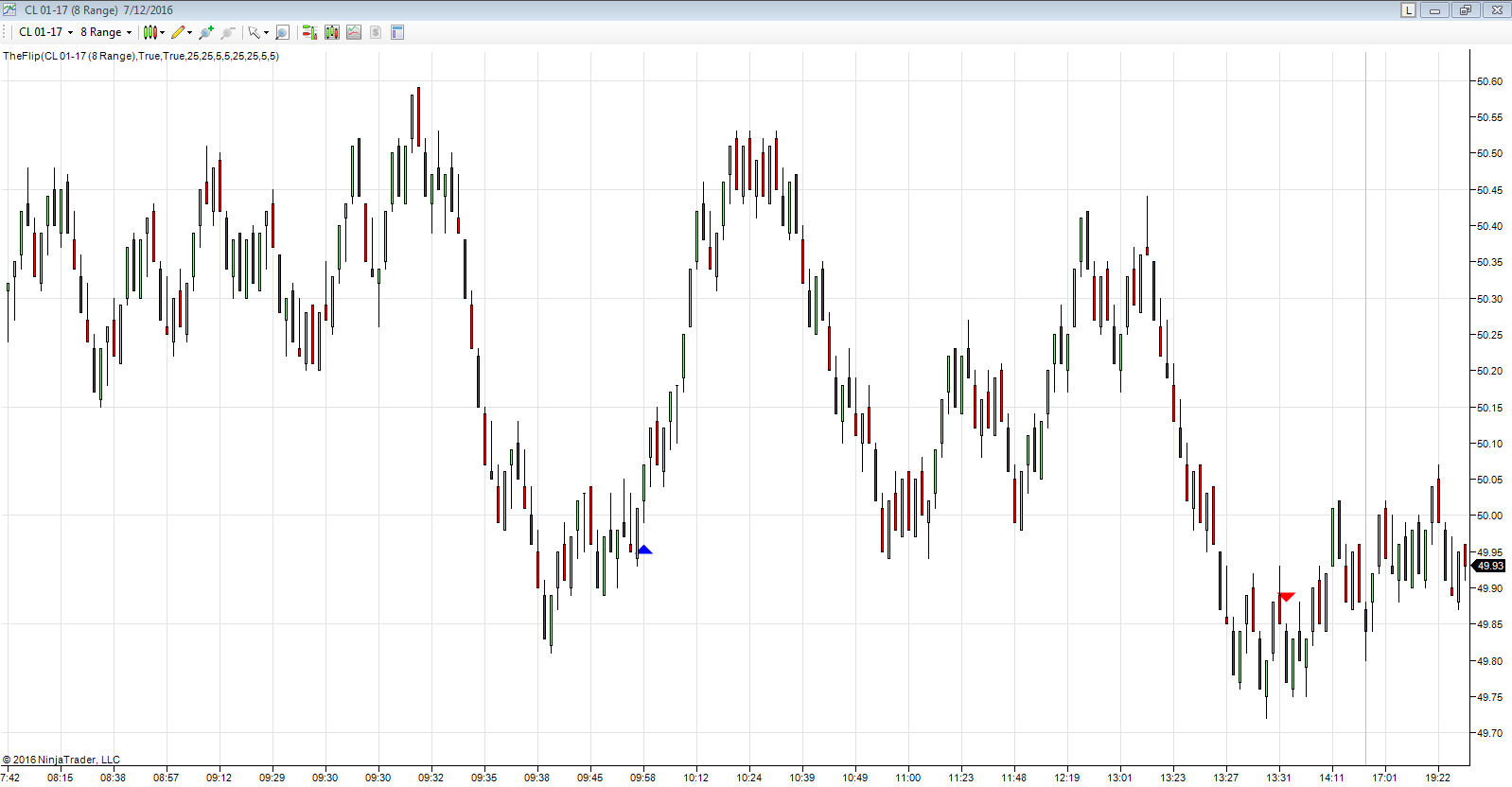

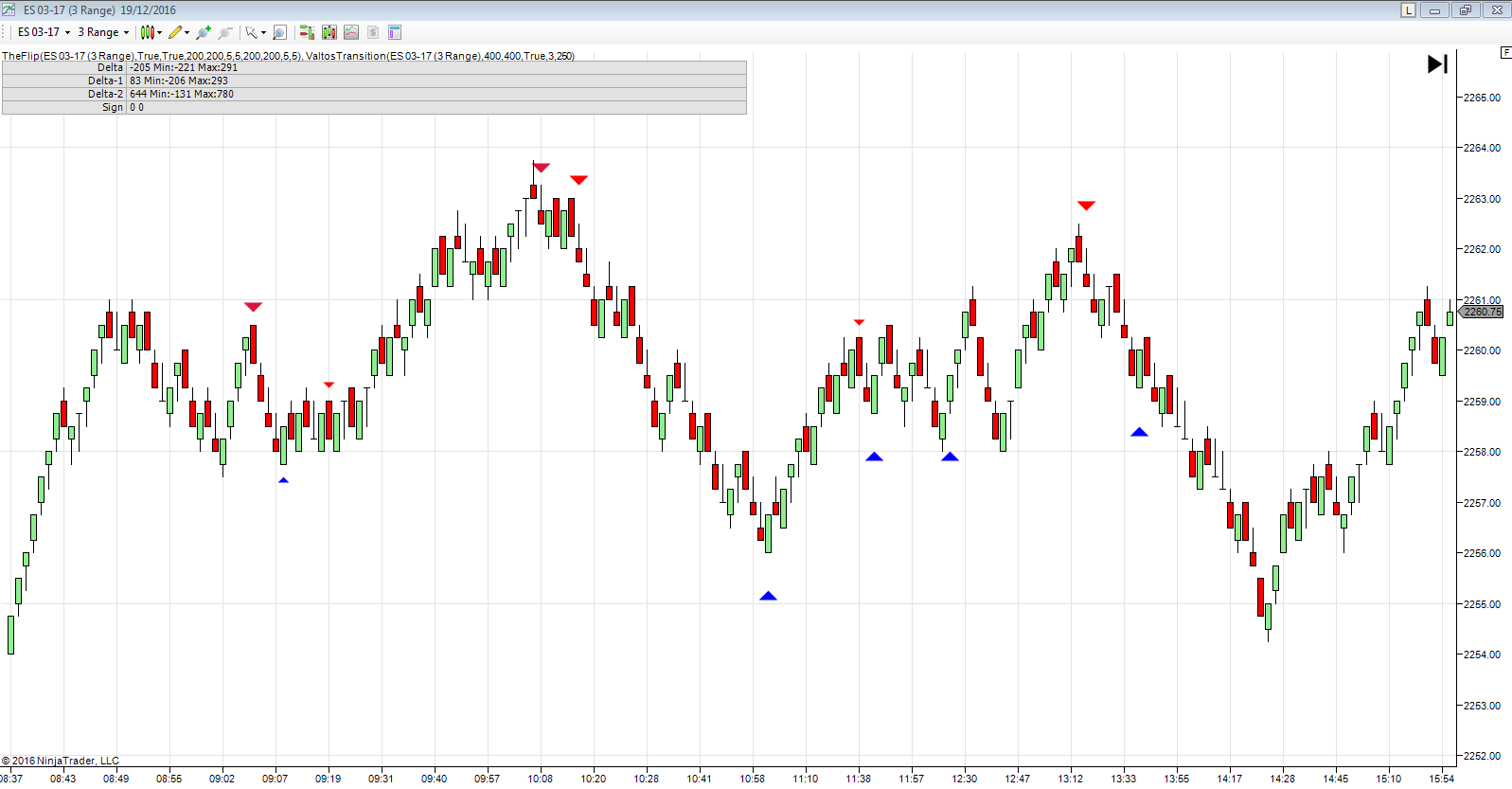

Here are some examples of the Flip in action:

Currently I have packaged The Flip, The Transition and The U-Turn in a package during my launch period where you can get access to all three indicators for the low price of $600.