Order Flow Delta Gives Traders A Clue To Market Direction

One of the questions I get asked a lot about order flow is

“what is the most useful piece of order flow data?”

With order flow there are three main components: Delta, POC

and imbalances. Each component has its own value to traders.

Order flow delta is important because it helps a trader

understand when overall market sentiment is bullish or bearish.

Delta is the difference between aggressive buyers and aggressive

sellers in a bar.

There are different ways to interpret the order flow delta.

One of the ways we have coded into a tool called the Delta Scalper.

What the Delta Scalper does is it looks for the moments when

market sentiment becomes extremely bullish or bearish based on

the current trading taking place. More specifically, it looks

for bursts of aggressive buying right before market rally higher

or bursts of aggressive selling right before markets drop.

To learn more about the Orderflows Delta Scalper, go here:

http://www.deltascalper.com

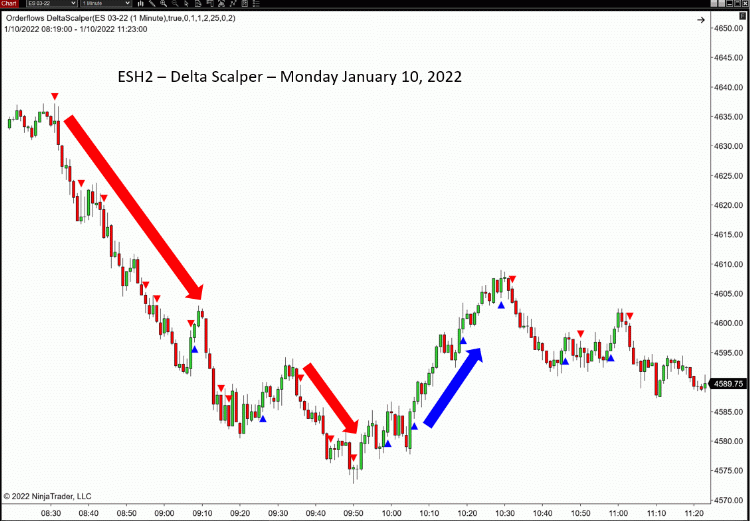

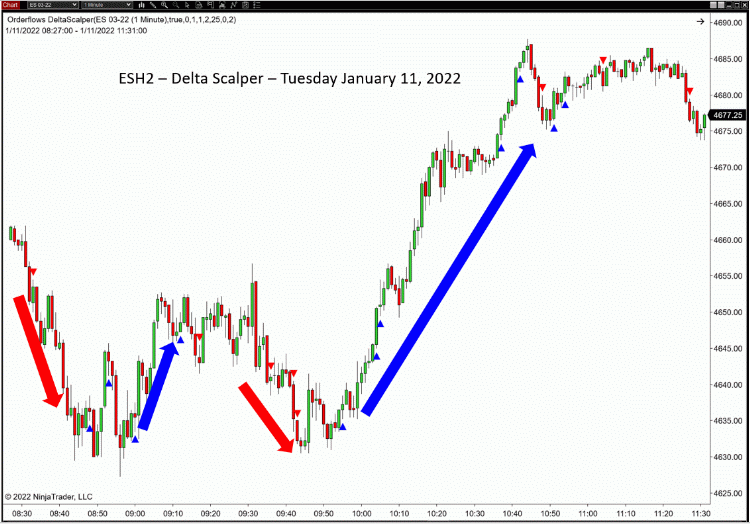

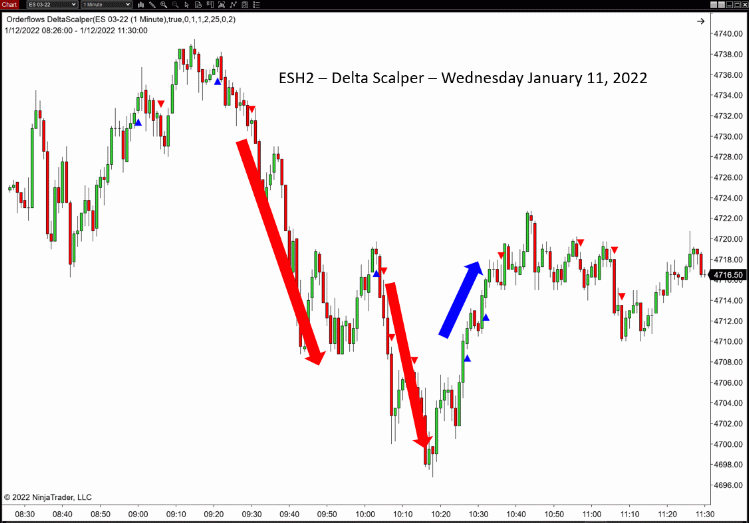

Here is how the Orderflows Delta Scalper performed the first

three days of week in the emini SP:

Monday

Tuesday

Wednesday

While there may be some false starts, with proper stop placement,

you can take advantage of the big moves when they appear.

To get started with the Orderflows Delta Scalper, please visit:

http://www.deltascalper.com

Delta Scalper runs on NinjaTrader 8 and requires tick replay.

To your trading success,

Mike Valtos