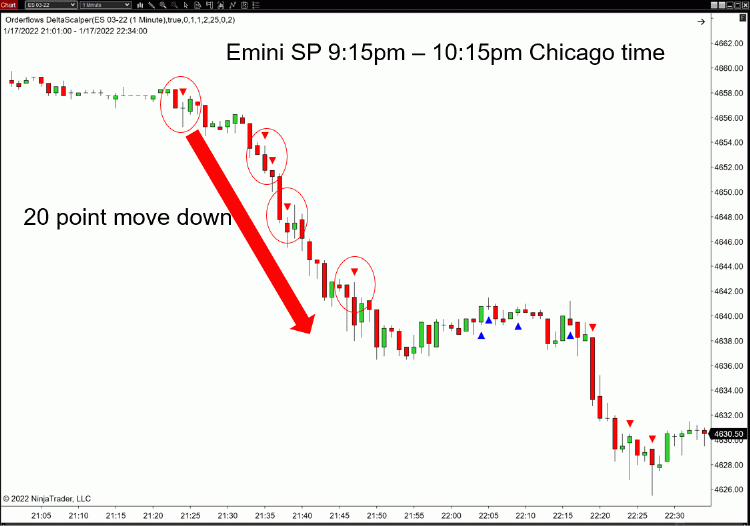

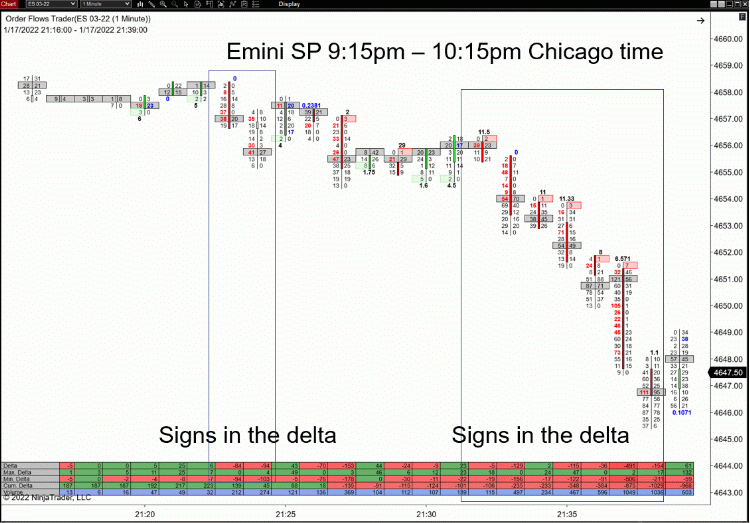

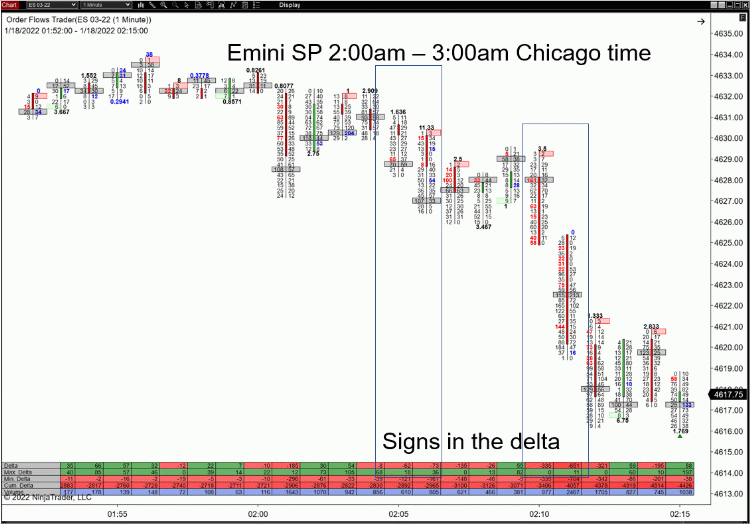

Last Night’s Order Flow Delta & 20 Point Market Sell Offs

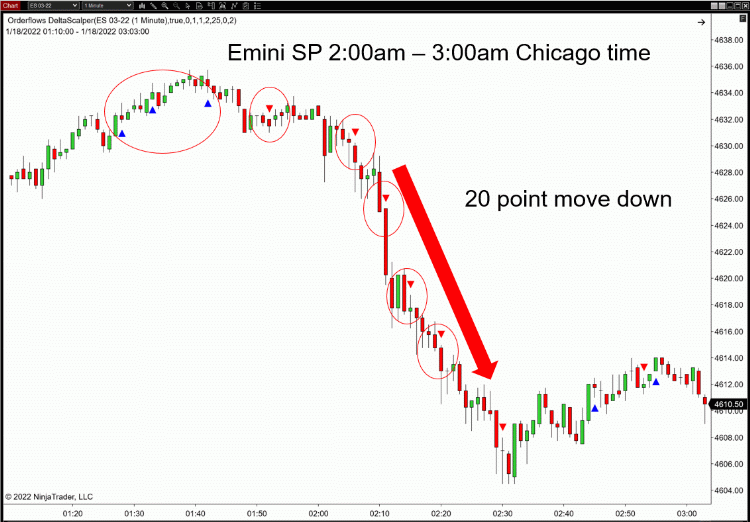

Last night in the Emini SP there were two clear 20 point sell offs.

Here is the bar chart:

Here is the bar chart:

One of the sell offs occurred during the Asian session and the other

happened during the London session. After the sell off during the Asian

session, I saw someone ask on Facebook asking what just happened? As usual,

the replied came in from people who don’t understand order flow and

liquidity, with the replies, “there was no liquidity.”

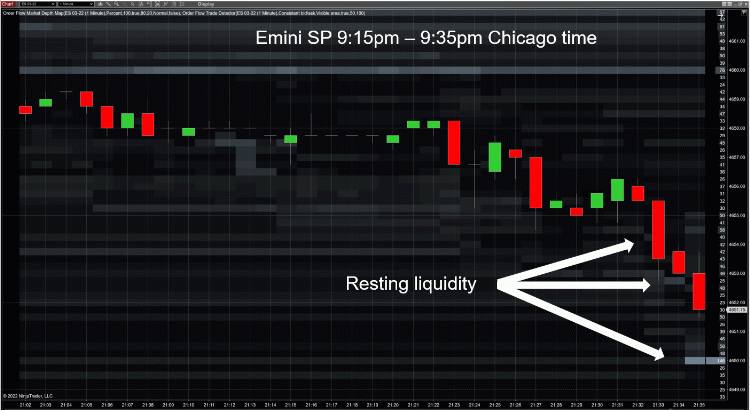

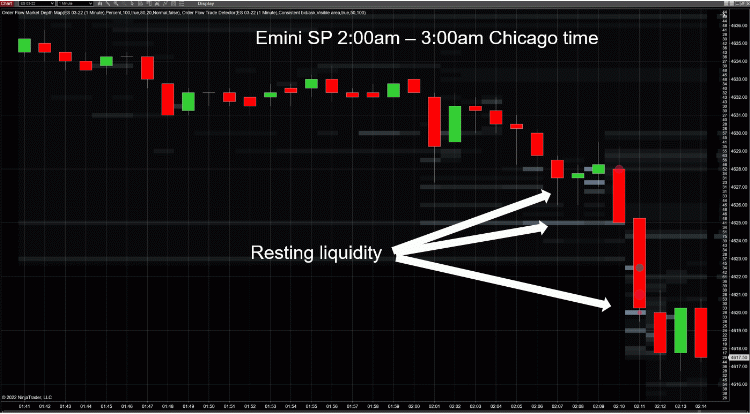

On the contrary, there was plenty of liquidity for those times of the day.

Looking at the volume traded, it was increasing BEFORE the sell offs.

If you look at the market depth maps, there was more liquidity on the bid

side than the offer side. The aggressive sellers were taking out the

resting liquidity with impunity.

Here is the market depth map:

Here is the market depth map:

If there was really a lack of liquidity, the market would have bounced back up.

But, the market didn’t bounce, it kept selling off.

So the question is how would a trader know these are legitimate moves?

Watch the order flow, specifically, the order flow delta.

What you often see before these big market moves is the delta is relatively

quiet or flat, then it decidedly & dramatically directionally increases.

Here is the footprint chart:

Here is the footprint chart:

To make it easier for traders to see and take advantage of these situations

we created a tool called the Orderflows Delta Scalper.

What the Delta Scalper does is look for those areas where the market comes

out of sideways to flat and directional order flow is appearing.

Directional order flow is what will move the market.

To learn more about the Orderflows Delta Scalper, please visit:

http://www.deltascalper.com

Now, not all moves will be 20 point moves, we wish, but you will

be better ready to take advantage of them when the occur.

While there may be some false starts, with proper stop placement,

you can take advantage of the big moves when they appear.

To get started with the Orderflows Delta Scalper, please visit:

http://www.deltascalper.com

Delta Scalper runs on NinjaTrader 8 and requires tick replay.

To your trading success,

Mike Valtos