Orderflows Trader Live Trading Room Special Offer

Do you want to learn order flow trading without spending a fortune?

Do you already use order flow software but don’t know what set ups to look for?

Do you want to apply order flow into your current trading plan?

Let’s face it, trading with order flow sounds great but there really isn’t much in the way of proper training. I have created the Orderflows Trader Live Trade Room as a way to give lessons on how to trade with order flow. While I prefer you to use my Orderflows Trader which runs on NinjaTrader, you don’t actually need to use my software. If you are using another software for you order flow analysis you can still join in my trading room and learn how I use order flow to trade. But of course it is better if you use Orderflows Trader Software.

The Orderflows Trader Live Trading room runs from 8am Chicago time to 10:30am/11am Chicago time Monday through Friday (occasionally there may be a day off during the week). In the trading room I trade and educate live during the US trading session.

It gives you an opportunity to learn how to apply order flow and use the Orderflows Trader Software Package. You can feel free to ask questions as to what is happening in the markets, what you should look for, etc. Orderflows Trader Live Trade Room is a great place for traders who want to understand order flow trading more. If you want a more comprehensive and 1-on-1 training, I also offer a mentoring program.

The normal price for the trading room is $299 per month. However when you purchase the Orderflows Trader Software Package you get 1 month access to the trading room for free so it is a saving of $299. Even if you don’t want to start access to the trading room now, just tell me when you would like your free month to start. If you want to avail of the mentoring program, I give you 3 months access to the trading room.

Among the topics I cover daily in the Orderflows Trader Live Trading Room include:

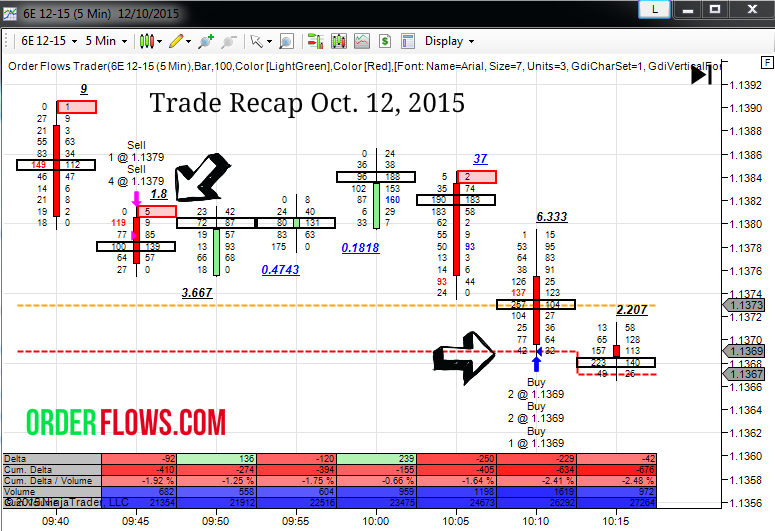

Trapped buyers and sellers – If you have ever bought the high of a move you have been trapped in the market and you have to get out with a loss. You know the feeling, all traders have been there. You found the perfect set up only to enter the market and immediately the market moved against you and you were never in the money on your position. It was a loss from the start. These types of traps happen all the time.

Orderflows Divergence – When the market makes a new high but there were more sellers in the bar or when the market makes a new low but there were more buyers in the bar. This often signals a turning point in the market. The market tried to go higher but couldn’t and was overwhelmed by sellers. The same is true at lows, the market was going lower and lower until the buyers stepped in and overwhelmed the sellers.

Last buyer/seller – Markets turn when the last buyer has bought at a high or when the last seller has sold at a low. With traditional bar charts you only see the low of the bar or the high of the bar. You cannot judge the internal buying or selling that has been apparent inside the bar.

Big buyer / seller – There are players in the market who are so big that their actions can determine if a trend stops or starts. These large institutions know market has moved out of supply and demand balance and act accordingly. The beauty of order flow analysis is that their actions can be seen in the analysis of volume.

Imbalance support and resistance – Aggressive buyers and sellers leave their mark on the market. Their levels of activity often become low risk trade entries when retested. When I say low risk, I am talking like 1, 2 or 3 ticks risk with profit potentials over 10x the risk.

Orderflows software identifies key price areas where low risk entry opportunities exist in the market as they happen. It is simple. The setups are not ambiguous. There is no confusion and no other way to interpret the setup. Jump in and jump out with a profit.

Trading isn’t rocket science, but it does take a bit of work. If you are interested in learning but not sure if you want to buy the software join the trading room to start.