Posted by Mike on Sep 30, 2015 in Blog

Today I was speaking with another trader about order flow trading and he asked me “what is so good about it?” This guy trades using price action and is quite good at it so its not like this guy is a losing trader and wants to move to the next shiny object, but like most successful traders he is inquisitive and wants to understand more ways to trade profitably. I walked him through 3 trades today to show him how I use order flow to make informed trading decisions. The first...

Read More »

Posted by Mike on Sep 29, 2015 in Blog

When one thinks of a tape reader, someone who read the ticker tape, they tend to think back to the 1920’s where everyone would stand around a machine with a glass top and a piece of paper, like a receipt, would come out with the recent stock trades on it. I always wondered how those traders used that information in making their trading decisions. Times have certainly changed, thank goodness! With advances in technology in the last 20 years in the area of home computing, a...

Read More »

Posted by Mike on Sep 26, 2015 in Blog

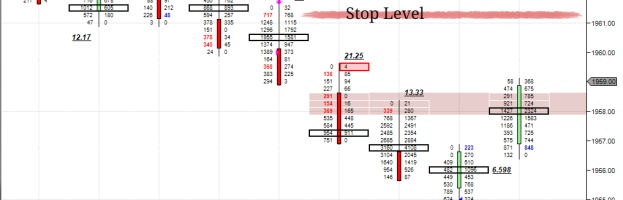

Every trader knows he has to use stops in some form. However the problem that many traders face is that most traders use arbitrary stop levels. Maybe they have back tested their system and see that the average loss is 10 ticks, so all of a sudden their stop is 10 ticks on every trade. While it is good that they have a stop plan in place, the stop level is kind of arbitrary. Wouldn’t it make more sense to have a stop level based on what the market is telling you? When...

Read More »

Posted by Mike on Sep 25, 2015 in Blog

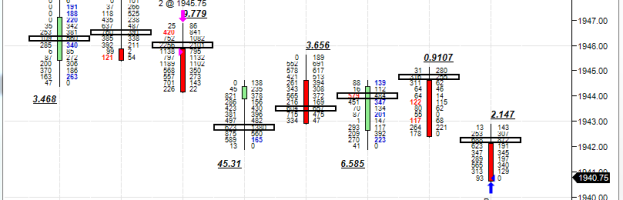

TGIF. Two trades for $2000. The first trade occurred in the ES. The set up was a trapped trader reversal. Even though the amount that was trapped was relatively small, the way the market couldn’t follow through on its buying imbalances was a sign the buying had dried up. I got short at 1945.75, which was actually a good fill as I went in trying to sell 1945.50s but the market got bid as my order was going in and I got a better fill. I immediately put in my take profit level...

Read More »

Posted by Mike on Sep 21, 2015 in Blog

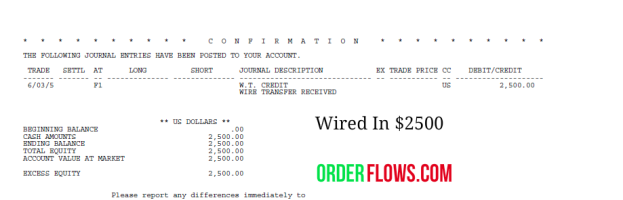

The first question most beginning traders ask is how much money do they need to start trading with? The simple answer is “as much as possible.” But the more realistic answer would depend on how much money you have to lose. A futures account can be opened and funded with as little as $1000. While $1000 is not very much it is a start. Intraday margins for many contracts, like the ES is as low as $500. You can’t do much with a $1000 account. At best you should only be trading...

Read More »