Posted by Mike on Sep 17, 2015 in Blog

Should I stay or should I go is a famous song by The Clash. But it also rings true in trading. Should I stay in a position or should I get out? That is the million dollar question that separates winning traders from losing traders. Consistently profitable traders know to get out and not let a position run too much against them. There is the old trading adage “let your winners run and cut your losses short.” The problem with that statement is being able to tell when a...

Read More »

Posted by Mike on Sep 16, 2015 in Blog

For years, funds have wanted a way to trade the Chinese markets. Although there is an index futures contract traded onshore in China, the CSI300 futures, it is only available to Chinese citizens or entities. It is not open to outsiders. The normal route for traders to have exposure to China is through the HKFE H-Shares futures and the more loosely correlated Hang Seng Futures. For many years this was the way a fund can trade their view of the Chinese market. A few years ago...

Read More »

Posted by Mike on Sep 15, 2015 in Blog

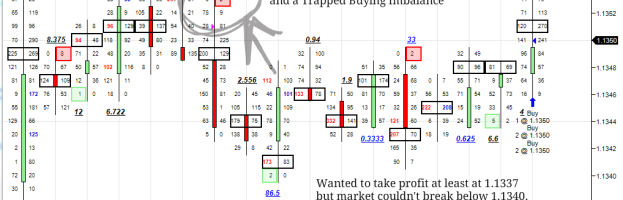

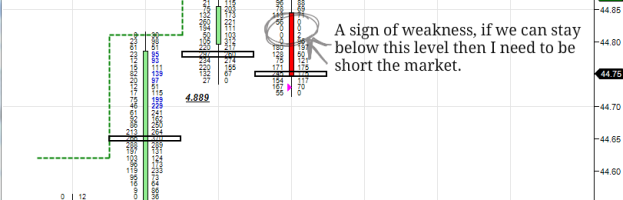

The reason I am a big believer in trading the order flow is because you can see things in the market that might otherwise be overlooked by traders. Sometimes prices move so fast there is nothing in the market for traders to trade against. It can occur when a trader sweeps the market by taking out all the bids down to a certain level or if a buy taking out all the offers on the way up. Of course there would have to be orders at those levels in order to get filled. If not...

Read More »

Posted by Mike on Sep 15, 2015 in Blog

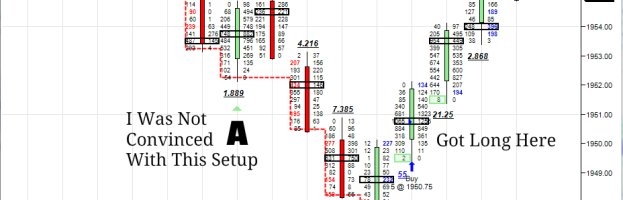

Trading is about making decisions. When to buy, when to sell. I am not the type of trader that just because there is a setup that I will blindly take the trade. I don’t recommend that. You should analyse the market to make a proper trading decision. There are times I see a basic setup occur. I have to make a decision to enter into the trade. I am not saying the trade needs to be qualified in order for me to take it, but rather I like to see other indications of market...

Read More »

Posted by Mike on Sep 14, 2015 in Blog

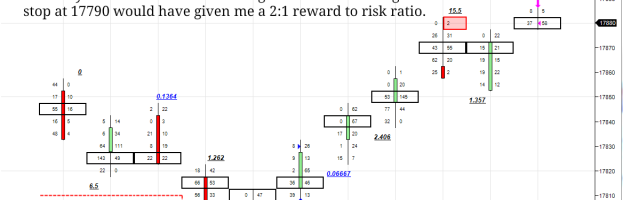

What happens in Asia, stays in Asia. Well, not really. The ES is one of the most traded futures markets on the planet. But there are many other futures markets that are perfectly acceptable to trade using order flow analysis. I have a soft spot in my heart for Asian products due to having lived in Asia for 10 years. The Nikkei on SGX and Osaka are great products for traders in the USA who can’t trade during the day because they have fulltime day jobs. One of the ‘concerns’...

Read More »