Posted by Mike on Sep 13, 2015 in Blog

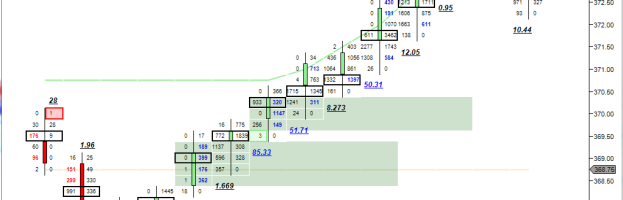

How often have you been in a trade that was a winner but then the market turned and you got stopped out for a loser or break even? If you are trading with indicators it almost feels like an all or nothing way of trading. You will either get to your profit target or get stopped out. That isn’t the way to trade. Every time I get into a trade I have a profit target that I work with as well as a stop level based on where the market would invalidate the reason for taking the...

Read More »

Posted by Mike on Sep 11, 2015 in Blog

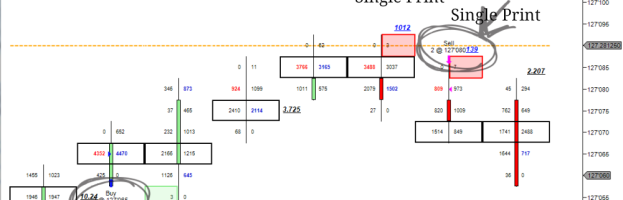

The hardest decision a trader has to make is when and where to get out of a position. You never want to have a winning trade to turn into a losing trade. The million dollar question is where to get out when the market just misses your target and starts coming back down to your entry level. Here is a trade I had going in the ES this morning. I bought at 1940.50 as the market was coming up off the low of the day and there were some single prints appearing. I usually like to...

Read More »

Posted by Mike on Sep 11, 2015 in Blog

There is a saying “A cluttered desk is a sign of genius.” Unfortunately when it comes to trade a cluttered chart is not a sign of genius. It is easy to want to throw up a bunch of indicators on your screen. It looks cool, but is it really helping you trade? You have to learn what is important to your trading chart and only keep those items on your screen. Personally, I find that the more information on the chart the more confusing it gets. I only want to look at what is...

Read More »

Posted by Mike on Sep 10, 2015 in Blog

As a trader we all want to get the most out of trades. In the best of all worlds the market will run straight to our take profit level. Unfortunately that doesn’t always happen. The market will do what it wants to do and no matter how much praying and hoping we do if the market doesn’t want to get to our take profit level we have to know when to take what is available. I am full of clichés and here is another one. Don’t leave money on the table. It is easier said than done....

Read More »

Posted by Mike on Sep 9, 2015 in Blog

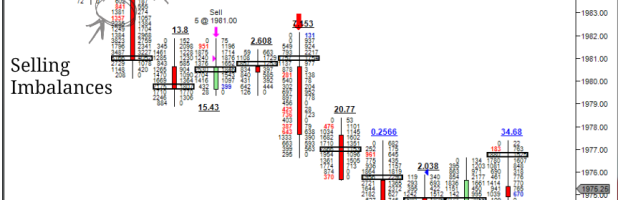

There are different ways to use order flow in your trading. To some order flow is the constant adding and subtracting of orders you see on the DOM. To others it is the trades that appear in the times & sales. To me it is the trail left by the actual orders that have been filled. Some will argue that is filled order flow or order flew, it is not the constant changing of bids and offers in the order book. I am not really interested in orders that are not getting filled....

Read More »