Posted by Mike on Feb 13, 2016 in Blog

A commodity’s price is determined by the market, and the volume represents interest. Price is not directly determined by fundamentals, the market simply reflects what the consensus is, exactly as it is. At the end of the analysis, the market’s price and volume present a sensitive balance between greed and fear. You may have seen a lot of technical methods of trading analysis, but how order flow differs from those is because it puts more reliance on volume. The thing about...

Read More »

Posted by Mike on Feb 6, 2016 in Blog

Complex trading techniques may be the way to go for most retail traders, however, being proficient in reading order flow is also a very efficient solution if you want to succeed in trading. Traders like to complicate things by adding this indicator with that indicator on this time frame with that chart type. In the end it gets so messy you being to wonder if you are even trading the market or trading an indicator. Order Flow is a vague term which can have different meanings...

Read More »

Posted by Mike on Feb 5, 2016 in Blog

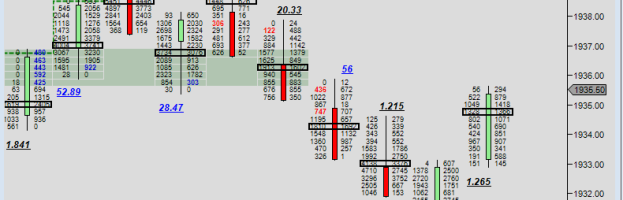

I am always interested when the market makes a high of day (or low of day) and there is a lot of volume traded at that high and the market comes off. On February 1st, the ES traded up to 1940 and 1673 lots traded on the offer at that price causing a buying imbalance and the market proceeded to sell of the rest of the week. While I am NOT going to say “order flows called that high.” That is a stupid assumption to make and anyway that tries to tell you that also has some...

Read More »

Posted by Mike on Feb 1, 2016 in Blog

We are pleased to announce the release of OrderFlows Trader for NT8 today. If you are using NT8 and would like to switch just send me an email or use the contact form on this website. I realize that not everyone is going to be switching the NT8 right away, so when you are ready to make the switch with the software just let me know. I know in trading your software is indispensable. So you might not be willing to make the switch so early in the release of NT8. You want to...

Read More »

Posted by Mike on Jan 26, 2016 in Blog

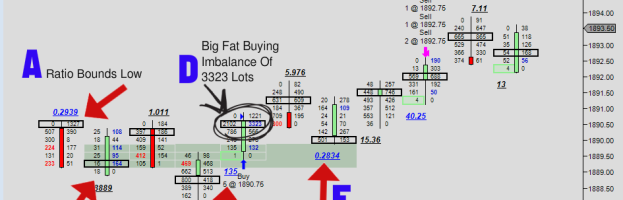

Understanding aggressive buyers and aggressive sellers in relation to big passive buyers and big passive seller. When you have aggressive sellers they are selling into passive buyers. When you have aggressive buyers they buy from passive sellers. By definition, aggressive sellers sell into the bid, occasionally there will be bids that are big enough to absorb all the aggressive selling. The same is true with aggressive buyers, sometimes there is a big passive offer that the...

Read More »

Posted by Mike on Jan 24, 2016 in Blog

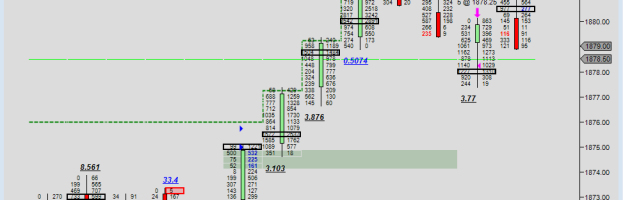

2016 has been a very interesting trading year so far. I always like to start the year with a bang, but this year has really been bang! bang! bang! Here is a trade I took on Thursday January 21, 2016 as the market was rallying to the day’s high. I usually look for a reason to get short around a high, as opposed to looking for reasons to buy the breakout. However every now and then I do buy breakouts into the high when I feel it is too good to pass up. So on this day, we had...

Read More »